Mexican Peso Technical Price Outlook: USD/MXN Trade Levels

- Mexican Peso updated technical trade levels – Weekly Chart

- USD/MXN posts weekly reversal off long-term uptrend resistance

- Risk for a deeper correction while below 24.8205.

The Mexican Peso surged more than 6.5% vs the US Dollar last week with USD/MXN posting a massive outside weekly-reversal off multi-year uptrend resistance. The Dollar is paring a portion of the decline early in the week but the threat of a larger correction in the days ahead remains. These are the updated targets and invalidation levels that matter on the USD/MXN weekly price chart. Review my latest Strategy Webinar for an in-depth breakdown of the setupswe’re tracking this week.

Mexican Peso Price Chart – USD/MXN Weekly

Chart Prepared by Michael Boutros, Technical Strategist; USD/MXN on Tradingview

Notes: In my last Mexican Peso Price Outlook we noted that USD/MXN had, “responded to a key technical confluence and the immediate USD/MXN rally may be vulnerable while below up-slope resistance.” The level in focus was 25.4474/5466 – a region defined by pitchfork resistance, the March high and the 200% extension of the 2017 advance. The rally registered a high at 25.7782 before marking an outside-day reversal with price posting an outside weekly reversal off confluence resistance last week.

USD/MXN opened the week just above slope support at the 38.2% parallel with price poised to mark yet another outside day reversal today- this time, to the topside. While we may see more upside on this relief rally, the broader risk remains for a deeper setback while below the 61.8% retracement of monthly range at 24.8205. Weekly open support rests at 23.2710 backed by 23.0065.Ultimately, a break below the median-line / 2017 high at 22.0376 would be needed to suggest a more significant high was set last week.

Bottom line: USD/MXN has reversed off uptrend resistance and the risk remains for a deeper correction while below 24.8205. From a trading standpoint, be on the lookout topside exhaustion on this recovery with a break below the weekly open needed to fuel the next leg lower in price. Ultimately a larger setback may offer more favorable long-entries closer to uptrend support. I’ll publish an updated Mexican Peso Price Outlook once we get further clarity on the near-term USD/MXN technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

---

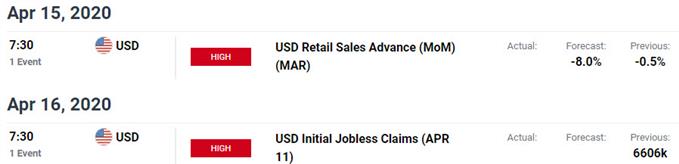

Key US / Mexico Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- Gold (XAU/USD)

- Sterling (GBP/USD)

- US Dollar (DXY)

- Crude Oil (WTI)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- S&P 500 (SPX500)

- Euro (EUR/USD)

--- Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex