Talking Points:

- USDOLLAR Index continuing to fail against daily 21-EMA.

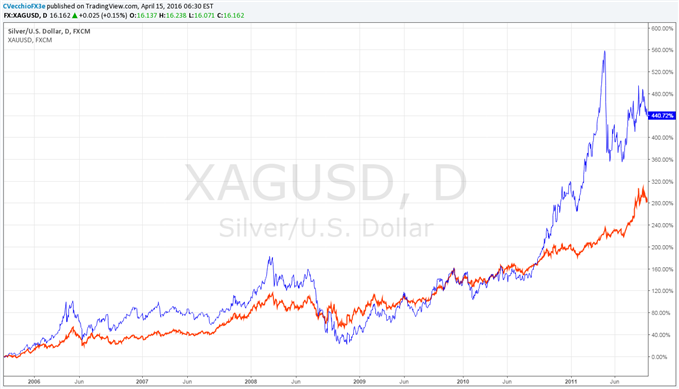

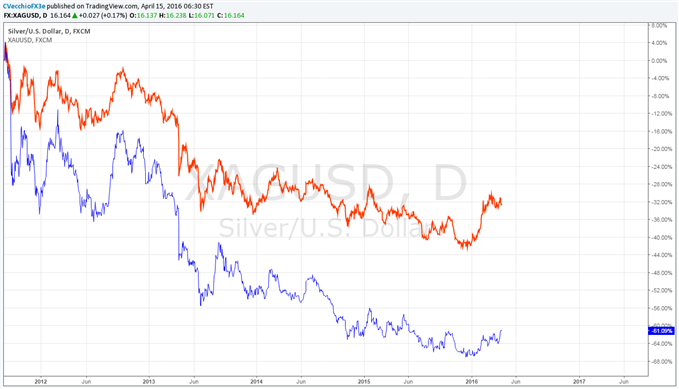

- Silver tends to outpace Gold (CFD: XAU/USD) during periods of broad strength in precious metals, weakness in US Dollar.

- As market volatility rises, it's a good time to review risk management principles.

Silver prices have started to outpace Gold prices - which if it continues, would be historically good for precious metals and foreboding for the US Dollar. This matters greatly for the USDOLLAR Index, currently battling to uphold support against the September and October 2015 swings lows.

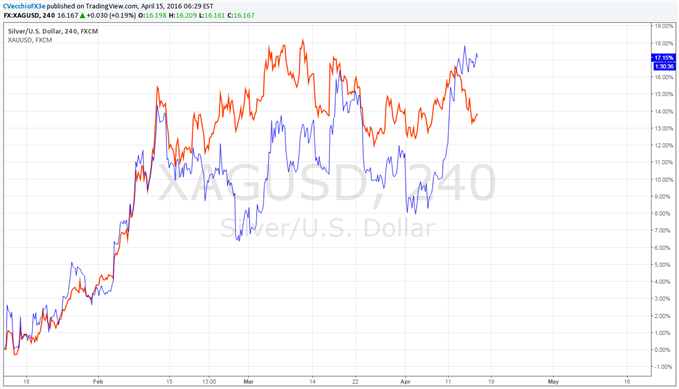

Chart 1: Gold Prices versus Silver Prices (Performance Since Third Week of January 2016)

Recent price action in Silver and Gold is worth watching over the coming days as further gains by Silver relative to Gold could indicate the potential for greater US Dollar declines moving forward.

Chart 2: Silver Prices Outpace Gold Prices to the Upside... (2005 to 2011)

Chart 3: ...Silver Prices Underperform Gold to the Downside (2011 to 2016)

See the above video for trade implications and technical considerations in SPX500, USD/CAD, GBP/USD, Crude Oil, EUR/USD, USD/JPY, and the USDOLLAR Index.

Read more: Now Fueled by Weaker EUR & JPY, Global Equities Run Higher

If you haven't yet, read the Q2'16 Euro Forecast, "EUR/USD Stuck in No-Man’s Land Headed into Q2’16; Don’t Discount ’Brexit’," as well as the rest of all of DailyFX's Q2'16 quarterly forecasts.

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher's e-mail distribution list, please fill out this form