Euro Outlook:

- EUR/JPY and EUR/USD rates have been holding below short-term EMAs for over one month, delineating lines in the sand for the recent bearish impulse.

- Meanwhile, both EUR/GBP rates have been holding within a range that began back in late-February.

- Per the IG Client Sentiment Index, each major EUR-cross has a different bias.

Euro Looking for Stability Ahead of ECB

As global financial markets contend with the severity of the COVID-19 delta variant, traders will have a chance to hear from European Central Bank policymakers tomorrow when the July meeting concludes. While the major EUR-crosses have been experiencing a slow, steady burn, the ECB meeting represents a significant catalyst and a potential turning point – or accelerator – for recent trends.

However, considering that the meeting will produce a new set of economic projections, all focus is on what the ECB has to say about its recent policy review and possible adjustments made to its QE program (shifting from the narrow PEPP to a broader APP). With measures of volatility constrained, markets don’t appear to be expecting many fireworks (more on that from my colleague Rich Dvorak later today), meaning current trends appear likely to persist.

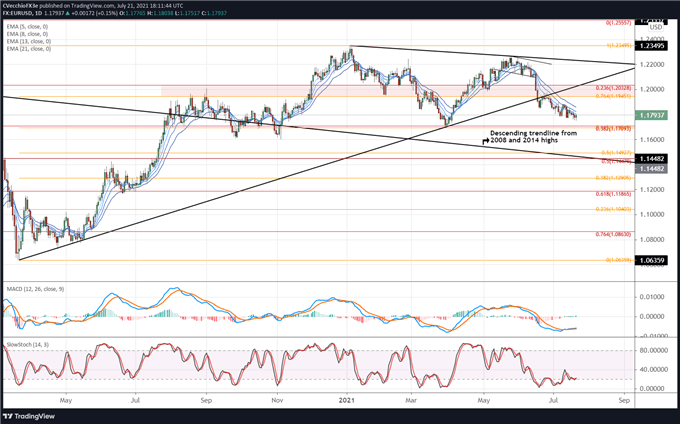

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to July 2021) (CHART 1)

EUR/USD rates set a fresh monthly low today, but the fact of the matter is that not much progress has been made ever since breaching the early-July low of 1.1782; at the time of writing, EUR/USD rates were trading at 1.1794. But recovery has not transpired in a meaningful way, thanks in part to the strength seen by the broader DXY Index in recent days.

The pair remains below its daily 5-, 8-, 13-, and 21-EMA envelope, which is still in bearish sequential order. Daily MACD is creeping higher but is persisting deep in bearish territory. Elsewhere, daily Slow Stochastics are bouncing along the delineating line that separates ‘bearish territory’ from ‘oversold.’If there is another dive, the March low at 1.1704 should prove as meaningful support; beyond there, the September and November 2020 lows at 1.1600 are in focus. A bullish reversal may gather pace above the daily 13-EMA, which EUR/USD rates have closed below every session since June 8.

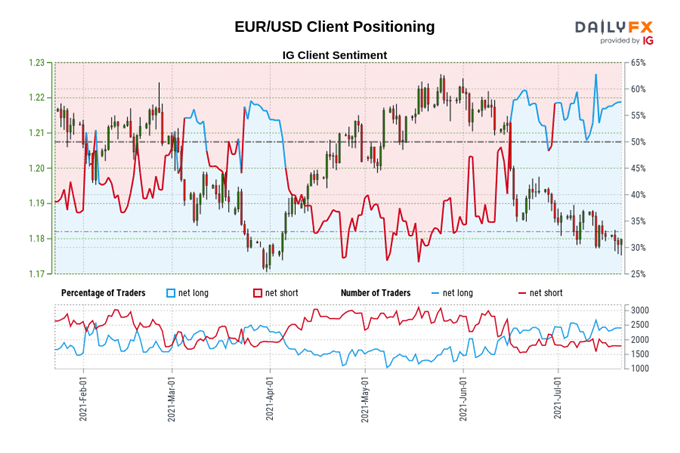

IG Client Sentiment Index: EUR/USD Rate Forecast (July 21, 2021) (Chart 2)

EUR/USD: Retail trader data shows 59.06% of traders are net-long with the ratio of traders long to short at 1.44 to 1. The number of traders net-long is 4.52% higher than yesterday and 3.43% higher from last week, while the number of traders net-short is 5.20% higher than yesterday and 5.27% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

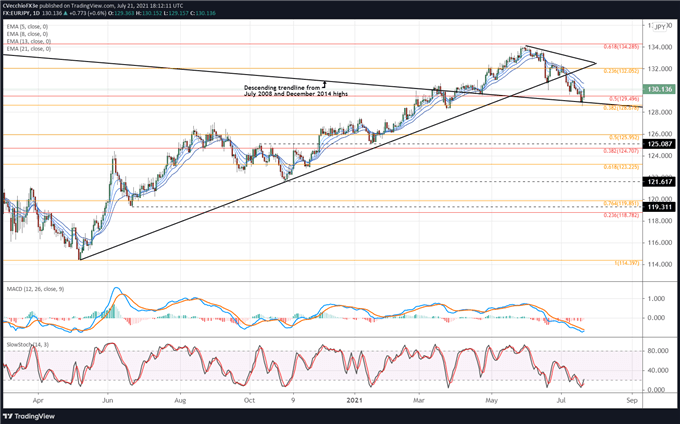

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to July 2021) (CHART 3)

In the prior update, it was noted that “although technically not a high, an evening star candle cluster may be forming, a hint at more weakness to come; support comes into play below 129.00.” EUR/JPY rates did drop below 129.00, reaching the descending trendline from the July 2008 and December 2014 highs before bouncing, which also coincided with support in the form of the 38.2% Fibonacci retracement of the 2018 high/2020 low range at 128.88. Confidence in the bullish reversal would increase upon overtaking 130.67, the daily 21-EMA, which EUR/JPY rates have closed below every session since June 18.

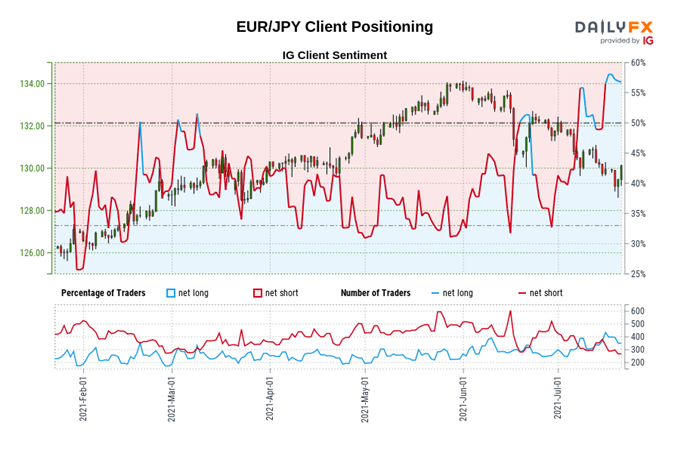

IG Client Sentiment Index: EUR/JPY Rate Forecast (July 21, 2021) (Chart 4)

EUR/JPY: Retail trader data shows 55.12% of traders are net-long with the ratio of traders long to short at 1.23 to 1. The number of traders net-long is 11.99% higher than yesterday and 1.66% lower from last week, while the number of traders net-short is 2.69% lower than yesterday and 22.52% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/JPY prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/JPY-bearish contrarian trading bias.

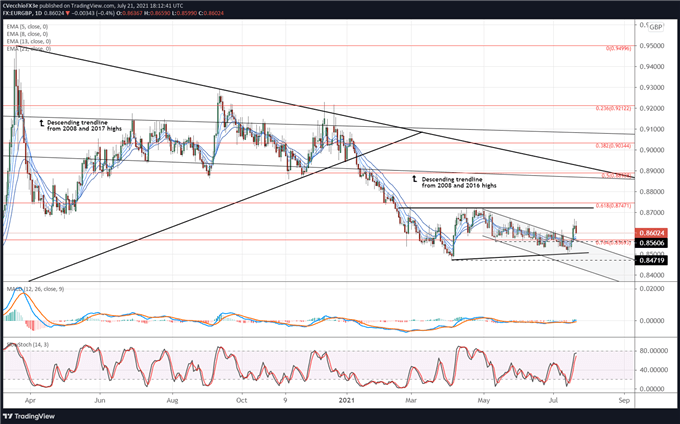

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to July 2021) (CHART 5)

EUR/GBP rates continue remain extremely choppy, in a sideways range effectively since late-February. In the past few days, the pair broke above descending channel resistance in place since the start of May, nullifying the perspective that “a return to the April low at 0.8472 is beginning to take shape.” With momentum indicators finding no sense of agreement, this may be the one pair to stay away from over the coming days; clearer opportunities exist elsewhere.

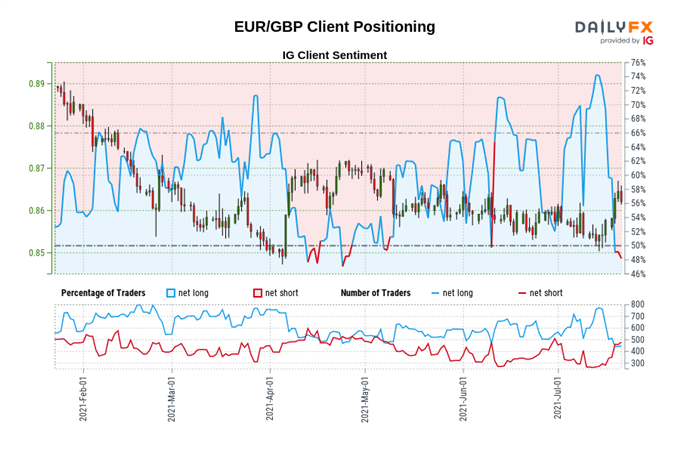

IG Client Sentiment Index: EUR/GBP Rate Forecast (July 21, 2021) (Chart 6)

EUR/GBP: Retail trader data shows 46.38% of traders are net-long with the ratio of traders short to long at 1.16 to 1. The number of traders net-long is 0.46% lower than yesterday and 49.30% lower from last week, while the number of traders net-short is 7.25% higher than yesterday and 66.01% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bullish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist