- Bank of Canada (BoC) to Keep Benchmark Interest Rate on Hold for Third-Consecutive Meeting.

- Will Governor Stephen Poloz Continue to Highlight an Improved Outlook?

For more updates, sign up for David's e-mail distribution list.

Trading the News: Bank of Canada Interest Rate Decision

The Bank of Canada (BoC) interest rate decision may boost the appeal of the loonie and spur a pullback in USD/CAD should the central bank adopt a more hawkish tone for monetary policy.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Expectations for a stronger recovery may encourage BoC Governor Stephen Poloz to highlight an improved outlook for the region, and the central bank may show a greater willingness to move away from its wait-and-see approach as it anticipates the positive dynamics underling the real economy to ‘reassert themselves during the second quarter, and to do so clearly in the second half of the year.’

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Retail Sales (MoM) (MAR) | 0.3% | 0.7% |

| Unemployment Rate (APR) | 6.9% | 6.8% |

| Ivey Purchasing Manager Index s.a. (APR) | 49.2 | 58.2 |

The BoC may release a more hawkish statement amid the pickup in private-sector activity, and a material shift in the forward-guidance may produce a near-term correction in USD/CAD as market participants boost the interest rate outlook.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Consumer Price Index (YoY) (APR) | 1.0% | 0.8% |

| New Housing Price Index (YoY) (MAR) | 1.3% | 1.2% |

| International Merchandise Trade (MAR) | -0.80B | -3.02B |

However, slowing inflation paired with the weakness in global trade may push the BoC to largely retain its current policy throughout 2015, and the Canadian dollar may continue to underperform against its U.S. counterpart should Governor Poloz endorse a neutral stance for monetary policy.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bullish CAD Trade: BoC Turns Increasingly Upbeat & Adopts Hawkish Tone

- Need red, five-minute candle following the rate decision for a potential short USD/CAD trade.

- If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish CAD Trade: Governor Poloz Endorses Wait-and-See Approach

- Need green, five-minute candle to consider a long USD/CAD position.

- Carry out the same setup as the bullish Canadian dollar trade, just in reverse.

Read More:

USD/JPY Marks First Overbought Signal in 2015; Retail Turns Net-Short

USDCAD Scalps Faces 1.25 Key Resistance Ahead of BoC, GDP

Potential Price Targets For The Release

USD/CAD Daily

Chart - Created Using FXCM Marketscope 2.0

- Despite the move back above former support around 1.2360 (38.2% retracement) to 1.2380 (50% retracement), need a break of the triangle/wedge formation carried over from March to favor a resumption of the long-term bullish trend.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-short USD/CAD since May 22, with the ratio currently sitting at -1.40.

- Interim Resistance: 1.2480 (61.8% retracement) to 1.2500 pivot (trendline resistance)

- Interim Support: 1.2110 (61.8% retracement) to 1.2130 (23.6% retracement)

Impact that the BOC Interest Rate decision has had on CAD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

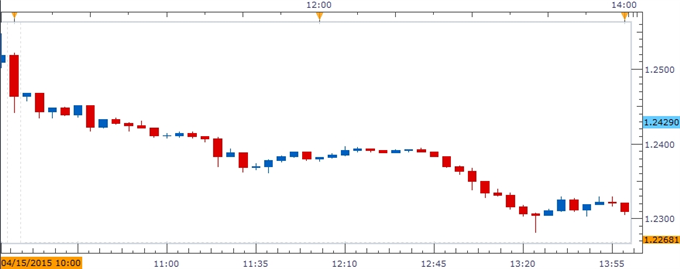

| APR 2015 | 04/15/2015 14:00 GMT | 0.75% | 0.75% | -108 | -245 |

April 2015 Bank of Canada(BOC) Interest Rate Decision

As expected, the Bank of Canada (BoC) kept the benchmark rate unchanged at 0.75% in April. Despite the neutral stance, BoC Governor Stephen Poloz appears to be turning increasingly optimistic towards the region as the central bank head looks through the recent weakness in the real economy and anticipates a stronger recovery in the second-quarter of 2015. The Canadian Dollar strengthened following the less-dovish statement, with USD/CAD slipping below the 1.2300 handle to end the day at 1.2273.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums