British Pound Outlook:

- The British Pound’s performance against the commodity currencies has been middling. While GBP/JPY is up by over +8% year-to-date, GBP/AUD is up by just over +1.7%, GBP/NZD is up less than +0.2%, and GBP/CAD has dropped by over -1.75%.

- GBP/AUD remains rangebound, while GBP/CAD and GBP/NZD continue to coil ever more into their triangular consolidations.

- According to the IG Client Sentiment Index, the British Pound has a mixed trading bias.

Commodity Currency GBP-crosses Turning Higher?

By most measures, the British Pound is among the best performing currencies in the developed currency space. And while this is true particularly against the lower yielding currencies, it’s not-so against growth-sensitive or high beta currencies. While GBP/JPY is up by over +8% year-to-date, GBP/AUD is up by just over +1.7%, GBP/NZD is up less than +0.2%, and GBP/CAD has dropped by over -1.75%.

Coming out of the local Scottish elections last weekend that failed to generate enough implicit support for a second Scottish independence referendum at present time, the British Pound has been able to unburden itself of a speculative albatross (another concern dissipating post-Brexit, for now).

Concurrently, with global equity markets in a state of turmoil (or rather, asset reallocation), some of the high beta currencies have pulled back as well; the mix of news has been fertile for near-term gains in the commodity currency GBP-crosses.

Read more: Central Bank Watch: BOE & ECB Interest Rate Expectations Update

GBP/AUD RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to May 2021) (CHART 1)

In the prior commodity currency GBP-crosses update, it was noted that GBP/AUD “looks destined to stay rangebound for the foreseeable future.” GBP/AUD has been rangebound for several months now, only briefly breaching the February high (1.8112) at the start of April before immediately turning lower, while it has not yet dropped below the February low (1.7689).

Overall, the pair continues to persist in a slightly descending parallel channel dating back to late-May 2020. Momentum is flat as evidenced by the lack of difference among the EMA envelope and with daily MACD hugging its signal line. For breakout or trend traders, better opportunities may exist elsewhere, still.

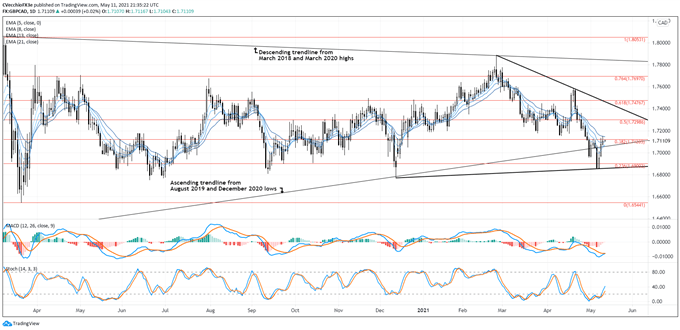

GBP/CAD RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to May 2021) (CHART 2)

GBP/CAD has been the most volatile commodity currency GBP-crosses in recent days, not necessarily a surprise given the batch of North American labor market data at the end of last week. The brief drop below the ascending trendline from the August 2019 and December 2020 lows hints at a false bearish breakout, ripe for a more significant reversal higher after finding support near the 23.6% Fibonacci retracement of the 2020 high/low range at 1.6900.

However, it appears that the perspective of GBP/CAD may be shifting, insofar as a symmetrical triangle appears to be forming, carved out against the December 2020 and May 2021 swing lows and the February and April 2021 swing highs. It may be the case that if GBP/CAD is able to overcome the 38.2% retracement (1.7120) and the daily 21-EMA, the path may be clear to trade higher towards the confluence of the 50% retracement (1.7297) and triangle resistance by mid-June.

GBP/NZD RATE TECHNICAL ANALYSIS: DAILY CHART (February 2020 to May 2021) (CHART 3)

It’s been previously noted that “if GBP/NZD rates were to settle above the February high of 1.9418, it would constitute an effort towards a significant reversal and establish a false bearish breakout below the ascending trendline from the October 2008 and August 2015 lows.” And while the pair did achieve the conditions for a reversal, said gains did not last; now, GBP/NZD finds itself back below the ascending trendline from the October 2008 and August 2015 lows once more.

With the benefit of hindsight, it appears that GBP/NZD too is consolidating in a symmetrical triangle. Resistance is carved out against the August 2020 and March 2021 highs and support comes in from the December 2020, January 2021, and May 2021 swing lows. Now trading between the 23.6% and 38.2% Fibonacci retracements of the 2020 high/low range, GBP/NZD rates may be destined to stay rangebound for the foreseeable future.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist