Talking Points:

- EUR/USD slides below $1.0900 on weaker than expected EZ CPI data.

- EUR/CAD, GBP/CAD breaks lower in line with bottom potential in Crude Oil.

- Risk management is the cornerstone of long-term success in trading - learn more.

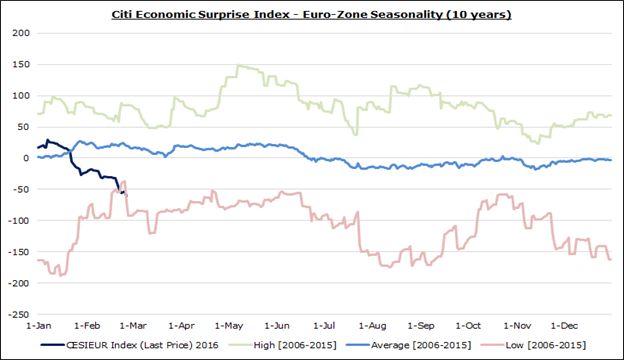

The thematic tug-of-war in the Euro’s underlying fundamentals continues to play out, although the scales have tipped in favor of the bears in recent days. The ongoing slide in Euro-Zone economic data relative to expectations (chart 1 below) has weighed on the EUR-crosses on advance to the March 10 ECB meeting, and the lack of a material rebound in energy prices has compounded the deteriorating inflation outlook.

Chart 1: Euro-Zone Citi Economic Surprise Index – 10 year Seasonality

The indication of price pressures receding into deflation territory merely.confirms what we've known for several weeks now: markets are fully committed to the belief thtat the ECB will cut its deposit rate by 10-bps at its next meeting. Yet this all seems far too familiar - there is a sense of déjà vu coursing its way through the markets. Investor behavior and price developments hint at a replay of late-November/early-December 2015 for EUR/USD especially.

See the above video for technical considerations in EUR/CAD, GBP/CAD, AUD/USD, EUR/USD, GBP/USD, and the USDOLLAR Index.

Read more: Euro Sinks as Investors Await ECB Action - Nov/Dec 2015 Redux

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com.

Follow him on the DailyFX Real Time News feed, Twitter, and Stocktwits at @CVecchioFX.

To be added to Christopher’s e-mail distribution list, please fill out this form.