Talking Points:

- The DXY Index has whipped between gains and losses on Wednesday

- Without a new Summary of Economic Projections or a press conference for Fed Chair Powell, there is little reason to believe that policy will be changing.

- See the full DailyFX Webinar Calendar for upcoming strategy sessions pertaining to the November FOMC meeting.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The US Dollar (via the DXY Index) has seen prices alternate between gains and losses on Wednesday as market participants digest the results of the 2018 US midterm elections. With the base case scenario having been achieved - Democrats controlling the House, Republicans controlling the Senate - reaction across financial markets has been limited.

If there is a surprise about the election results, it's the extent to which Republicans extended their majority in the Senate. Such gains portend to an environment that makes it more likely Republicans will also control the Senate after the 2020 elections. To this end, with the Trump tax plan largely to remain in place for the foreseeable future (years), US equity markets have been outperforming as the one of the major factors lead to strong earnings growth is likely to stay in place.

Otherwise, fiscal policy gridlock is coming. The only significant area of agreement between House Democrats and President Trump is infrastructure, but it's still a longshot that a deal can be reached after such a confrontational election season. Deregulation efforts may be slowed, but will ultimately continue as Trump-appointed agency heads will remain in place.

If you missed it, now that the midterm elections are in the rearview mirror, it's a good time to review the top charts and themes that will come back into focus as the calendar winds down into the end of the year.

Looking ahead to tomorrow, as far as FOMC meetings go, the November gathering should turn out to be one of the duller central bank rate decisions in 2018. Rates markets are pricing in a 1% chance of a 25-bps rate hike, effectively making the meeting a placeholder for future gatherings.

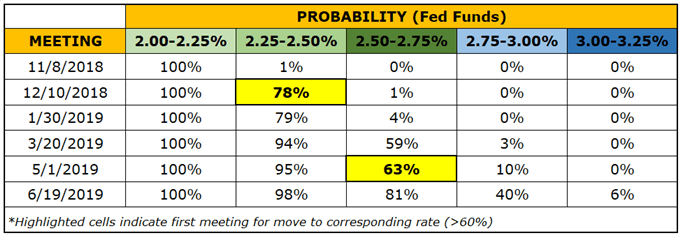

Fed Rate Hike Expections (November 7, 2018) (Table 1)

The lack of anticipated action at the November meeting shouldn't be a surprise, as market participants have been classically conditioned by policymakers at the major central banks to only anticipate policy changes when new forecasts are in hand and the head of the central bank is afforded a press conference: November will yield neither of these; December will. Accordingly, there is a 78% chance of a 25-bps hike next month.

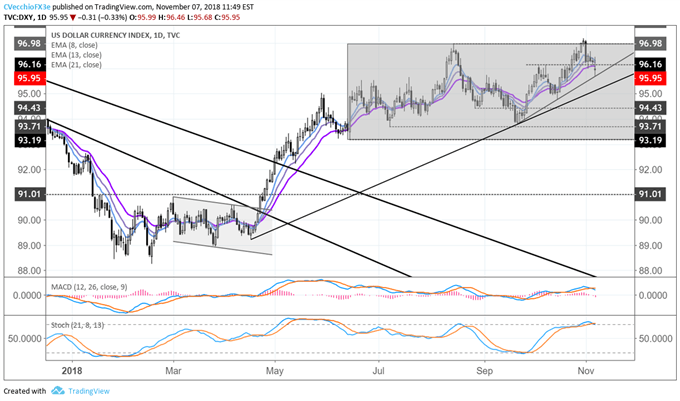

DXY Index Price Chart: Daily Timeframe (January to November 2018) (Chart 1)

There seems little chance that the DXY Index's recent pause post-midterms will give way before the FOMC meeting tomorrow - and maybe not even thereafter. Momentum has stalled in recent days for the greenback. After hitting a fresh yearly high last week, price is sitting in the middle of its daily 8-, 13-, and 21-EMA envelope as a doji candle forms. For now, the uptrend from the September and October swing lows remains in place, but a close back above 96.16 would raise the odds of bullish developments in the coming days.

Read more: Markets After the US Midterms: Charts and Themes to Watch

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX