US Dollar Analysis & News

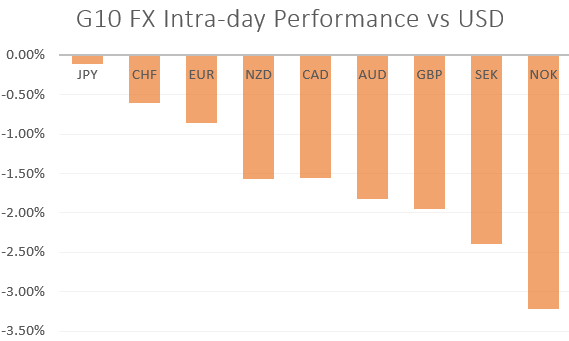

USD: As we have mentioned yesterday, the stress in the funding market has continued to propel the US Dollar higher, much like the 2008 global financial crisis. Consequently, we have seen a firm break above the 100.00 handle as continued market turbulence benefits the greenback.

GBP: The Pound has come under heavy selling pressure throughout the session, largely on the back of a rampant US Dollar. However, the Pound is among the underperformers in the G10 space having hit its lowest level since 1985. Given that the severity of the spread of coronavirus in the UK has increased dramatically since last week, the Bank of England is expected to cut interest rates to the effective lower bound (0.1%) and announce that it will restart its QE program. While the BoE meeting is scheduled next Thursday, it is becoming increasingly likely that the central bank will provide yet another emergency monetary policy decision. GBP rallies to be faded. At the time of writing, reports continue to do the rounds that London may go into lockdown in the coming days.

| Change in | Longs | Shorts | OI |

| Daily | 2% | -7% | -1% |

| Weekly | 13% | 7% | 11% |

AUD: The Australian Dollar continues to trade heavy as risk appetite deteriorates further. Alongside this, the RBA is expected to announce another rate cut to 0.25%, marking a record low, which will likely be accompanied with fresh unconventional monetary policy, potentially in the form of QE or Yield Curve Control.

Source:, Refinitiv

Economic Calendar (18/03/20)

Source: DailyFX,

WHAT’S DRIVING MARKETS TODAY

- “Euro Struggles to Hold EUR/USD 1.1000 Against a Rampant US Dollar” by Nick Cawley, Market Analyst

- “DAX 30, Euro Stoxx 50 Outlook: Europe Heading Towards a Recession” by Justin McQueen, Market Analyst

- “FX Volatility Will Oscillate, but the High Vol Regime is Here to Stay” by Paul Robinson, Market Analyst

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX