Top FX Headlines Talking Points:

- As the DXY Index hovers below its yearly highs, it’s evident that traders are waiting for the July Fed meeting before a decision is made around these make-or-break levels.

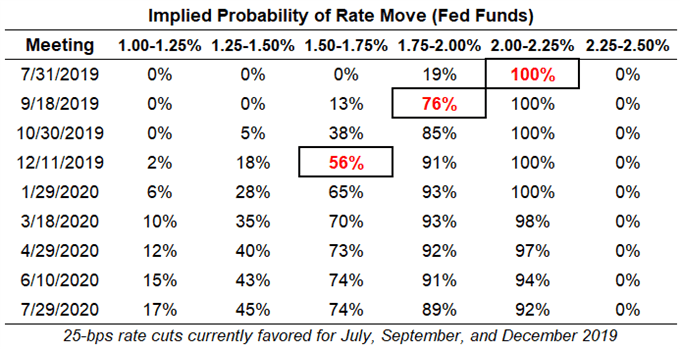

- Fed funds futures see a 56% chance of 75-bps of rate cuts by the end of 2019. Meanwhile, Eurodollar contract spreads are much less dovish, only foreseeing a 33% of 50-bps of rate cuts by the end of 2019.

- Retail traders are selling the US Dollar ahead of the July Fed meeting.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

We’ve entered the gravitational pull of the July Fed meeting. With FOMC policymakers widely expected to begin the Fed rate cut cycle tomorrow, traders are not focusing on if a rate cut is coming but rather how deep the rate cut will go.

Improvements in US economic data in recent weeks juxtaposed against lackluster progress in the US-China trade war talks have put FOMC policymakers in a bind; it’s difficult for market participants to understand the immediate justification for rate cuts when the unemployment rate (U3) is at cycle lows and equity markets are at all-time highs.

Fed Funds Discounting Up to 75-bps of Rate Cuts in 2019

Rate cut odds remain frontloaded nevertheless. With just over 24-hours until the July Fed meeting, Fed funds futures are pricing in a 100% chance of a 25-bps rate cut and an 19% chance of a 50-bps rate cut in July.

Federal Reserve Interest Rate Expectations (July 30, 2019) (Table 1)

Assuming the FOMC only decides on on a 25-bps rate cut at the July Fed meeting, Fed funds futures are discounting a 76% chance of another 25-bps rate cut in September and a 56% chance of a third and final 25-bps rate cut in December 2019. Collectively, Fed rate cut odds have receded relative to where they were two weeks ago.

Fed Rate Cut Odds Remain Frontloaded Due to US-China Trade War

This week especially, traders should study the way that rates markets are currently discounting Fed rate cuts. Fed funds remain more aggressive than Eurodollar contracts in their dovish pricing for the Fed rate cut cycle. Such dissonance typically yields volatility; the July Fed meeting should produce a particularly pronounced market reactions across asset classes.

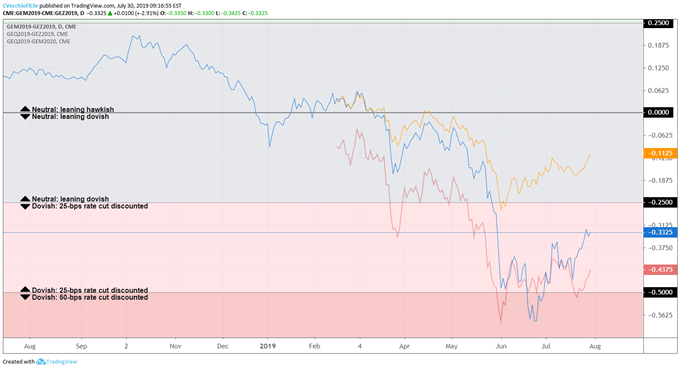

With Eurodollars contract spreads, we can measure whether a rate cut is being priced-in by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. The chart below showcases the difference in borrowing costs – the spreads – for the June 19/December 19 (blue), August 19/December 19 (orange), & August 19/June 20 (red) periods in order to gauge where interest rates are headed by the end of December 2019 and the end of June 2020, respectively.

Eurodollar Contract Spreads – June 19/December 19 (Blue), August 19/December 19 (Orange), & August 19/June 20 (Red): Daily Timeframe (July 2018 to July 2019) (Chart 1)

Based on the Eurodollar contract spreads, a 25-bps rate cut is fully discounted at the July Fed meeting. However, there are only 8-bps priced-out thereafter through the end of 2019, or a 33% chance of a second 25-bps rate cut by December. However, Eurodollar contract spreads are suggesting a 75% chance of three 25-bps rate cuts coming by June 2020.

Regardless, markets feel that if the Fed rate cut cycle is about to begin, it will do so in aggressive fashion over the next several months in direct response to the US-China trade war. Accordingly, if a US-China trade deal materializes at any point in time, there will be a violent repricing of Fed rate cut odds – and the US Dollar.

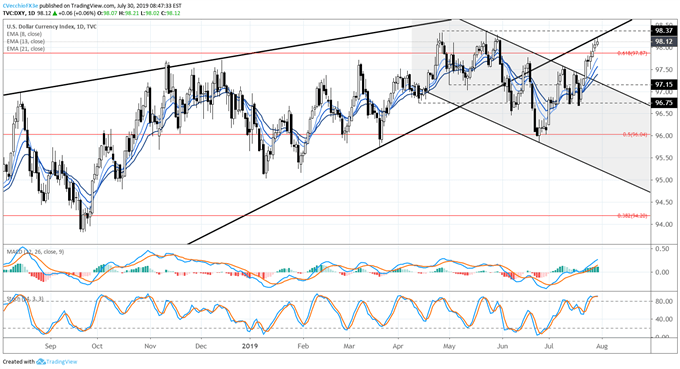

DXY INDEX TECHNICAL ANALYSIS: DAILY PRICE CHART (NOVEMBER 2017 TO JULY 2019) (CHART 2)

Alongside receding Fed rate cut odds in recent weeks, the US Dollar (via the DXY Index) has been able to find follow through on the breakout above downward sloping channel in place since May. Bullish momentum has been strong, with price holding above the daily 8-, 13-, and 21-EMA envelope, daily MACD extending its advance above the signal line in bullish territory, and Slow Stochastics holding overbought territory.

But now we’ve run into critical resistance in the former of (1) former trendline support from the February 2018 and March 2019 lows and (2) the bearish daily key reversal bar set at the yearly high at 98.37. As the DXY Index hovers below its yearly highs, it’s evident that traders are waiting for the July Fed meeting before a decision is made around these make-or-break levels.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides