Talking Points:

- Concerns over European banks' exposure to Turkey has hit EUR/USD hard, lifting the DXY Index to fresh yearly highs and its highest level in a year.

- EUR/USD's loss of 1.1510 adds confidence to DXY Index breakout above 95.53; next key levels are 1.1370 and 96.52, respectively.

- Retail traders are have faded both EUR/USD and GBP/USD losses, keeping the IG Client Sentiment Index at a bullish outlook for the US Dollar.

See our longer-term forecasts for the US Dollar, Euro, British Pound and more with the DailyFX Trading Guides

Fears of Turkish Contagion Weigh on the Euro

The US Dollar (via the DXY Index) is trading in at fresh yearly highs on the day, finally breaking out to the topside of a two-month long consolidation effort that left price in an ascending triangle. The efforts made by the greenback to push to its highest level in a year are not rooted in positive developments on the US Dollar's side, but rather new concerns quickly emerging for the Euro.

According to a report by the Financial Times, the European Central Bank's supervisory arm, the Single Supervisory Mechanism, has been taking a close look at European banks' lending activities in Turkey. Given the sharp depreciation seen in the Turkish Lira in recent months, ECB regulators are beginning to express concern that Turkish borrowers are improperly hedged against Lira weakness, and may begin to default on their foreign currency loans.

Per the BIS, Turkish borrowers owe Spanish banks $83.3 billion, French banks $38.4 billion, and Italian banks $17 billion. While these exposures are small in the grand scheme of things, there is a sense of contagion that is making its way through the market on Friday.

But even a 'small crisis' could impact the ECB's best laid plans to normalize rates over the next year, forcing it back into a stance of providing liquidity to markets for longer than currently expected. The knock-on effect has been a higher demand for dollar-denominated assets as a result; both the US Dollar and US Treasuries are trading higher this morning.

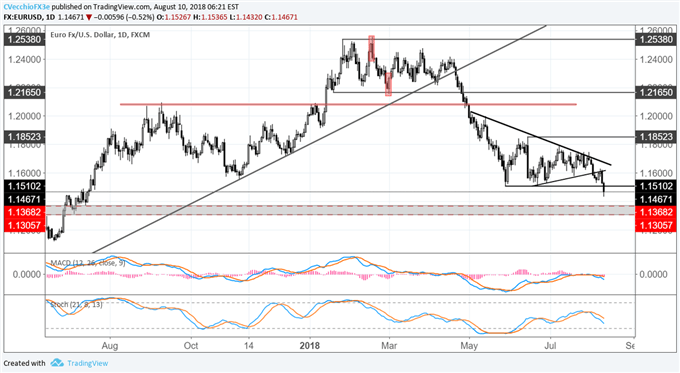

EUR/USD Price Chart: Daily Timeframe (July 2017 to August 2018) (Chart 1)

EUR/USD's decline today carried it through 1.1510, key support going back to the end of May, highlighted by the June 21 bullish key reversal. But bearish momentum has accelerated in recent days, with price comfortably below its daily 8-, 13-, and 21-EMA envelope, and both MACD and Slow Stochastics issuing sell signals. The descending triangle's continuation effort is fully underway, with the next key level of support coming in near the early-July 2017 swing lows at 1.1370.

Keep an Eye on July US CPI Later

Coming into the week, there was a 90% chance of a 25-bps rate hike in September and a 65% chance of another hike in December. Ahead of the release of the July US CPI report this morning, odds are up at 92% for a rate hike in September. There are two takeaways here.

First, there is still room for a September hike to be priced in further, if only marginally; the upside potential is limited. Conversely, and secondly, because rate hike odds are so high, a 'miss' on the headline inflation will likely generate a bigger reaction in price than a 'beat' would.

As it were, if inflation comes in at +2.9% y/y again, then it will be outpacing wage growth at +2.7% y/y, leading to the unenviable scenario of a negative real wage growth trend starting to set in for the US economy. This will only further reinforce the idea that more rate hikes are necessary, beyond what is expected in September. December rate hike odds will soon start to hold more influence over the DXY Index than September rate hike odds.

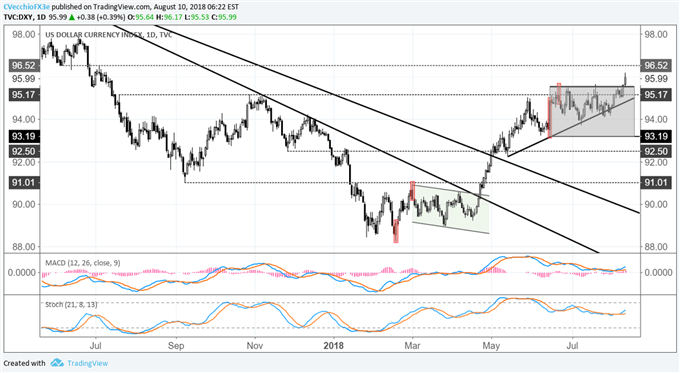

DXY Index Price Chart: Daily Timeframe (June 2017 to August 2018) (Chart 2)

The US Dollar's (via DXY Index) bullish technical posture is proving forceful today, with a breakout finally taking place. A breakout resulting from the bullish ascending triangle remains valid given a weeky close through the June 21 bearish daily key reversal and June 27 to 29 evening doji star candle cluster highs at 95.53.

In turn, the largest component of the DXY Index, EUR/USD (at 57.6%), needs to sustain its break below 1.1510. The next major resistance for the DXY Index comes at the early-July 2017 swing high at 96.52.

Read more: DXY Index Hovering Below Fresh Yearly Highs Ahead of July US CPI

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX