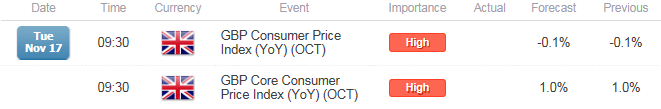

- Headline U.K. Consumer Price Index (CPI) to Contract 0.1% for Second Straight Month.

- Core Rate of Inflation to Hold Steady at Annualized 1.0% for Third Consecutive Month.

Trading the News: U.K. Consumer Price Index

Despite forecasts for another 0.1% in the headline reading of U.K. inflation, stickiness in the core Consumer Price Index (CPI) may improve the appeal of the British Pound and spark a larger rebound in GBP/USD as the Bank of England (BoE) largely stays on course to normalize monetary policy.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though the BoE remains in no rush to normalize monetary policy, signs of stronger inflation may spur a greater dissent at the December 10 interest rate decision as central bank officials see a more sustainable recovery in the U.K. However, a weaker-than-expected CPI may encourage the majority of the Monetary Policy Committee (MPC) to retain the highly accommodative stance for an extended period amid the external risks clouding the economic outlook region.

For more updates, sign up for David's e-mail distribution list.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Trade Balance (SEP) | -3.000B | -1.353B |

| Net Consumer Credit (SEP) | 1.1B | 1.3B |

| Retail Sales ex Auto Fuel (MoM) (SEP) | 0.4% | 1.7% |

Improved demand from home and abroad may encourage U.K. firms to boost consumer prices, and a stronger-than-expected CPI print may prompt GBP/USD to retrace the decline from earlier this month as it puts increased pressure on the BoE to lift the benchmark interest rate off of the record-low.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Average Weekly Earnings ex. Bonus (3Mo3M) (SEP) | 2.6% | 2.5% |

| Jobless Claims Change (OCT) | 1.4K | 3.3K |

| Gross Domestic Product (YoY) (3Q A) | 2.4% | 2.3% |

However, tepid wage growth accompanied by the recent weakness in private-sector activity may drag on inflation, and an unexpected slowdown in the core CPI may produce near-term headwinds for the sterling as market participants push out bets for a BoE rate-hike.

How To Trade This Event Risk(Video)

Bullish GBP Trade: Sticky Core CPI Boosts Interest Rate Expectations

- Need green, five-minute candle following the release to consider a long British Pound trade.

- If market reaction favors bullish sterling trade, long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: U.K. Inflation Report Disappoints

- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

Potential Price Targets For The Release

GBPUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- GBP/USD remains at risk of giving back the advance from back in April as the pair struggles to push back above former soft-support around 1.5250 (50% retracement), while the Relative Strength Index (RSI) preserves the bearish formation from back in May.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long GBP/USD since August 21, but the ratio continues to come off of recent extremes as it narrows to +1.42, with 59% of traders long.

- Interim Resistance: 1.5460 (23.6% retracement) to 1.5508 (October high)

- Interim Support: 1.4860 (78.6% retracement) to 1.4910 (61.8% retracement)

Join DailyFX on Demand for Real-Time Updates on the DailyFX Speculative Sentiment Index!

Impact that the U.K. Core CPI report has had on GBP during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

SEP 2015 | 10/13/2015 08:30 GMT | 1.1% | 1.0% | -39 | -37 |

September 2015 U.K. Core Consumer Price Index

The U.K. Consumer Price Index (CPI) unexpectedly weakened in September, with the headline reading for inflation contracting an annualized -0.1% in September. At the same time, the core rate of inflation fell short of market expectations as the print held steady at an annualized 1.0% for the second consecutive month. Even though the Bank of England (BoE) continues to prepare U.K. households and businesses for higher borrowing-costs, Governor Mark Carney may look to carry the current policy into 2016 in an effort to further insulate the region from external shocks. Despite the limited market reaction to the U.K. CPI print, GBP/USD largely struggled to hold its ground throughout the day as the pair ended the North American trade at 1.5246.

Read More:

GBP/USD Technical Analysis: The Cable is All Wound Up for Inflation Data

GBP/USD Range Vulnerable to Unexpected Slowdown in U.K Consumer Price Index (CPI)

Pivotal Day for USD/JPY, GBP/JPY Technicals after Japanese GDP

GBP/USD Underside of Trendline Provides Resistance

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand