Talking Points:

- EUR/USD quickly approaching the February highs.

- USD/JPY tests lows near ¥111.20 - don't dismiss significant downside from here.

- As FX market volatility stays elevated, it's a good time to review risk management principles.

We've been consistent in our skepticism over the US Dollar's strength through Q1'16, even going so far as to say that the Federal Reserve's untethered projected policy path would be a "major problem" for the US Dollar in the wake of the Fed's confusing decision to keep rates - and its dot plot - unchanged in January. So, for us, as both active market pariticpants and passive market observers, seeing the Fed backtrack and reconcile its forecasts with those more closely resembling what the broader market believes offers up a vindicated sigh of relief.

For the US Dollar, no such solace exists.

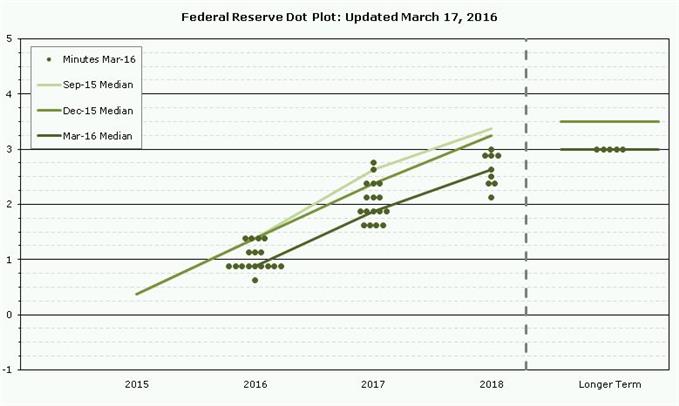

Chart 1: Fed's Dot Plot from March 2016 - Updated March 17, 2016

The Fed's glide path (as seen in the chart above) has seen consistent downgrades to its rate of change and terminal rate level. The US Dollar may still be the greenback, but it's green in the face now that the Fed has all but stamped out the "divergence trade" that's carried the world's reserve currency for the past two years.

Instead, no matter where you turn, US Dollar charts are 'puking' - most everyone was on one side of the trade, and now everyone is rushing for the exits at the same time.

See the video (above) for technical considerations and trade setups in EUR/USD, AUD/USD, GBP/USD, USD/JPY, SPX500, Crude Oil (USOIL), and the USDOLLAR Index.

Read more: USD Coiling Before FOMC Holds, Hints at Hike Around June

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form