Euro Forecast & ECB Meeting Overview:

- The Euro has plowed ahead at the start of October and Q4’17, and looks to hold onto its gains as the calendar turns through the October ECB meeting – the final meeting with President Mario Draghi at the helm.

- Rates markets don’t anticipate any action from the ECB in the first half of 2020, now pricing in the next rate cut coming in September 2020 (53% chance).

- Per the IG Client Sentiment Index, EUR/JPY and EUR/USD may trade sideways through the October ECB meeting.

See our long-term forecasts for the Euro and other major currencies with the DailyFX Trading Guides.

Euro Retains Gains Ahead of October ECB Meeting

The Euro has plowed ahead at the start of October and Q4’17, and looks to hold onto its gains as the calendar turns through the October ECB meeting – the final meeting with President Mario Draghi at the helm. On the back of progress on the Brexit and US-China trade war fronts, global risk appetite has been lifted, giving room for the Euro to recover. The trio of safe haven currencies continue to lead the way among the EUR-crosses month-to-date: EUR/JPY is up by 2.48%; EUR/USD has added 1.98%; and EUR/CHF has gained 1.24%.

Eurozone Economic Data Remains Down

The forex economic calendar has been light for the Euro in the days ahead of the October ECB meeting. Overall, Eurozone economic data has continued to disappoint over the past few months, at least when trying to measure releases relative to expectations. The Citi Economic Surprise Index for the Eurozone, a gauge of economic data momentum, currently sits at -57.3 today relative to -65.3 one-month ago on September 25 and -33 on July 24.

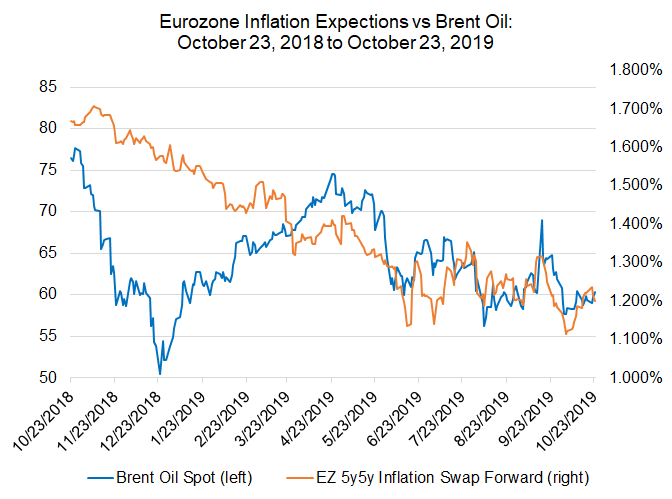

Eurozone Inflation Expectations Following Brent Oil

Tomorrow’s ECB meeting will be the last under Mario Draghi’s tenure which began eight years ago. Outgoing ECB President Draghi’s preferred measure of inflation, the Eurozone 5y5y inflation swap forwards, are currently trading at 1.201%, comfortably above the yearly low set at the start of October at 1.115%. Eurozone inflation expectations have stabilized in recent weeks: Eurozone 5y5y inflation swap forwards read 1.188% one month ago on September 25.

Eurozone Inflation Expectations versus Brent Oil Prices: Daily Timeframe (October 2018 to October 2019) (Chart 1)

The relationship between Eurozone 5y5y inflation swap forwards and Brent oil prices has tightened up over the past few weeks. The current 20-day correlation between Eurozone inflation expectations and Brent oil prices has held steady in recent weeks, from 0.48 one month ago to 0.47 today.

Given the state of Eurozone 5y5y inflation swap forwards – a medium-term market-derived measure of inflation expectations – traders should expect a cautious tone from outgoing ECB President Draghi.

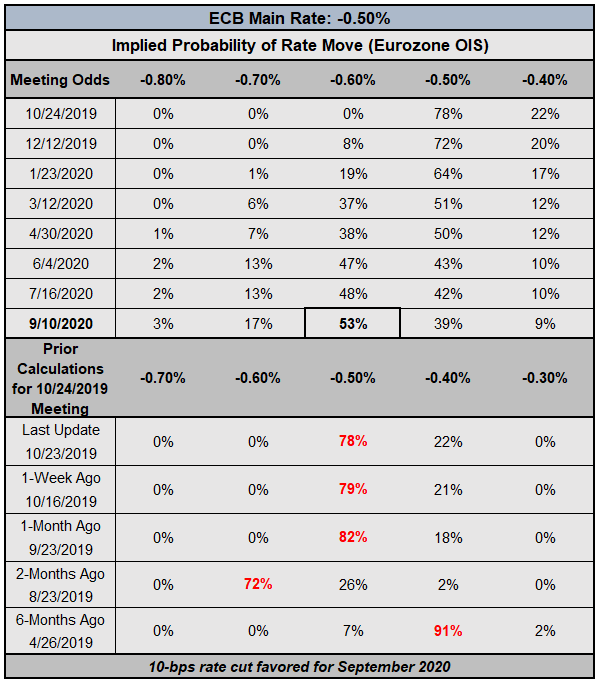

ECB Rate Cut Timeline Being Pushed Back

Thanks to progress on both the Brexit and the US-China trade war fronts, G10 currencies’ central banks interest rate cut odds have continued to drop in recent days, the ECB included. According to overnight index swaps, market participants are currently discounting a 78% chance of no policy change at the October ECB meeting, down from 80% last week. But this isn’t due to rising rate cut odds; on the contrary, odds of a 10-bps rate hike have increased from 20% to 22%.

European Central Bank Interest Rate Expectations (October 23, 2019) (Table 1)

Nevertheless, having just previously cut interest rates last month, it seems highly unlikely that the ECB would reverse course in such quick order. That said, it appears that the ECB will remain on hold for some time. Two months ago, there was a 72% chance of a 10-bps rate cut and a 26% chance of a hold. Rates markets don’t anticipate any action from the ECB in the first half of 2020, now pricing in the next rate cut coming in September 2020 (53% chance).

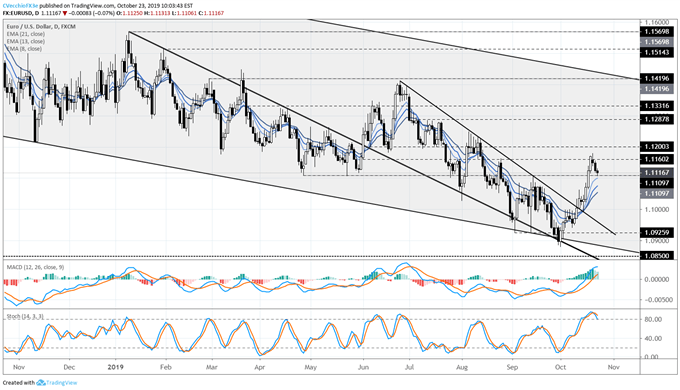

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (OCTOBER 2018 to OCTOBER 2019 INTRADAY) (CHART 2)

In our last EUR/USD rate technical forecast update, it was noted that there was “more evidence that a false bearish breakout has occurred below 1.0926. False breakouts typically yield reversals back to the other side of the consolidation. As previously noted, in this case, EUR/USD would be looking for a return towards the prior range high near 1.1110. A move above this level would suggest that a meaningful bottom has been found in EUR/USD rates.” In the interim period since our last update, EUR/USD hit a high of 1.1180.

To this end, there is significant evidence that a meaningful bottom has indeed been established.Having cleared the descending trendline from the June, July, and September highs, EUR/USD continues to extend its gains above the daily 8-, 13-, and 21-EMA envelope. Daily MACD continues to extend above its median line, while Slow Stochastics are still in overbought territory. For now, the daily 8-EMA is near-term bullish momentum support for EUR/USD rates.

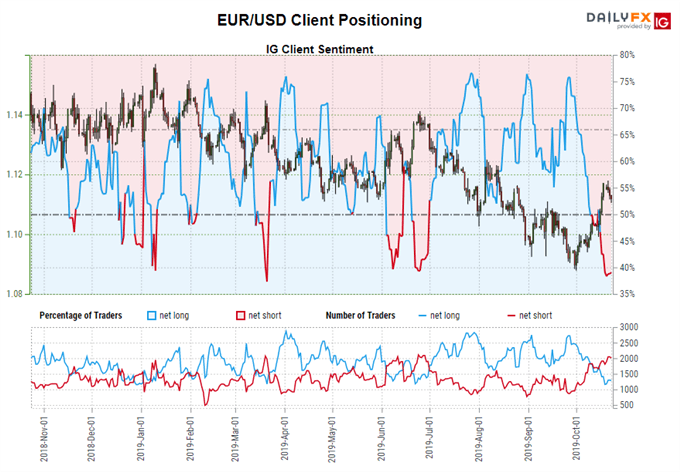

IG Client Sentiment Index: EUR/USD Rate Forecast (October 23, 2019) (Chart 3)

EUR/USD: Retail trader data shows 40.7% of traders are net-long with the ratio of traders short to long at 1.46 to 1. In fact, traders have remained net-short since October 16 when EUR/USD traded near 1.1074; price has moved 0.4% higher since then. The number of traders net-long is 6.8% higher than yesterday and 19.6% lower from last week, while the number of traders net-short is 4.6% lower than yesterday and 28.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

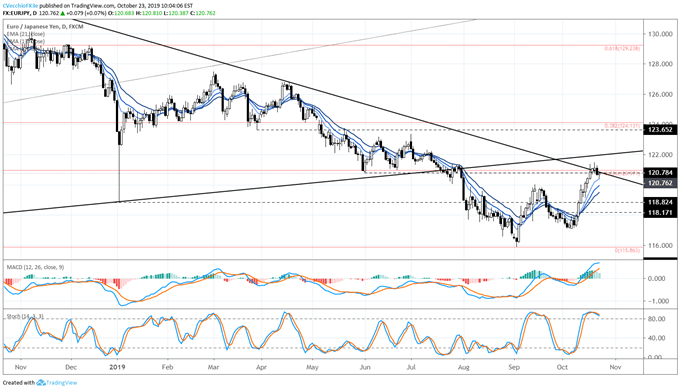

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (OCTOBER 2018 to OCTOBER 2019 INTRADAY) (CHART 4)

The advance in EUR/JPY rates has slowed down in recent days. Running into the descending trendline from the September 2018 and April 2019 highs, EUR/JPY has likewise hit resistance in the form of the 23.6% retracement of the 2018 high/2019 low range at 120.97. The path of least resistance may be higher yet, nonetheless. EUR/JPY rates are comfortably above the daily 8-, 13-, and 21-EMA envelope (which is in bullish sequential order). Daily MACD continues to rise above its signal line (now at its highest point of the year) and Slow Stochastics is holding in overbought territory. A turn higher from here would see EUR/JPY rates eye 122.00 by the end of the month. For now, the daily 8-EMA is near-term bullish momentum support for EUR/JPY rates.

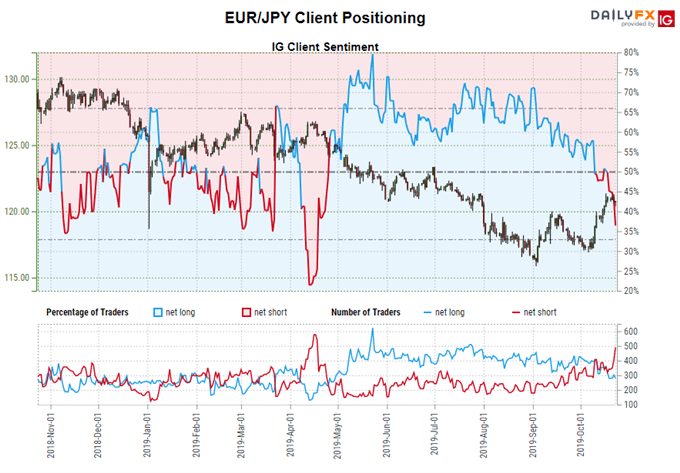

IG Client Sentiment Index: EUR/JPY Rate Forecast (October 23, 2019) (Chart 5)

EUR/JPY: Retail trader data shows 42.3% of traders are net-long with the ratio of traders short to long at 1.36 to 1. The number of traders net-long is 12.1% higher than yesterday and 4.0% lower from last week, while the number of traders net-short is 7.2% higher than yesterday and 42.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/JPY trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX