- European Central Bank (ECB) Widely Expected to Announce Quantitative Easing (QE) Program.

- Will ECB Share the Risk & Get Local Central Banks Involved?

For more updates, sign up for David's e-mail distribution list.

NOTE: FXCM Inc, Parent Company of DailyFX, will raise margin requirements given volatility risk.

Trading the News: European Central Bank (ECB) Interest Rate Decision

EUR/USD may face fresh monthly lows over the next 24-hours of trade as the European Central Bank (ECB) is widely expected to announce more non-standard measures to further mitigate the risk for deflation.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Despite headlines for a EUR 50B/month asset-purchase program, the details surrounding the new initiative may play a greater role in driving EUR/USD especially as the Governing Council struggles to achieve its one and only mandate for price stability.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Producer Price Index (YoY) (NOV) | -1.4% | -1.6% |

| Consumer Price Index (YoY) (DEC A) | -0.1% | -0.2% |

| Purchasing Manager Index Composite (DEC F) | 51.7 | 51.4 |

Indeed, the heightening risk for deflation may prompt the ECB to further embark on its easing cycle, and the central bank may keep the door open to implement additional monetary support over the near to medium-term in an effort to encourage a more sustainable recovery.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| ZEW Survey (JAN) | -- | 45.2 |

| Retail Sales (MoM) (NOV) | 0.2% | 0.6% |

| Sentix Investor Confidence (JAN) | -1.0 | 0.9 |

However, the ECB may provide limited details and make an attempt to buy more time as President Mario Draghi struggles to produce a unanimous vote within the Governing Council, and we may see a more meaningful rebound in EUR/USD should the central bank disappoint.

Join DailyFX on Demand for Coverage of the Entire ECB Rate Decision!

How To Trade This Event Risk(Video)

Bearish EUR Trade: ECB Unveils Open-Ended QE Program

- Need red, five-minute candle following the policy announcement to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Attempts to Buy More Time

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

Read More:

ECB Rumor Puts EUR/USD on the Rocks, >100-pip Range After US Open

T-Minus 1: Setting EUR Expectations for Tomorrow’s ECB Meeting

Potential Price Targets For The Release

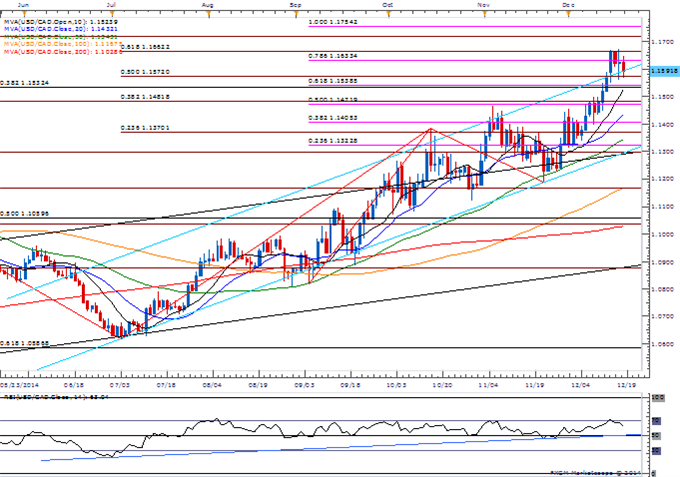

EUR/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- Despite the string of closing prices above the 1.1500 handle, downside targets remain favored for EUR/USD as the RSI retains the bearish momentum and holds in oversold territory.

- Interim Resistance: 1.1720 (23.6% retracement) to 1.1740 (161.8% expansion)

- Interim Support: 1.1458 (January low) to 1.1500 pivot

Impact that the ECB rate decision has had on EUR/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| DEC 2014 | 12/04/2014 12:45 GMT | 0.05% | 0.05% | +41 | +65 |

December 2014 European Central Bank Interest Rate Decision

As expected, the European Central Bank (ECB) kept the benchmark rate at the record low of 0.05%, but announced it would consider a broad-based asset purchase program which could including sovereign debt next month in order to achieve a EUR 1T expansion in its balance sheet. At the same time, the ECB also lowered its economic outlook of the euro-area, with the central bank lowering its 2014/2015 forecasts for growth and inflation. Despite the dovish remarks, the Euro strengthened after the statement as the ECB further delays the QE program, with EUR/USD closing the day at 1.2376.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums