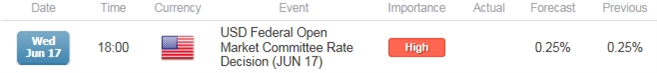

- Federal Open Market Committee (FOMC)Expected to Retain Current Policy in June.

- Will the Fed’s Updated Interest Rate Dot-Plot Remain Centered Around 0.50% to 0.75% for 2015?

Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

The updated forecasts coming out of the Federal Open Market Committee (FOMC) meeting may generate a bullish reaction in the greenback and spur downside pressures for EUR/USD should the central bank show a greater disposition to remove the zero-interest rate policy (ZIRP) in 2015.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:As the Fed remains on course to switch gears, market participants may pay increased attention to the Fed’s interest rate dot-plot in an effort to gauge the pace of the normalization cycle, but a more gradual trajectory for U.S. borrowing-costs may dampen the appeal of the reserve currency as it drags on rate expectations.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| U. of Michigan Confidence (JUN P) | 91.2 | 94.6 |

| Advance Retail Sales (MAY) | 1.2% | 1.2% |

| Non-Farm Payrolls (MAY) | 226K | 280K |

The Fed may continue to highlight an upbeat outlook for the U.S. economy as the central bank anticipates a stronger recovery to emerge in the second-half of the year, and the fresh forecasts may help the greenback resume the bullish trend from earlier this year should the dot-plot remain centered around 0.50% to 0.75% for 2015.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Industrial Production (MoM) (MAY) | 0.2% | -0.2% |

| ISM Non-Manufacturing (MAY) | 57.0 | 55.7 |

| Personal Consumption Expenditure- Core (YoY) (APR) | 1.4% | 1.2% |

Nevertheless, we may see a growing number of Fed officials show a greater willingness to retain the ZIRP for an extended period of time, and the central bank may sound more dovish this time around as the ongoing slack in the real economy limits the committee’s scope to achieve the 2% inflation target over the policy horizon.

Join DailyFX on Demand to Cover the Entire FOMC Rate Decision!

How To Trade This Event Risk(Video)

Bullish USD Trade: Upbeat FOMC Prepares U.S. Households & Businesses for Rate Hike

- Need red, five-minute candle following the fresh Fed updates to consider a short EUR/USD position.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Committee Shifts to More Gradual Normalization Cycle

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bullish dollar trade, just in the opposite direction.

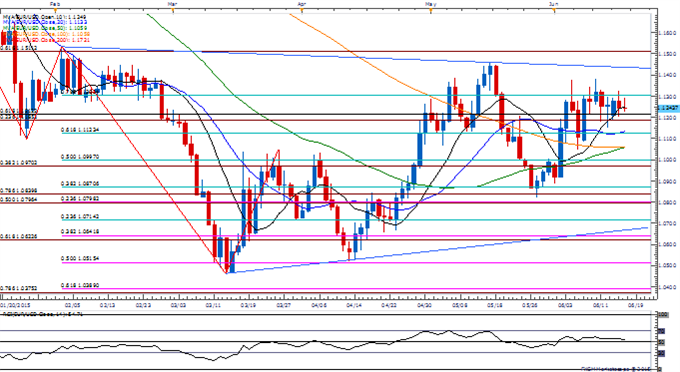

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD remains at risk of giving back the advance from earlier this month as it appears to be carving a near-term top (lower-high); long-term outlook remains bearish amid the ongoing deviation in monetary policy.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since March 19, with the ratio currently standing at -2.10.

- Interim Resistance: 1.1510 (61.8% expansion) to 1.1532 (February high)

- Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)

Read More:

Price & Time: Looking To The Fed For Direction

Scalp Webinar: Bearish USD Technical Outlook to Face Upbeat FOMC

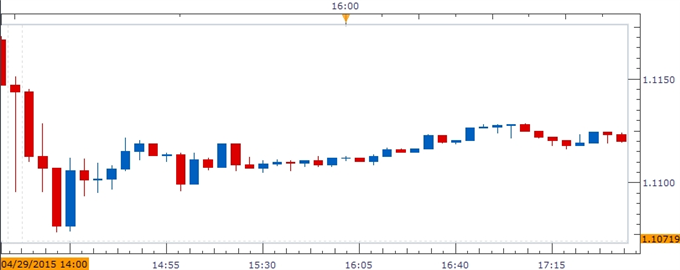

Impact that the FOMC rate decision has had on EUR/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

APR 2015 | 04/29/2014 18:00 GMT | 0.25% | 0.25% | -33 | -19 |

April 2015 Federal Open Market Committee (FOMC) Interest Rate Decision

Despite fears of a slowing recovery, the Federal Open Market Committee (FOMC) largely struck an upbeat outlook for the region and pledged to look past the ‘transitory factors’ dragging on the real economy as the central bank anticipates a stronger recovery to materialize in the months ahead. Despite the risk of seeing the Fed retain the zero-interest rate policy (ZIRP) beyond mid-2015, it seems as though the central bank will stay on course to normalize policy later this year as Chair Janet Yellen remains confident in achieving the 2% target for inflation over the policy horizon. The greenback strengthened following the upbeat comments from the Fed, with EURUSD dipping down below the 1.1100 handle, but the market reaction largely fizzled ahead of the close as the pair ended the session at 1.1127.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums