Talking Points:

- Fed funds now implying roughly 1/3 chance of hike in June.

- US Dollar insulated - so long as economic data trends improve.

- Higher volatility in FX markets should have implications for your trading strategies.

The Federal Reserve's minutes from their April meeting yesterday revealed little new information. After all, it was at their March meeting they made clear their preference to wait to raise rates until June - if the data allowed for it. Likewise, in recent weeks, Fed speakers have been talking up the possibility for a hike - if the data allowed for it. Now that US economic data has started to perk back up (the Atlanta Fed's GDPNow Forecast for Q2'16 is +2.5% annualized), market participants are resolving the disconnect between policymakers and markets.

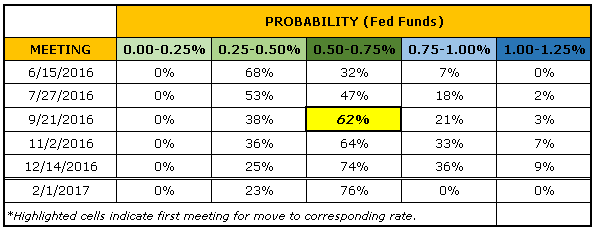

Ahead of yesterday's meeting, there was barely a 6% chance of a rate hike in June, according to the Fed funds futures contract. The dissonance between what the Fed has said it might do and what markets are expecting has proven to be a burden for the US Dollar in recent weeks. However, after the April Fed minutes revealed pretty much what we knew all along, rate expectations for the June meeting jumped - and a cushion for the US Dollar was established (see table 1 below). The minutes themselves said that Fed officials believed market expectations for a June hike "might be unduly low."

Table 1: Probability of Rate Hikes across Upcoming Fed Meetings

Markets are now pricing in September as the most likely period for the first rate hike, with the odds of a hike having jumped to 62%. For market participants to fully price in a Fed hike in June, we'd want to see the June implied probability jump above 60% itself. Correlation is not causation, but the Fed has not raised rates unless market participants have priced in at least a 60% chance in the front month of them doing so. Accordingly, if US data continues to edge up, then June expectations should rise, and keep the US Dollar insulated further.

Chart 1: USDOLLAR Index Daily Chart (September 2015 to May 2016)

The USDOLLAR Index is facing a key test today, tradng back to the declining trendline from the January and February 2016 highs. This may offer room for a pause. However, that's not to say that the short-term rebound still can't morph into a medium-term trend. Price action has been increasingly bullish on a momentum basis the past few days, particularly after the bullish key reversal that formed on May 3. Now, price is supported by the daily 8-EMA on a closing basis, and the daily MACD and Stochastics have shifted into bullish territory while trending higher.

The greenback's technical posture is improving, and a continued improvement in June rate hike odds should keep the US Dollar pointed higher in the near-term. EUR/USD may be the preferred instrument to trade given the pair's thinnest net-short positioning in about two years.

See the above video for technical considerations in EUR/USD, USD/JPY, the USDOLLAR Index, Gold (CFD: XAUUSD), and Crude Oil (CFD: USOIL).

Read more: If USD Wants ST Rebound to Become MT Trend, CPI Must Rise

If you haven't yet, read the Q2'16 Euro Forecast, "EUR/USD Stuck in No-Man’s Land Headed into Q2’16; Don’t Discount ’Brexit’," as well as the rest of all of DailyFX's Q2'16 quarterly forecasts.

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher's e-mail distribution list, please fill out this form