Talking Points:

- Both the Italian BTP 2- and 10-year yields have come off recent highs, but the Euro rally has faded across the board - EUR/GBP, EUR/JPY, and EUR/USD are at or near their opening price levels.

- US Dollar bid in recent days tied directly to concerns about the Italian budget; Fed rate hikes for the next 12-months are more dovish than they were a week ago, pre-September FOMC meeting.

- Retail traders remain net-long EUR/USD and GBP/USD after the US Dollar's recent surge.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The US Dollar (via the DXY Index) is trading back higher once again, working on its sixth consecutive day to the topside as concerns over the Italian budget situation proliferate. Despite an earlier report that the populist Italian government's deficit spending plans were short-term in nature only - by next year, fiscal policy would be attuned to cutting the debt - the Euro has been unable to shake off fears that an 'Italeave' is possible eventuality.

Both the Italian BTP 2- and 10-year yields have come off recent highs just set yesterday, in the case of the latter the highest yield seen since early-2014. But Italian-German yield spreads remain at multi-year highs, suggesting that the risk that Italy poses hasn't gone away by any stretch of the imagination.

Look no further than the lack of a Euro rally in the wake of the marginally lower Italian bond yields as evidence that traders are hesistant to say that their fears have been quelled. Both EUR/GBP and EUR/USD have started to form inverted hammers, having erased all of their daily gains and returned back to their opening price levels; EUR/JPY is in a similar situation (although with the Nikkei 225 off of its lows and the S&P 500 pointing higher, the Yen is on weaker footing still).

The revival of fears around Italy in recent days has been the sole motivating factor for a stronger US Dollar, as discussed yesterday. That the Fed's rate hike glide path for the next 12-months is more dovish today than it was before the September FOMC meeting last Wednesday underscores this fact.

Much like the US Dollar's gains in early-August, which were driven by external factors (emerging market meltdown) and not a hawkish shift in Fed rate hike pricing, the current run higher by the greenback is vulnerable should market participants reassess their dour view on the Italian situation. A deeper pullback in Italian bond yields would be enough to put a halt to the US Dollar's gains.

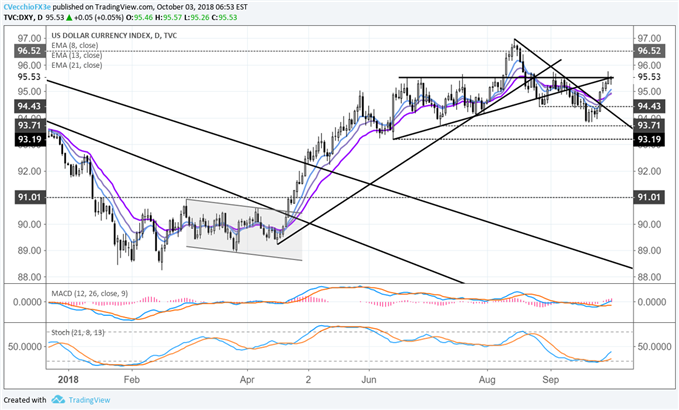

DXY Index Price Chart: Daily Timeframe (January to September 2018) (Chart 2)

Price action has been bullish this week, although not enough to reconsider the current neutral view. Despite testing prices higher, the DXY Index was unable to retake 95.53 yesterday, prior key resistance in July and August. Overall, Price is still above its daily 8-, 13-, and 21-EMA envelope, and the moving averages remain in sequential order again. Both daily MACD and Slow Stochastics remain in are continuing to trend higher, with the former back above its signal line now. Only a move back through 95.53 would constitute an upgraded outlook.

Read more: DXY Index Back to September High, EUR/USD at Six-Week Low

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX