- Euro poised for consolidation breakout – 1.1603-1.1750 range in focus ahead of ECB / US GDP

- Check out our 3Q Euro projections in our Free DailyFX EUR/USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Euro is virtually unchanged month-to-date with price continuing to consolidate just above key long-term support. We’re looking for a break of this consolidation with major event risk in the days ahead likely to offer a catalyst for price. Here are the updated targets and invalidation levels that matter for EUR/USD heading into the close of the month. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

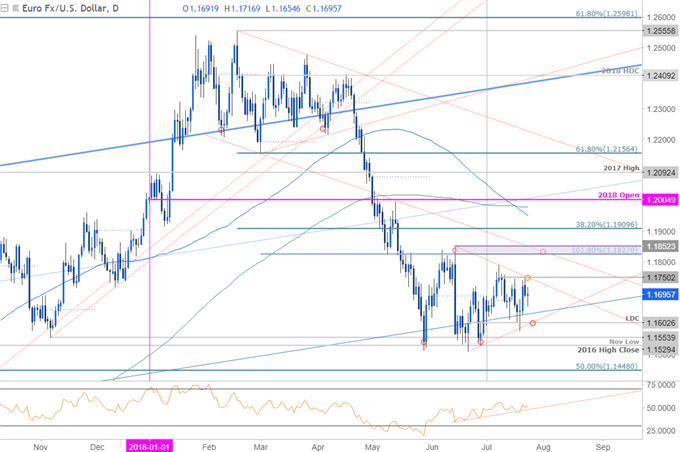

EUR/USD Daily Price Chart

Technical Outlook: For months now we’ve been tracking key weekly support in Euro at 1.1606, “where the October low-close converges on the median-line of the broader ascending pitchfork formation and basic trendline support extending off the 2016 low.” Price has continued to respect this threshold on a weekly close basis with the 2018 low-day close registering at 1.1603.

EUR/USD has continued to consolidate off the June highs and the focus is on a breakout of this formation to offer further guidance. That said, the risk remains for a larger recovery while above 1.1603 with a break below 1.1529/54 needed to mark resumption of the broader downtrend targeting 1.1448. Daily resistance stands at 1.1750 with a breach / close above 1.1827/52 needed to suggest a more Signiant low is in place.

New to Trading? Get started with this Free Beginners Guide

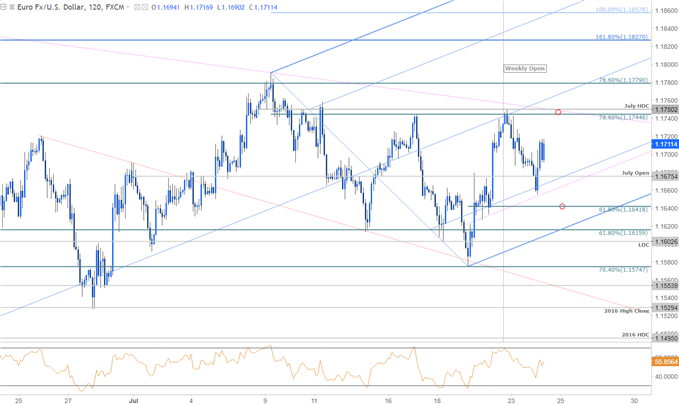

EUR/USD 120min Price Chart

Notes: A closer look at price action sees EUR/USD trading within the confines of a pitchfork formation extending off the June/July lows with price turning sharply from the median-line early in the week. Interim support rests with the sliding parallel (pink) around ~1.1660 backed closely by the 61.8% retracement at 1.1641- both levels of interest for possible exhaustion / long-entries with bullish invalidation steady at 1.1603.

Confluence resistance stands at the weekly opening-range highs at 1.1745/50- a breach there objectively shifts the focus towards 1.1779 and the 161.8% extension/ parallel resistance at 1.1827.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: We’re looking for a breakout of this multi-week consolidation just above long-term support. From a trading standpoint, I’ll continue to favor trading the long-side (fading weakness) while within this range with the risk for a larger recovery still in focus while above the 1.16-handle. Keep in mind we have the European Central Bank (ECB) interest rate decision on tap this Thursday with the first read on 2Q US GDP slated for Friday. For now, Euro is in a consolidation range – treat it as such with the next few days likely to bring further clarity here.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

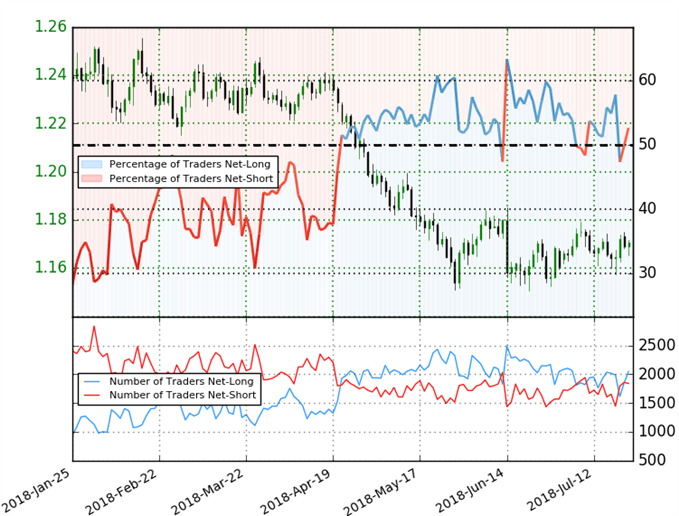

EUR/USD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long EUR/USD- the ratio stands at +1.11 (52.6% of traders are long) – extremely weak bearishreading

- Long positions are14.2% higher than yesterday and 2.0% lower from last week

- Short positions are 8.3% lower than yesterday and 1.7% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Traders are more net-long than yesterday but less net-long from last week and the combination of current positioning and recent changes gives us a further mixed EUR/USD trading bias from a sentiment standpoint.

See how shifts in EUR/USD retail positioning are impacting trend- Learn more about sentiment!

---

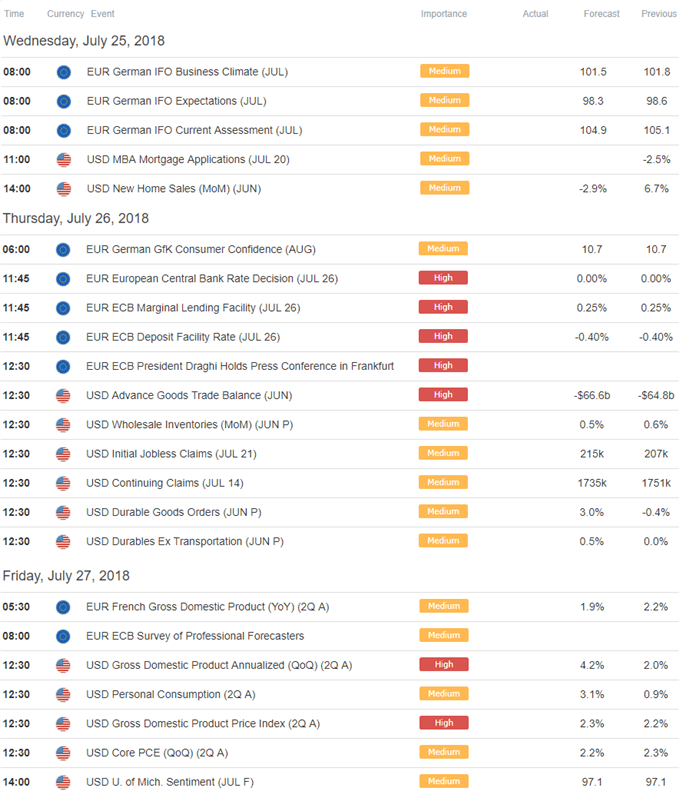

Relevant EUR/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play

- AUD/USD Technical Outlook: Aussie Holds Critical Price Support

- NZD/USD Technical Outlook: Kiwi Threatens Near-term Price Exhaustion

- XAU/USD Technical Outlook: Gold Price Breakdown Testing Support

- USD/JPY Technical Outlook: Is Yen Relief in Sight?

- Crude Oil Technical Outlook: Prices Plummet towards Initial Support

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com