Talking Points:

- USDOLLAR Index correction lasts until daily 34-EMA is tested.

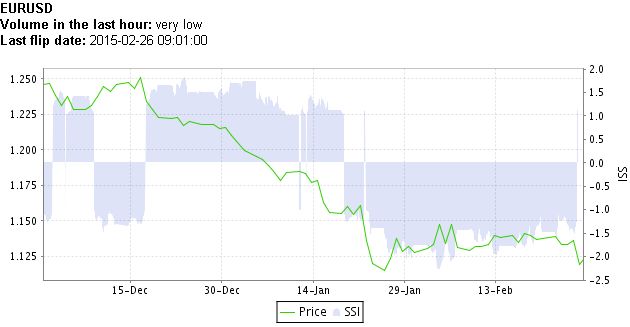

- EURUSD range breakdown coincides with crowd turning long.

- See the DailyFX Economic Calendar for Friday, February 27, 2015.

German CPI is expected to fall further into negative territory when released at 13:00 GMT today, but incoming data from the individual German states actually suggests a beat may be on the horizon.

The Bloomberg News consensus forecast is looking for readings of +0.6% m/m and -0.3% y/y, but with states like Bavaria (+0.3% from -0.2% m/m) and Hesse (+0.1% from -0.6% m/m) beating expectations, it’s possible that the inflation readings come in a touch hotter, in the range of +0.8-0.9% m/m and -0.1%--0.2% y/y. German bund yields are slightly higher across the belly of the curve this morning, reflecting the surprising CPI data, providing the Euro a small lift as a result.

Nevertheless, the key level to watch in EURUSD is $1.1260, the bottom side of the range that contained price since January 28 which broke yesterday. Concurrently, the retail trading crowd, which had been net-short EURUSD for the entire month of February, flipped to net-long once the range broke. We prefer to stay on the opposite side of the crowd, so for now, we’re tentatively looking to sell rallies back towards the $1.1260 figure while the crowd is net-long.

See the above video for technical considerations in EURUSD, AUDUSD, EURGBP, and USDOLLAR.

Read more: Yellen’s Dovish Wrinkle Boosts Carry Trade - Why No EUR/USD Rally?

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form