- Reserve Bank of New Zealand to Implement Back-to-Back Rate Cuts for First Time Since 2009.

- Will Governor Graeme Wheeler Keep the Door Open for Lower Borrowing-Costs?

For more updates, sign up for David's e-mail distribution list.

Trading the News: Reserve Bank of New Zealand Interest Rate Decision

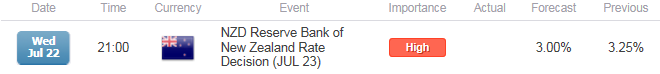

NZD/USD may extend the decline from earlier this year as Bloomberg News survey shows all of the 19 economists polled anticipate at least at 25bp rate cut from the Reserve Bank of New Zealand (RBNZ), and the pair may face further headwinds throughout the remainder of the year should the central bank endorse a dovish forward-guidance for monetary policy.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

However, a material shift in the central bank rhetoric may heavily influence the New Zealand dollar over the near-term, and signs of an end to the RBNZ’s easing cycle along with a softening of the verbal intervention may undermine the bearish sentiment surrounding the New Zealand dollar and pave the way for a more meaningful rebound in the exchange rate.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| NZIER Business Optimism Survey (2Q) | -- | 5 |

| ANZ Business Confidence (JUN) | -- | -2.3% |

| Gross Domestic Product s.a. (QoQ) (1Q) | 0.6% | 0.2% |

Waning confidence paired fears of a slower recovery may encourage the RBNZ to implement a back-to-back rate cut, and another round of monetary support may generate fresh 2015 lows in the exchange rate should Governor Graeme Wheeler keep the door open for lower borrowing-costs.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Consumer Price Index (YoY) (2Q) | 0.3% | 0.3% |

| Trade Balance (MAY) | -100M | 350M |

| Retail Sales ex Inflation (QoQ) (1Q) | 1.6% | 2.7% |

However, the RBNZ may look to conclude its easing cycle amid improving demand from home and abroad, and the New Zealand dollar may face a larger correction in the days ahead should the central bank endorse a wait-and-see approach.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bearish NZD Trade: RBNZ Delivers Lower Borrowing-Costs

- Need red, five-minute candle following the rate decision for a potential short NZD/USD trade.

- If market reaction favors a bearish aussie trade, sell NZD/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish NZD Trade: Governor Wheeler Highlights End of Easing Cycle

- Need green, five-minute candle to consider a long NZD/USD position.

- Carry out the same setup as the bearish aussie trade, just in the opposite direction.

Read More:

GBP/USD Fails to Breakout on BoE Minutes- NZD to Face RBNZ

USDOLLAR Sharp Outside Day Reversal from Uptrend Resistance

Potential Price Targets For The Release

NZD/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- Despite the failure to retain the bearish RSI momentum, the downward trend may continue to take shape in the days ahead as NZD/USD largely remains capped by the 20-Day SMA (0.6687).

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long NZD/USD since May 19, but the ratio has come off extremes ahead of the RBNZ meeting as it sits at +1.58, with 61% of traders long.

- Interim Resistance: 0.6890 (50% expansion) to 0.6900 (100% expansion)

- Interim Support: 0.6370 (50% retracement) to 0.6400 (61.8% retracement)

Impact that the RBNZ Interest Rate decision has had on NZD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| JUN 2015 | 06/10/2014 21:00 GMT | 3.50% | 3.25% | -123 | -174 |

June 2015 Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

The Reserve Bank of New Zealand (RBNZ) unexpectedly cut the Official Cash Rate (OCR) to 3.25% from 3.50%, with the central bank endorsing a dovish forward-guidance for monetary policy in an effort to combat the disinflationary environment. The shift in central bank rhetoric suggests that the RBNZ will continue to offer lower borrowing-costs to boost price pressures, and the New Zealand dollar remains at risk of facing a further decline over the near to medium-term as Governor Graeme Wheeler retains the verbal intervention on the local currency. The New Zealand dollar tumbled lower following the rate cut, with NZD/USD sliding below the 0.7100 handle and closing the Asia/Pacific session at 0.7017.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums