- USD/CAD breaks below yearly up-trend support; focus is lower below the Friday close

- Check out our 3Q projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Canadian Dollar is on the offensive with news of a renewed US / Mexico / Canada trade agreement further supporting the Loonie early in the week. Here are the updated targets and invalidation levels that matter on the USD/CAD charts heading into the start of October trade. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

USD/CAD Daily Price Chart

Technical Outlook: In my most recent Weekly Technical Perspective on the USD/CAD, we highlighted a key confluence support zone at 1.2880– with, “The risk remains weighted to the downside in USD/CAD while below 1.3130.” Price gapped lower into the weekly / monthly open with the decline marking a break below 2018 up-trend support (purple) and the 200-day moving average. Initial daily support now rests with the lower 50-line of the descending pitchfork formation extending off the yearly highs.

New to Forex Trading? Get started with this Free Beginners Guide

USD/CAD 240min Price Chart

Notes: A closer look at Canadian Dollar price action further highlights the weekly gap open with the opening range high converging on the 38.2% retracement of the 2017 advance at 1.2880. We’ll reserve the Friday close at 1.2908 as our near-term bearish invalidation level with a breach / close above needed to shift the focus back to the long-side.

Initial support eyed at 1.2778 backed by 1.2724/28- a region is defined by the confluence of the 50% retracement and the 100% extension pf the June declines. Look for a more significant reaction off that threshold with a break lower eyeing subsequent support targets at the lower parallel, currently ~1.2663.

Why does the average trader lose? Avoid these Mistakes in your trading

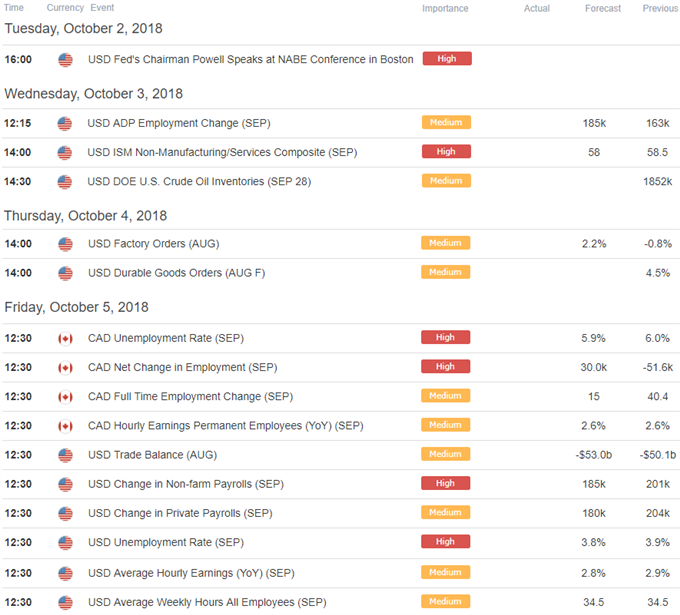

Bottom line: The focus remains lower in USD/CAD with price now approaching initial support targets. From a trading standpoint, look to reduce short-exposure / lower stops at these levels with a near-term recovery in price to offer more favorable entries while below 1.2908. Keep in mind that we are heading into the end of the start of a new month / quarter with key employment data from both the U.S. and Canada on Friday likely to fuel added volatility in USD/CAD price action- tread lightly.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

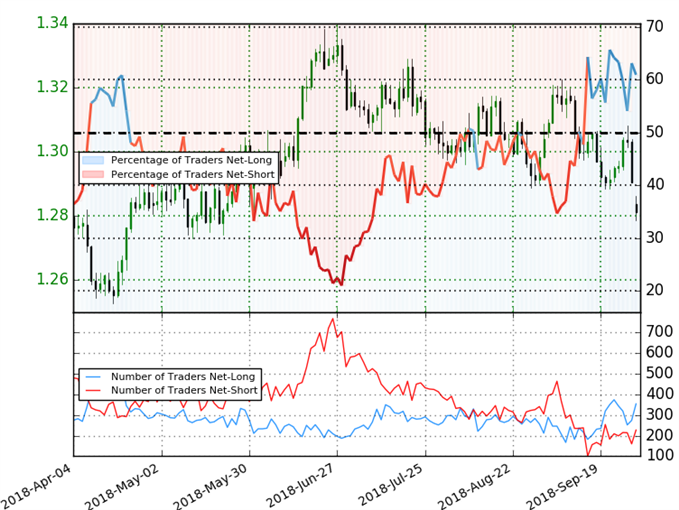

USD/CAD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long USD/CAD - the ratio stands at +1.56 (60.9% of traders are long) – bearish reading

- Traders have remained net-long since September 14th; price has moved 1.4% lower since then

- Long positions are32.1% higher than yesterday and 14.5% lower from last week

- Short positions are 26.8% higher than yesterday and 20.7% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. However traders are more net-long than yesterday but less net-long from last week and the combination of current positioning and recent changes gives us a further mixed USD/CAD trading bias from a sentiment standpoint.

See how shifts in USD/CAD retail positioning are impacting trend- Learn more about sentiment!

---

Relevant USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide !

Active Trade Setups

- USD/JPY Price Outlook: Yen Decision Time as Rally Tests Yearly Highs

- EUR/USD Price Outlook: Euro Break Out Eyes July Highs

- Gold Price Outlook: Breakout Potential as XAU/USD Consolidates

- Crude Oil Price Outlook: WTI Reversal Approaching Initial Targets

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com