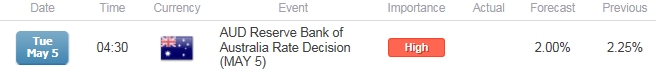

- Reserve Bank of Australia (RBA) Expected to Cut Benchmark Interest Rate to 2.00%.

- Will Governor Glenn Stevens Toughen the Verbal Intervention as AUD/USD as Well?

For more updates, sign up for David's e-mail distribution list.

Trading the News: Reserve Bank of Australia Interest Rate Decision

According to a Bloomberg News survey, 25 of the 29 economists polled anticipate the Reserve Bank of Australia (RBA) to reduce the cash rate by 25bp to 2.00%, and another round of easing may prompt a further decline in AUD/USD amid the deviation in the policy outlook.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The RBA may take additional steps to combat the downside risks surrounding the region as Governor Glenn Stevens keeps the door open to offer lower borrowing-costs, and the central bank may also look to toughen its verbal intervention on the local currency in an effort to further assist with the rebalancing of the real economy.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| NAB Business Confidence (1Q) | -- | |

| Westpac Consumer Confidence s.a. (MoM) (APR) | -- | -3.2% |

| Gross Domestic Product s.a. (QoQ) (4Q) | 0.6% | 0.5% |

Waning confidence along with fears of a slowing recovery may push the RBA to further support the $1T economy, and another round of monetary easing may dampen the appeal of the aussie especially if the central bank keeps the door open to push the cash rate to fresh record-lows.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Consumer Price Index- Trimmed Mean (YoY) (1Q) | 2.2% | 2.3% |

| Employment Change (MAR) | 15.0K | 37.7K |

| Retail Sales (MoM) (FEB) | 0.4% | 0.7% |

However, the RBA may retain its current policy in May amid sticky price growth paired with the pickup in private-sector activity, and the aussie-dollar may continue to retrace the decline from the beginning of the year should Governor Stevens endorse a wait-and-see approach.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bearish AUD Trade: RBA Cuts Cash Rate & Toughens Verbal Intervention

- Need red, five-minute candle following the rate decision for a potential short AUD/USD trade.

- If market reaction favors a bearish aussie trade, sell AUD/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish AUD Trade: Governor Stevens Endorses Interest Rate Stability

- Need green, five-minute candle to consider a long AUD/USD position.

- Carry out the same setup as the bearish aussie trade, just in reverse.

Read More:

COT-Large Yen Speculators Close to a Net Long Position

Bullish USD/JPY Retail Sentiment Narrows Despite Risk for Breakout

Potential Price Targets For The Release

AUD/USD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

- Lack of momentum to close above former support around 0.8000 (61.8% retracement) to 0.8020 (38.2% expansion) may highlight a near-term topping process in AUD/USD; waiting for a break of the bullish RSI momentum for confirmation/conviction.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd has flipped to net-short AUD/USD coming into the first full-week of May, with the ratio currently holding at -1.02.

- Interim Resistance: 0.8000 (61.8% retracement) to 0.8020 (38.2% expansion)

- Interim Support: 0.7710 (23.6% retracement) to 0.7740 (78.6% expansion)

Impact that the RBA Interest Rate decision has had on AUD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| APR 2015 | 04/07/2014 4:30 GMT | 2.25% | 2.25% | +37 | +3 |

April 2015 Reserve Bank of Australia (RBA) Interest Rate Decision

The Reserve Bank of Australia (RBA) retained the benchmark rate at 2.25%, but kept the door open to further embark on its easing cycle in an effort to further assist with the rebalancing of the real economy. The RBA continued to highlight the risk for below-trend pace amid the slowdown in global growth, but Governor Glenn Stevens may continue to promote a wait-and-see approach in the first-half of 2015 as the Australian dollar exchange rate works it was towards the 0.7500, the preferred exchange rate outlined by the central bank head. The Australian Dollar strengthened following the rate decision, with AUD/USD climbing above the 0.7700 handle, but the market reaction quickly fizzled as the pair largely consolidated over the remainder of the Asian/Pacific trade to end the session at 0.7669.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums