MARKET DEVELOPMENT Analysis

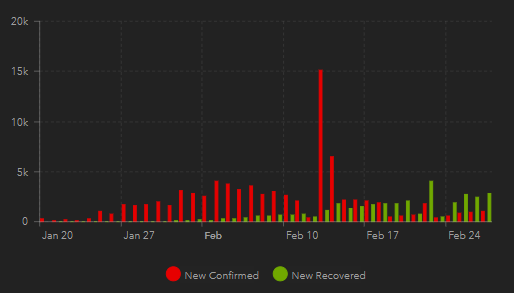

Equities: A sea of red yet again as global equities remain under heavy selling pressure. Consequently, US bond yields have once again printed fresh record lows with the 10yr yielding 1.26% and money markets pricing over 2 rate cuts this year from the Fed. That said, while the spread of the coronavirus has continued to spark panic, the rate of recoveries has been outpacing the rate of new cases over the past week (Figure 1). Alongside this, we are also cognisant of the fact that with month-end looming, given the outperformance in bonds over equities (US bonds outperforming S&P 500 by over 6%), there is a potential for portfolio rebalancing to pave the way for a sizeable bounce across equities in the absence of more negative virus related newsflow.

Figure 1. Coronavirus Recovery Rate Higher Than New Case Rate

Source: gisanddata coronavirus

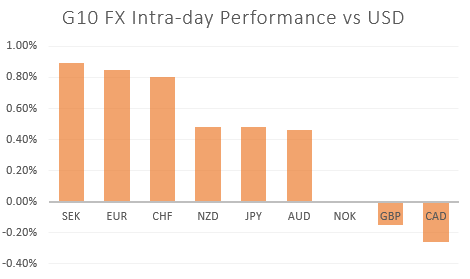

EUR: Carry unwind and shorts heading for the exit push the Euro towards 1.10 against the greenback. As such, the currency is on course for its strongest daily gain since August 2019. That said, the outlook remains weak for the Eurozone and thus a break above the 1.1000 may be somewhat difficult to maintain.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -7% | -3% |

| Weekly | -6% | 6% | -2% |

GBP: The UK announced its mandate for trade talks with the EU and as expected, the UK have maintained their pledge that they are willing to fall onto WTO terms should talks with the EU fail. However, more interestingly, the UK noted that a decision as to whether a no-deal would take place, may be as soon as June, which marks the deadline for the UK to ask for an extension to the transition period.

| Change in | Longs | Shorts | OI |

| Daily | -3% | -9% | -5% |

| Weekly | 6% | -10% | 0% |

Source: DailyFX, Refinitiv

Economic Calendar (27/02/20)

Source: DailyFX,

WHAT’S DRIVING MARKETS TODAY

- “British Pound (GBP) Latest: GBP/USD at Risk with Volatility on the Rise” by Mahmoud Alkudsi, Market Analyst

- “Dow Jones Outlook – Historical Extreme Suggests Big Bounce Nearing” by Paul Robinson, Currency Strategist

- “Coronavirus Impact: S&P 500, DAX, Gold and Crude Oil Outlook” by Justin McQueen, Market Analyst

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX