USD, USD/JPY, Gold Analysis & News

- Equities Pullback From Recent Highs

- USD Correction Persists

- Gold Upside Capped by Rising Yields

QUICK TAKE: US Dollar Correction Persists, Equities Softer

Equities: A slightly softer start to the week as equity markets pullback from recent highs. The weaker tone seen in Asia has extended into Europe bourses as virus concerns continue to weigh, particularly with Japan finding a new COVID variant that differs from the UK and South African strains.

Euro Stoxx 50 Sector BreakdownOutperformers: Real Estate (+0.7%), Healthcare (+0.5%), Communication Services (+0.4%)Laggards:Energy (-1.5%), Materials (-1.2%), Utilities (-0.9%)

US Futures: S&P 500 (-0.4%), DJIA (-0.5%), Nasdaq 100 (+0.01%)

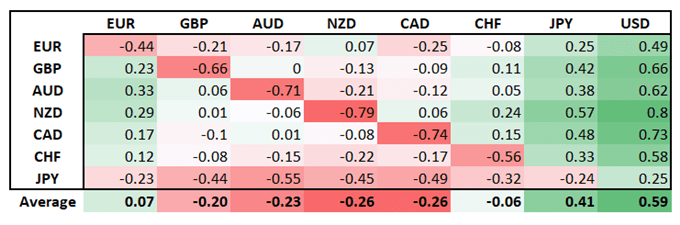

FX

FX: The US Dollar remains in a correction phase amid the recent push higher in US rates, alongside rate-differentials moving in favour of the greenback, while an unwind of crowded short-positioning could see the move higher in the greenback extend further. However, the outlook remains for a broadly softer USD throughout the year. That said, the Pound is on the backfoot as the UK government look to toughen the already strict national lockdown. Meanwhile, USD/JPY has continued to track US yields higher, although as cross-JPY dips, gains in the pair may be capped at 104.50.

USD/JPY Chart: Daily Time Frame

Source: Refinitiv

Analyst pick: US Dollar Forecast: USD/JPY to Follow Surging Treasury Yields

Commodities: As the USD and US Yields pick-up, the short-term upside in gold is likely to be challenging. The precious metal bounced off support from 1820 overnight, however, gains have been limited to 1850 thus far. Elsewhere, oil prices have taken a breather following last week’s impressive rally.

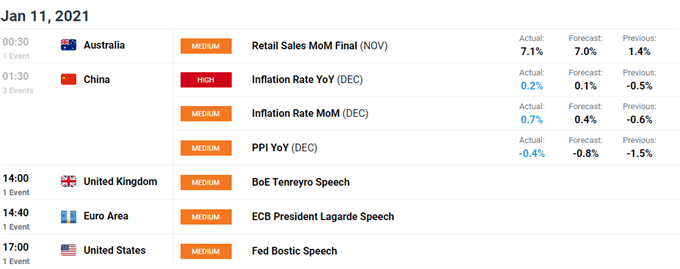

Looking ahead: A plethora of Fed officials speaking this week with Bostic and Kaplan kicking off proceedings. Although with the recent hawkish commentary from Bostic over potentially recalibrating bond purchases, eyes will be on the more dovish members, including Fed’s Brainard. Elsewhere, BoE’s Tenreyro is due to speak at 1400GMT with the topic on negative rates, thus it is worth keeping in mind that Tenreyro has been more among the supporters of negative rates.

DailyFX Economic Calendar Events

Source: DailyFX