Euro Outlook:

- With EUR/USD rising again, several of the EUR-crosses have seen price action turn higher over the course of the week.

- EUR/CHF rates may be suggesting a better environment for risk appetite, while EUR/NOK and EUR/SEK rates’ price action still suggests deeper setbacks are possible.

- According to the IG Client Sentiment Index, EUR/CHF has a mixed bias in the near-term.

EUR-crosses Give Greenlight to Risk

FX markets have quieted down in recent weeks, thanks largely due to the fact that stability in global bond yields has deprived interest rate-sensitive assets a catalyst for volatility. But lower volatility environments tend to translate into more risk seeking behavior by market participants, and with EUR/USD rising again, several of the EUR-crosses have seen price action turn higher over the course of the week. EUR/CHF rates may be suggesting a better environment for risk appetite, while EUR/NOK and EUR/SEK rates’ price action still suggests deeper setbacks are possible.

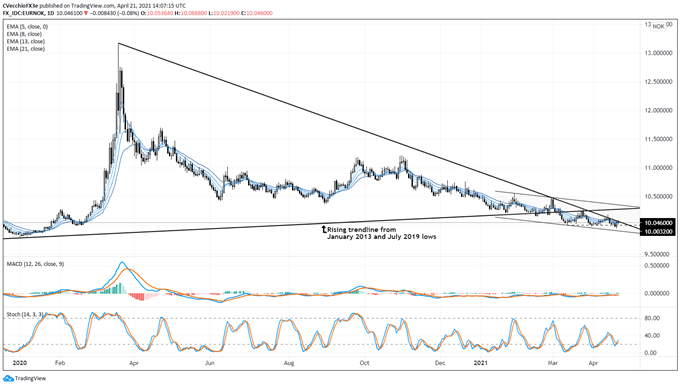

EUR/NOK RATE TECHNICAL ANALYSIS: DAILY CHART (December 2019 to April 2021) (CHART 1)

Through April, EUR/NOK rates have not made much progress, remaining within the descending parallel channel that’s developed in 2021; momentum is listless. But trading is a function of price and time, and the passage of time has now seen the pair return to the descending trendline from the March 2020 and February 2021 highs, leaving open the potential for a short-term reversal. Nevertheless, even if there is a break higher, EUR/NOK rates are still below the rising trendline from the January 2013 and July 2019 lows, evidence that, on a longer-term basis, we remain in bearish breakout territory. Per the prior update, it still holds that “a more decisive break below the yearly low established at 10.0032 would be the necessary trigger before a bearish directional move is likely to succeed.”

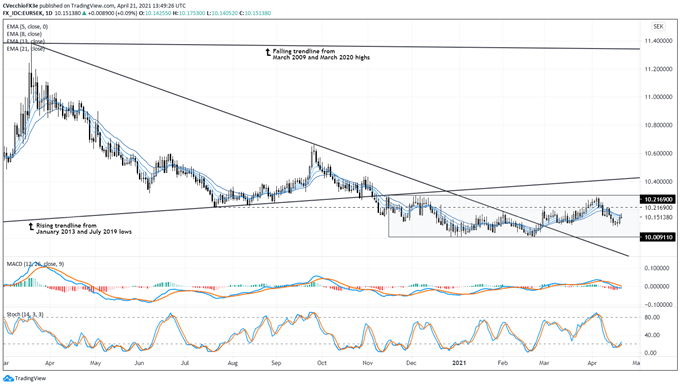

EUR/SEK RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to April 2021) (CHART 2)

Although EUR/SEK rates started the month by trading through range resistance dating back to late-December 2020, it appears that a broader range has been carved out dating back to mid-November 2020, where a daily bearish key reversal high has remained untested. The decline in EUR/SEK rates prior to achieving 10.2169, marked by a daily bearish piercing candle, actually saw the pair produce a ‘lower low’ in April relative to March.

The context of the sideways consolidation since mid-November suggests that it may be a multi-month bear flag in the making, given that EUR/SEK rates have been in a steady holding pattern below the rising trendline from the January 2013/July 2019 lows. It may be the case that, for the past few months, EUR/SEK rates have been simply digesting crowded positioning that built up after the immediate onset of the pandemic. A deeper setback may soon emerge.

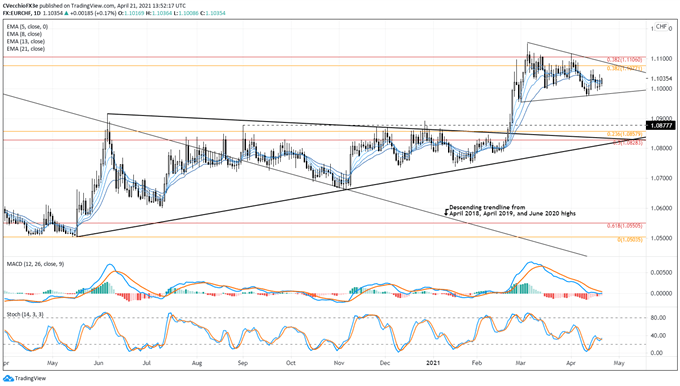

EUR/CHF RATE TECHNICAL ANALYSIS: DAILY CHART (April 2020 to April 2021) (CHART 3)

In the prior update for EUR/CHF rates it was noted that the passage of time “yielded the clarity of a symmetrical triangle having formed in recent weeks around the aforementioned Fibonacci retracements. While more patience is required, in context of the preceding move, traders may want to keep an eye on potential bullish resolution in EUR/CHF rates.” More patience is required as the symmetrical triangle has morphed to take on a more encompassing formation; it retains the context of a bullish continuation effort nevertheless.

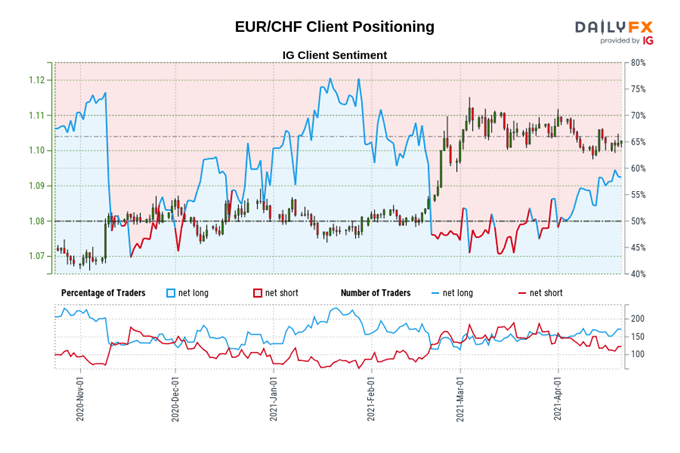

IG Client Sentiment Index: EUR/CHF Rate Forecast (April 21, 2021) (Chart 4)

EUR/CHF: Retail trader data shows 58.70% of traders are net-long with the ratio of traders long to short at 1.42 to 1. The number of traders net-long is 4.88% higher than yesterday and 11.34% lower from last week, while the number of traders net-short is 0.83% higher than yesterday and 5.47% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/CHF prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/CHF trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

.jpg)