- Kiwi up more than 1.3% off weekly lows- Breach above July opening-range to validate reversal

- Check out our new 3Q projections in our Free DailyFXTrading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The New Zealand dollar has carved out the July opening-range just above key weekly support with a strong reversal yesterday threatening a larger recovery in Kiwi. Here are the updated targets and invalidation levels that matter for NZD/USD heading into the close of the week. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

NZD/USD Daily Price Chart

Technical Outlook: In my latest Weekly Technical Perspective on the New Zealand Dollar, we highlighted that price had, “stretched into a critical support zone last week at 6663-6717- a region defined by the 61.8% retracement of the 2015 advance and the 100% extension of the 2017 decline. Note that the median-line of the descending pitchfork formation extending off the 2017 highs and further highlights the technical significance of the threshold.”

Price posted an outside-day reversal into support to register a low at 6713 yesterday before reversing sharply. Looks like near-term exhaustion and we’re looking to see if price will validate a larger reversal in Kiwi. Initial daily resistance stands with the 2017 low-day close at 6811 backed by the monthly opening-range highs / May low at 6851/59- a breach there would be needed to suggest a more significant low is in place. Note the pending RSI resistance trigger in the daily momentum profile.

New to Trading? Get started with this Free Beginners Guide

NZD/USD 120min Price Chart

Notes: A closer look at price action sees NZD/USD trading within the confines of a descending channel off the monthly high with a proposed embedded pitchfork off the recent lows keeping the focus higher while above 6753 (initial support ~6780). Kiwi is approaching initial topside targets at 6811/19 with a breach above channel resistance targeting subsequent objectives at 6851 and 6874/85.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: NZD/USD is responding to long-term weekly support with our near-term focus higher in price while within this formation. Keep in mind Kiwi remains within the objective July opening-range and we’ll be looking for the break to offer further conviction on our near-term directional bias. From a trading standpoint, I’ll favor fading weakness while above parallel support. A break of the weekly lows invalidates the reversal play with such a scenario targeting initial support targets at 6660/75.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

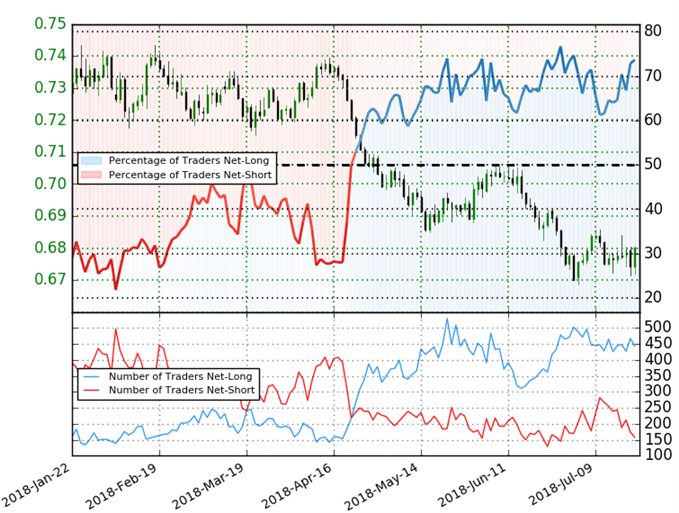

NZD/USD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long NZD/USD- the ratio stands at +2.8 (73.7% of traders are long) – weak bearishreading

- Traders have remained net-long since April 22nd; price has moved 7.7% lower since then

- Long positions are0.7% lower than yesterday and 3.5% higher from last week

- Short positions are 21.8% lower than yesterday and 37.8% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias from a sentiment standpoint.

See how shifts in NZD/USD retail positioning are impacting trend- Learn more about sentiment!

---

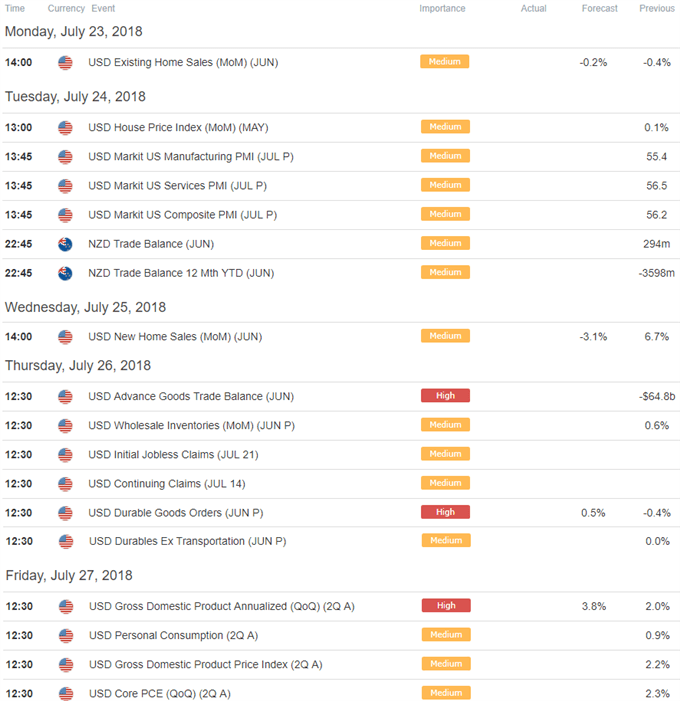

Relevant NZD/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play

- XAU/USD Technical Outlook: Gold Price Breakdown Testing Support

- USD/JPY Technical Outlook: Is Yen Relief in Sight?

- Crude Oil Technical Outlook: Prices Plummet towards Initial Support

- US Dollar Trade Levels– Majors Carve Clear Monthly Opening-ranges

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/scalping_report/2018/07/16/Crude-Oil-Technical-Outlook-Prices-Plummet-towards-Initial-Support-Chart-Analysis.html?ref-author=Boutros