- A look at the weekly technicals for AUD/JPY heading into major event risk

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

In this series we scale-back and take a look at the broader technical picture to gain a bit more perspective on where we are in trend. Here are the key levels that matter on the weekly chart for the Australian Dollar vs the Japanese Yen (AUD/JPY). Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

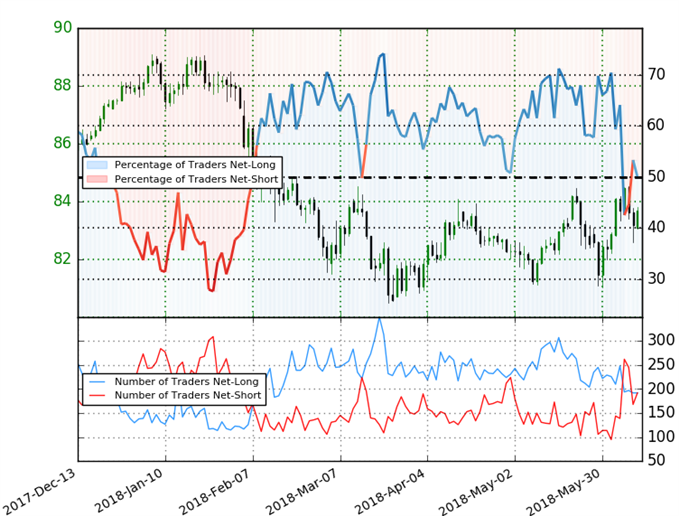

AUD/JPY Weekly Price Chart

Notes: AUD/JPY has continued to trade within a well-defined range for nearly ten weeks now with major event risk this week likely to be a catalyst for the break and to offer clarity on our medium-term price outlook. Key support rests at 81.58/97 where the 2015 & 2017 lows converge on basic trendline support extending off the 2016 lows. Range resistance stands at the 2017 open / 100% extension at 84.25/71.

A downside break of this range targets the 1.618% extension of the 2017 decline at 79.45. A topside breach of this range (alongside a break above the pending RSI resistance trigger) eyes subsequent confluence resistance objectives at ~85.50s where the 52-week moving average converges on former slope support, turned resistance.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

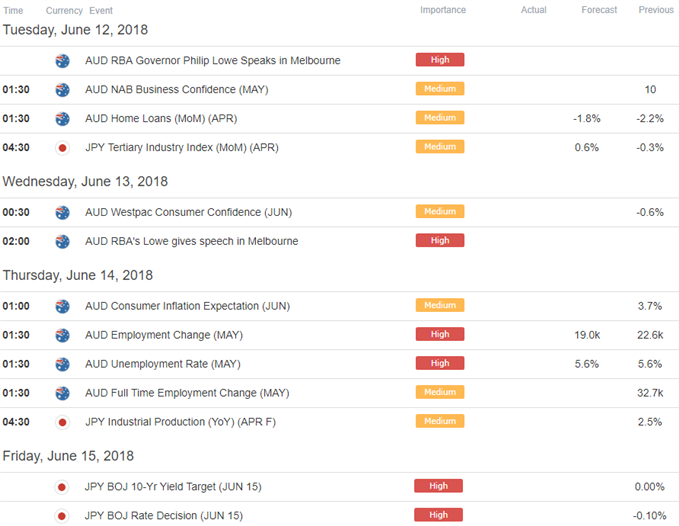

Bottom line: We’re looking for a price breakout for guidance. From a trading standpoint, I’ll favor fading strength near-term but respect this range with a weekly close needed to validate a break on either side. Keep in mind this is considered a ‘risk sensitive’ pair – expect volatility this week with the interest rate decisions from the FOMC & BoJ (Bank of Japan), Australian employment data and the Nuclear Summit between President Trump and North Korean Leader Kim Jung Un, likely to drive market sentiment in the days ahead.

AUD/JPY IG Client Positioning

- A summary of IG Client Sentiment shows traders are flat AUD/JPY- the ratio stands at +1 (50.0% of traders are long) – neutral reading

- Long positions are 5.0% lower than yesterday and 16.2% lower from last week

- Short positions are 7.3% higher than yesterday and 74.5% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-neutral offers little indication. Yet traders are less net-long than yesterday and compared with last week and therecent changes in sentiment warn that the current AUD/JPY price trend may soon reverse higher despite the fact traders remain net-long.

Why does the average trader lose? Avoid these Mistakes in your trading

AUD/JPY Economic Calendar

Economic Calendar - latest economic developments and upcoming event risk

Previous Weekly Technical Perspectives

- Weekly Technical Perspective on the Japanese Yen (USD/JPY)

- Weekly Technical Perspective on Crude Oil Prices

- Weekly Technical Perspective on the British Pound (GBP/USD)

- Weekly Technical Perspective on the US Dollar

- Weekly Technical Perspective on AUD/USD

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com