Talking Points:

- As US Dollar dives, both EUR/USD and GBP/USD have seen their rallies carry them to fresh 2017 highs.

- With commodities under pressure, the British Pound and Euro are well-suited for further gains against the Australian and New Zealand Dollars as well.

- Retail crowd positioning shows traders buying AUD and NZD while selling EUR and GBP.

See the DailyFX Webinar Calendar for all upcoming strategy sessions.

The drama surrounding the Trump administration has enveloped the US Dollar as hopes fade for fiscal stimulus coming down the pipeline any time soon. As markets price out healthcare reform and tax reform in 2017, the implication of fewer drivers pushing inflationary pressures up has laid waste to market expectations for an aggressive Fed rate hike path: only one hike is priced in for the rest of 2017. The flattening yield curve bodes poorly for the US Dollar.

As the greenback has sold off, the retail crowd has been quick to pile into short EUR/USD and GBP/USD positions. We use the IG Client Sentiment data as a contrarian indicator, given that the retail crowd shares the same key characteristic as commercial hedgers in the futures market: fading the predominant trend.

Yet the crowd isn't buying US Dollars everywhere: traders have staked out long AUD/USD and NZD/USD positions as well. Implicitly, then, this combination of being net-short EUR and GBP and net-long AUD and NZD means that we should focus on the crosses: EUR/AUD, EUR/NZD, GBP/AUD, and GBP/NZD.

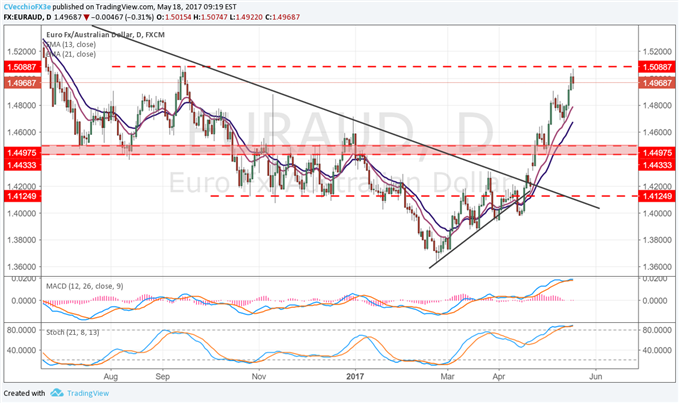

Chart 1: EUR/AUD Daily Chart (August 2016 to May 2017)

While the issue hasn't gotten the same attention that developments in European (French and British elections) or American (the Trump/Comey saga) politics have, commodities and their associated currencies have been under a great deal of pressure the past few weeks. In particular, base metals like Copper and Iron Ore have been decimated since mid-March. Perhaps this is a canary in the coal mine about under the radar developments in China; but regardless of the reasoning, weaker commodity prices don't bode well for the Australian or New Zealand Dollars.

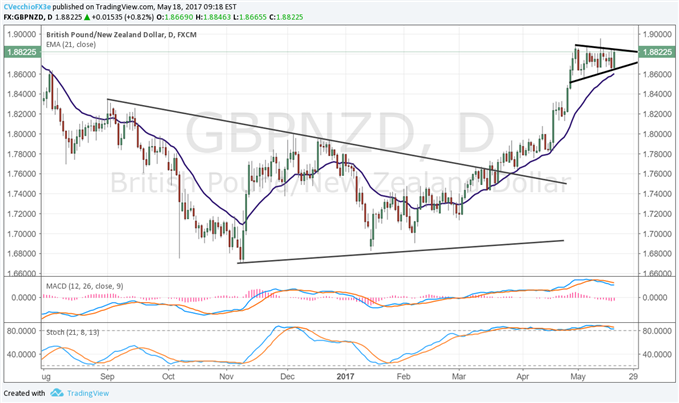

Chart 2: GBP/NZD Daily Chart (July 2016 to August 2017)

Pairs like EUR/AUD, EUR/NZD, GBP/AUD, and GBP/NZD normally get little fanfare, but their strong uptrends recently deserve more attention - buying dips against the daily 13- and 21-EMAs has proven profitable since the end of March. Certainly, they will be influenced by themes across FX markets like political risk in Europe, but they won't be hostage to the daily newsflow currently weighing down the US Dollar.

See the above video for technical considerations and levels to watch for in EUR/USD, GBP/USD, AUD/USD, USD/JPY, EUR/AUD, GBP/AUD, AUD/JPY, and DXY Index.

Read more: Trump is the USD’s Albatross, Gains from Election Wiped Out

--- Written by Christopher Vecchio, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form