- Euro-Zone Consumer Price Index (CPI) to Halt Four Straight Months of Negative Price Growth.

- Core Rate of Inflation to Hold Steady at Annualized 0.8% for Second Month.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Euro-Zone Consumer Price Index (CPI)

Even though the Euro-Zone’s Consumer Price Index (CPI) is expected to hold flat in June, stickiness in the core rate of inflation may boost the appeal of the single-currency and fuel a larger rebound in EUR/USD as it curbs speculation for additional monetary support.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The European Central Bank (ECB) may continue to endorse a dovish outlook for monetary policy amid the disintegration in Europe, but President Mario Draghi and Co. may largely promote a wait-and-see approach at the next interest-rate decision on July 21 as the slew of non-standard measures work their way through the real economy.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| M3 Money Supply (YoY) (MAY) | 4.8% | 4.9% |

| Employment (QoQ) (1Q) | -- | 0.3% |

| Gross Domestic Product s.a. (YoY) (1Q F) | 1.5% | 1.7% |

The pickup in private-sector lending accompanied by signs of a stronger recovery may encourage stronger price growth in the monetary union, and a positive development may spur a bullish reaction in the Euro as market participants scale back bets for additional ECB support.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Business Climate Indicator (JUN) | 0.26 | 0.22 |

| Retail Sales (MoM) (APR) | 0.4% | 0.0% |

| Producer Price Index (YoY) (APR) | -4.1% | -4.4% |

Nevertheless, waning confidence paired with the slowdown in household spending may encourage European firms to offer discounted prices, and a soft inflation report may drag on the single-currency as it puts increased pressure on the ECB to further support the euro-area.

How To Trade This Event Risk(Video)

Bullish EUR Trade: CPI Report Exceeds Market Forecast

- Need green, five-minute candle following the report to consider a long EUR/USD trade.

- If market reaction favors a bullish Euro trade, buy EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from cost; need at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish EUR Trade: Headline & Core Inflation Disappoint

- Need red, five-minute candle to favor a short EUR/USD trade.

- Implement same strategy as the bullish euro trade, just in the opposite direction.

Potential Price Targets For The Release

EURUSD Daily

- EUR/USD stands at risk of giving back the advance from earlier this year as it fails to preserve the upward trend from December, with a closing price below the Fibonacci overlap around 1.0960 (23.6% retracement) to 1.0970 (38.2% retracement) raising the risk for a further decline as a head-and-shoulders formation appears to be taking shape.

- Key Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

- Key Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Check out the short-term technical levels that matter for EUR/USD heading into the report!

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Impact that the Euro-Zone CPI has had on EUR/USD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

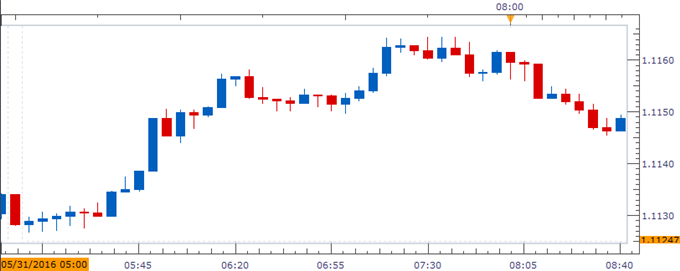

MAY 2016 | 05/31/2016 9:00 GMT | -0.1% | -0.1% | +16 | -5 |

May 2016 Euro-Zone Consumer Price Index (CPI)

The Euro-Zone’s Consumer Price Index (CPI) slipped an annualized 0.1% in May following the 0.2% contraction the month prior, while the core rate of inflation advanced to 0.8% from 0.7% during the same period. The low-inflationary environment may encourage the European Central Bank (ECB) to preserve a dovish outlook for monetary policy, but the Governing Council may largely endorse a wait-and-see approach over the coming months as the non-standard measures work their way through the real economy. The initial market reaction was short-lived, with EUR/USD bouncing back from 1.1127, but the pair consolidated throughout the day to close at 1.1129.

Get our top trading opportunities of 2016 HERE

Read More:

S&P 500: Months of ’Chop’ Wiped Away in One Fell Swoop

GBPUSD, EURUSD & Gold Technical Outlook in a Post Brexit World

NZD/CAD Longs at Risk on Approach of Key Resistance at 9200

Brexit Aftermath Analysis Directory

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.