- Bank of England (BoE) Widely Expected to Retain Current Monetary Policy Stance.

- Will BoE Governor Mark Carney Continue to Warn of Higher Borrowing-Costs?

For more updates, sign up for David's e-mail distribution list.

Trading the News: Bank of England (BoE) Interest Rate Decision

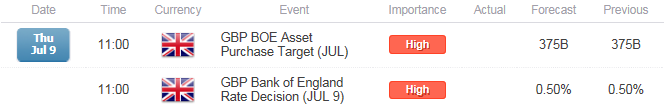

The Bank of England (BoE) interest rate decision may offer little relief to recent decline in GBP/USD as the central bank is widely expected to retain its current policy in July, and the committee may continue to endorse a wait-and-see approach amid the growing threat of a Greek exit.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Heightening uncertainties surrounding the Euro-Zone – the U.K.’s largest trading partner – may prompt the BoE to further delay its normalization cycle, and the British Pound may face additional headwinds in the second-half of the year should Governor Mark Carney highlight a more dovish outlook for monetary policy.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Industrial Production (MoM) (MAY) | -0.2% | 0.4% |

| Retail Sales ex Auto Fuel (MoM) (MAY) | -0.2% | 0.2% |

| Average Weekly Earnings ex. Bonus (3MoY) (APR) | 2.5% | 2.7% |

Stronger wage growth along with the narrowing slack in the real economy may encourage the BoE to adopt a more upbeat tone this time around, and the sterling may trade on a firmer footing in the second-half of 2015 should Governor Carney continue to prepare U.K. households and businesses for higher borrowing-costs.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Mortgage Approvals (MAY) | 68.8K | 64.4K |

| Consumer Price Index Core (YoY) (MAY) | 1.0% | 0.9% |

| Construction Output s.a. (MoM) (APR) | 0.1% | -0.8% |

However, the BoE may largely retain its current policy throughout the remainder of the year as the geopolitical risks surrounding the U.K. dampens the outlook for growth and inflation, and the central bank may carry the record-low interest rate into 2016 in an effort to encourage a stronger recovery.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bullish GBP Trade: BoE to Stay on Course to Remove Record-Low Interest Rate

- Need green, five-minute candle following the decision to consider a long GBP/USD trade.

- If market reaction favors buying Cable, go long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: MPC Highlights Dovish Outlook for Monetary Policy

- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish sterling trade, just in opposite direction.

Potential Price Targets For The Release

GBP/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- Failure to preserve the bullish RSI momentum carried over from March raises the risk for a further decline in GBP/USD; break/close below 1.5330 (78.6% retracement) may spark a run at the June low (1.5169).

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd turned net-long GBP/USD coming into July, with the ratio approaching extremes as it climbs to +1.74.

- Interim Resistance: 1.5550 (50% retracement) to 1.5570 (38.2% retracement)

- Interim Support: 1.5169 (June low) to 1.5180 (23.6% retracement)

Read More:

Price & Time: Cable Outlook Getting Less Murky

USD/JPY Retail FX Crowd Remains Net-Long Despite Fresh Monthly Lows

Impact that the BoE rate decision has had on GBP during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| JUN 2015 | 06/04/2015 11:00 GMT | 0.50% | 0.50% | -33 | -72 |

June 2015 Bank of England (BoE) Interest Rate Decision

As expected, the Bank of England (BoE) refrained from releasing a policy statement as the central bank kept the benchmark interest rate steady at 0.50% in June. It seems as though the BoE will stick to the sidelines in 2015 as the committee gauges the margin of slack in the real economy, but Governor Mark Carney may continue to prepare U.K. households and businesses for higher borrowing-costs as the central bank head anticipates a stronger recovery over the coming months. The initial uptick in the sterling was short-lived, with GBPUSD struggling to hold above the 1.5400 handle and ending the day at 1.5357.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums