- AUD/USD recovery testing major pivot zone- constructive near-term while above 7115

- Check out our new 2019 projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Australian Dollar rallied nearly 1.7% against the US Dollar from the monthly lows with price now targeting a major pivot zone. While the immediate advance may be vulnerable the broader picture remains constructive heading into Australian employment data later tonight. These are the updated targets and invalidation levels that matter on the AUD/USD charts.

New to Forex Trading? Get started with this Free Beginners Guide

AUD/USD Daily Price Chart

Technical Outlook: AUD/USD has posted 3.2% monthly opening-range with price turning just pips from yearly open support at 7042 last week. The advance is now approaching a critical resistance zone at 7175-7200 where the 50% & 61.8% retracement of the late-January decline converge on the median-line of the broader descending pitchfork formation we’ve been tracking off the 2017 / 2018 highs.

A daily close above this threshold is needed to fuel the next leg higher in price with such a scenario targeting more significant resistance at 7270/76- a region defined by the February open, the 200-day moving average and the 38.2% retracement of the 2018 decline. Daily support rest with the low-week close at 7115- weakness beyond this level would invalidate the reversal play.

Learn how to Trade with Confidence in our Free Trading Guide

AUD/USD 120min Price Chart

Notes: A closer look at price action shows Aussie trading within the confines of an ascending pitchfork extending of the monthly lows. Price is probing near-term resistance here at 7175 with the upper parallel just higher around ~7185. A breach higher still must contend with the 72-handle- look for a bigger reaction there IF reached.

Look for initial support along the median-line backed by the weekly open at 7133 with bullish invalidation at 7115. A topside breach above the figure targets the upper parallel, currently around ~7230s backed by 7270/76.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

Bottom line: Aussie is approaching initial topside resistance targets that could limit the advance near-term – that said, the broader outlook remains constructive while above 7115. From a trading standpoint, a good place to reduce long-exposure / raise protective stops- favoring fading weakness while within this formation targeting a breach above 7200.Weakness below 7100 would shift the focus back towards the yearly open at 7042. I’ll publish an updated AUD/USD Weekly Technical Outlook once we get further clarity on the longer-term price structure into the close of the week.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

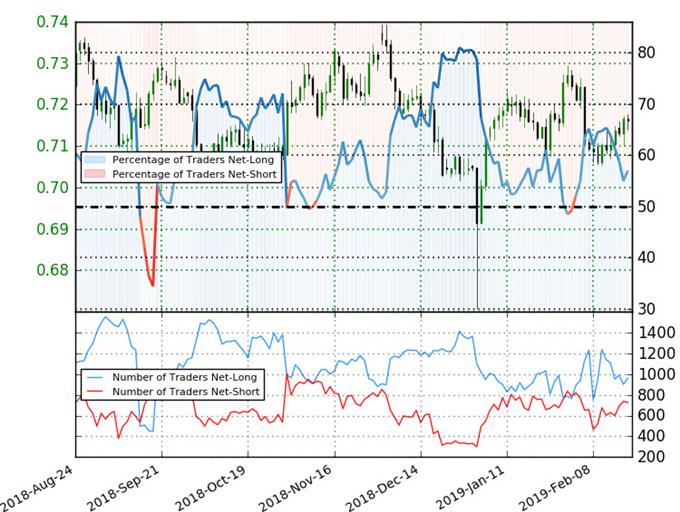

AUD/USD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long AUD/USD - the ratio stands at +1.33 (57.0% of traders are long) – weak bearishreading

- Traders have remained net-long since February 5th; price has moved 0.7% lower since then

- Long positions are7.3% lower than yesterday and 17.8% lower from last week

- Short positions are 2.0% higher than yesterday and 12.9% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in AUD/USD retail positioning are impacting trend- Learn more about sentiment!

---

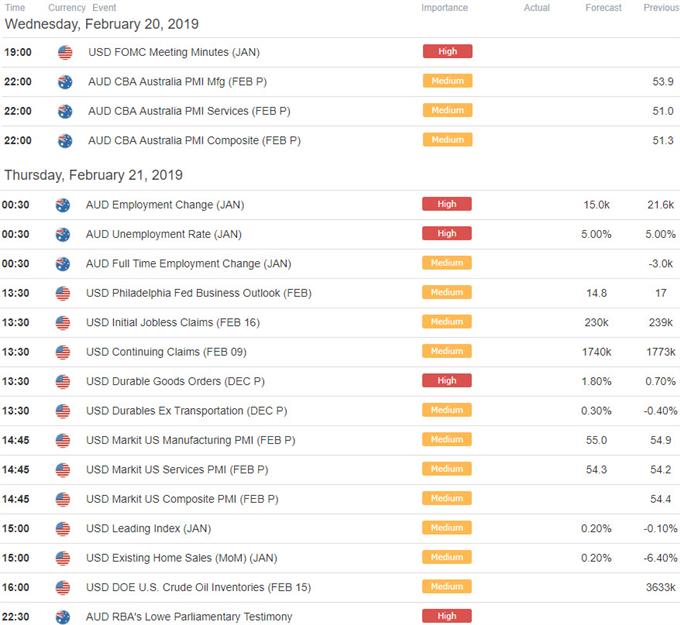

Relevant AUD/USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide !

Active Trade Setups

- Canadian Dollar Price Outlook: USD/CAD Fails at Monthly Range Highs

- Gold Price Technical Outlook: XAU/USD Breakout Imminent

- EUR/USD Price Outlook: Euro Back Above 1.13 – Bull Trap or Breakout?

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex