- Updated weekly technicals for AUD/USD- key range in focus 7327-7500

- Check out our 3Q price projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

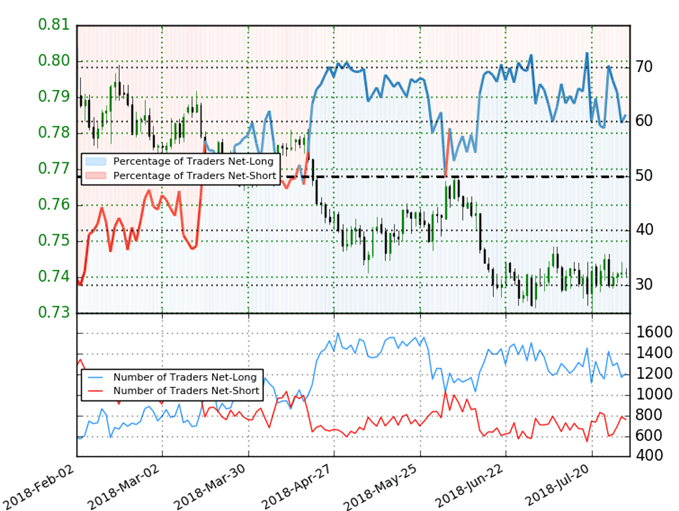

In this series we scale-back and take a look at the broader technical picture to gain a bit more perspective on where we are in trend. The Australian dollar has continued to trade within a well-defined range just above a critical support zone heading into the August open with major event risk on the horizon. Here are the key targets & invalidation levels that matter on the AUD/USD weekly chart.

New to Forex Trading? Get started with this Free Beginners Guide

AUD/USD Weekly Price Chart

Notes: In my previous AUD/USD Weekly Technical Perspective we highlighted that price was testing, “key support at 7327- a level defined by the 61.8% retracement of the 2016 advance and the May 2017 swing lows.” Nearly a month later and Aussie has continued to hold just above this critical support barrier with price respecting the confines of the July opening range.

Heading into the start of August trade, the focus remains on this key support barrier with initial weekly resistance eyed at 7501/05 where the December lows and the 23.6% retracement of the 2018 range converge on the 75% line of the descending pitchfork formation extending off the 2017 highs. Note that weekly RSI has flattened right at the lows registered in January / December of 2016 and further highlights the near-term threat to the broader downtrend here.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: Aussie has rebounded off downtrend support and leaves the broader short-bias vulnerable while above 7327. From a trading standpoint, we’re looking for a break of the 7327-7505 range for further guidance. I’ll continue to favor the long-side while within this range but ultimately a breach above 7500 would be needed to suggest a more significant low is in place with such a scenario targeting 7615/26.

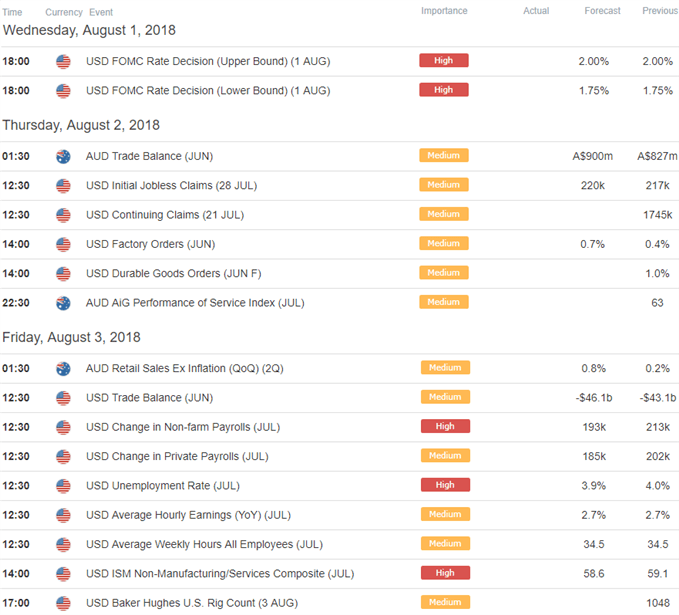

A downside break of this key support zone would invalidate the rebound idea and exposes subsequent support targets at the lower parallels / 2016 swing lows around ~7145. Keep in mind it’s the first trading day of the month with the FOMC rate decision, Australia trade balance figures, and US Non-Farm Payrolls (NFP) still on tap – tread lightly. I’ll publish an updated AUD/USD scalp report once we get further clarity on near-term price action.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

AUD/USD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long AUD/USD- the ratio stands at +1.59 (61.3% of traders are long) –weak bearishreading

- Traders have remained net-long since June 5th; price has moved 1.8% lower since then

- Long positions are3.1% lower than yesterday and 2.4% lower from last week

- Short positions are 2.2% lower than yesterday and 8.9% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are less net-long than yesterday but more net-long from last week. The combination of current positioning and recent changes gives us a further mixed AUDUSD trading bias from a sentiment standpoint.

See how shifts in AUD/USD retail positioning are impacting trend- Learn more about sentiment!

Relevant AUD/USD Data Releases

Economic Calendar – for the latest economic developments and upcoming event risk

Previous Weekly Technical Perspectives

- Euro vs Japanese Yen (EUR/JPY)

- New Zealand Dollar (NZD/USD)

- Japanese Yen (USD/JPY)

- Crude Oil Prices (WTI)

- Euro (EUR/USD)

- British Pound (GBP/USD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com