Talking Points:

- The DXY Index has made another attempt at cracking through its June and July highs, but thus far triangle resistance remains intact.

- Without EUR/USD breaking below 1.1510, it's difficult to envision a sustained breakout through 95.53 for the DXY Index.

- Retail traders are have faded both EUR/USD and GBP/USD losses over the past week, leaving us with a bullish outlook for the US Dollar.

See our longer-term forecasts for the US Dollar, Euro, British Pound and more with the DailyFX Trading Guides

The US Dollar (via the DXY Index) is easing back on Tuesday as global risk appetite continues to improve amid a quieter economic calendar. With Chinese and US policymakers seemingly allowing trade tensions to cool off, USD/CNH has wiped out any progress made since July 26, although the pair remains up by nearly +3% in July. Accordingly, Chinese equity markets just posted their best gain in two years.

The bump in risk appetite may prove problematic for the US Dollar, insofar as a continued easing of tensions between the world's two largest economies should incentivize traders to reduce their holdings of low yielding, safe haven currencies and instead focus on higher yielding names in the FX space. US equities runing towards their all-time highs, for example, will do more to help emerging market currencies than the US Dollar.

Emerging market currencies, outside of the Chinese Yuan and Turkish Lira, have actually done quite well since the beginning of July: the Brazilian Real, South African Rand, and Mexican Peso are all higher over the past five weeks. Add into the mix ongoing weakness in the precious metal space, and it's difficult to say that risk appetite is anything but improving in short order.

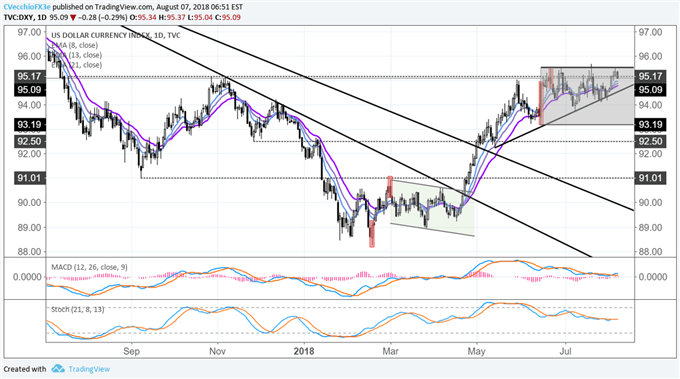

DXY Index Price Chart: Daily Timeframe (July 2017 to July 2018) (Chart 1)

Where does that leave the US Dollar? The consolidation experienced by the DXY Index over the past six weeks remains in place after the recent failed attempt at a topside breakout. We continue to await a close above 95.53 (the June 21 bearish key reversal and the June 27 to 29 evening doji star candle cluster highs) to signal that the recent price congestion has finished. Commensurately, a move below 1.1510 in EUR/USD is necessary to confirm the DXY Index breakout.

Looking ahead to the economic calendar, traders will be better suited if they pay attention to the news wire. There is very little by way of US economic data before Friday that will prove to be a significant hurdle for the US Dollar; the only 'high' rated event comes on Friday in the form of the July US Consumer Price Index. With price pressures running high at +2.9% y/y in June and due to have remained at the same level in July, there is little doubt the Federal Reserve will tighten policy again when it meets in September.

Currently, Fed funds futures are pricing in a 90% chance of a 25-bps rate hike in September and a 65% chance of a hike in December. A week ago, odds were closer to 80% and 60% for September and December, respectively.

Read more: DXY Index Approaches Consolidation Resistance Near Yearly Highs

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX