Talking Points:

- The British Pound has been under pressure ever since UK parliament came back into session on April 23.

- Cross-party talks between the Labour and Tory party leaders appears to be yielding little by way of getting enough votes to pass the EU-UK Withdrawal Agreement.

- It’s possible that UK Prime Minister Theresa May is pressured to resign or face a ‘no confidence’ vote if there is no progress in the coming days.

Looking for longer-term forecasts on the British Pound? Check out the DailyFX Trading Guides.

UK Prime Minister Theresa May and Labour party leader Jeremy Corbyn have continued cross-party talks in the wake of the EU-UK agreement to push the Brexit deadline back to October 31. However, ever since UK parliament came back into session on April 23, little progress has been made towards the goal of finding enough common ground to pass the EU-UK Withdrawal Agreement.

It appears that no cross-party deal is the most likely outcome.Even though the Tory party can’t push for a ‘no confidence’ vote until December 2019, it’s likely that the party pressures Tory party leader May to step down as prime minister. If she does resign, this would trigger a new Tory party leadership election in May. Otherwise, if UK PM May does not resign, the Labour party would likely move towards its own ‘no confidence’ vote.

Regardless, from where things stand today, it would appear that the odds are rising of another UK general election.

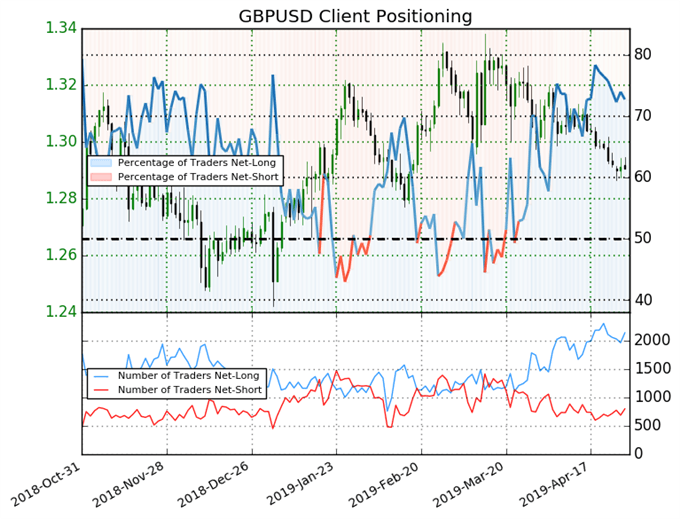

IG Client Sentiment Index: GBPUSD Price Forecast (April 29, 2019) (Chart 1)

GBPUSD: Retail trader data shows 72.7% of traders are net-long with the ratio of traders long to short at 2.67 to 1. In fact, traders have remained net-long since Mar 26 when GBPUSD traded near 1.31286; price has moved 1.7% lower since then. The number of traders net-long is 6.9% higher than yesterday and 5.1% lower from last week, while the number of traders net-short is 12.3% higher than yesterday and 15.5% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may soon reverse higher despite the fact traders remain net-long.

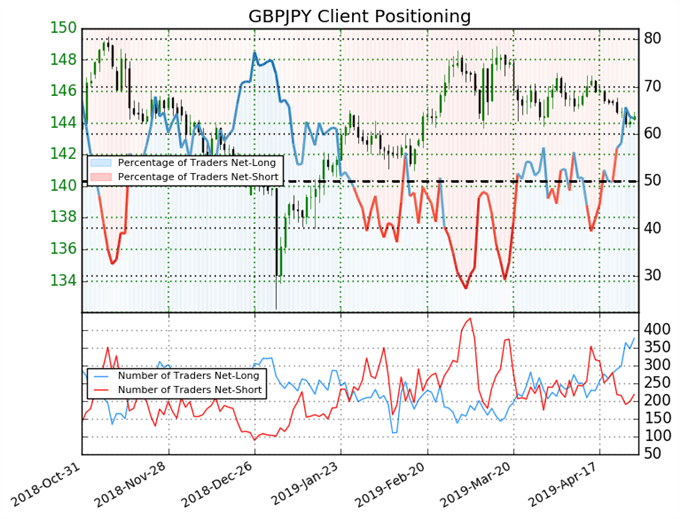

IG Client Sentiment Index: GBPJPY Price Forecast (April 29, 2019) (Chart 2)

GBPJPY: Retail trader data shows 63.3% of traders are net-long with the ratio of traders long to short at 1.72 to 1. The number of traders net-long is 1.8% lower than yesterday and 33.7% higher from last week, while the number of traders net-short is 10.1% higher than yesterday and 20.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPJPY prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPJPY trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides