- AUD/USD eyeing multi-year uptrend support- Short bias at risk above 7612

- Check out our 2018 AUD/USD projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Australian Dollar is approaching multi-year uptrend support after plummeting nearly 6% off the yearly highs. If the broader uptrend is to remain viable, prices will need to find a low ahead of this key structural support confluence in the days to come. It’s make-or-break here for the Aussie.

AUD/USD Daily Price Chart

Technical Outlook: In this week’s Technical Perspective, we noted that the Australian Dollar was, “approached a long-term support confluence we’ve been tracking since the start of the year at 7612/37. This region represents a critical inflection point for price and IF broken would risk a substantial sell-off in the Aussie.” Put simply, price is trading just above major uptrend support and we’re on the lookout for an exhaustion low while above 7612.

New to Forex Trading? Get started with this Free Beginners Guide

AUD/USD 240min Price Chart

Notes: A closer look at price action see’s Aussie trading within the confines of a descending channel formation with the lower parallels further highlighting support into 7612. A near-term embedded channel keeps the focus lower while below the weekly opening-range highs with a breach above 7707 needed to get things going. Such a scenario targets subsequent topside objectives at 7748, 7780 and the 61.8% retracement at 7812. A break / daily close below 7612 would invalidate the reversal play and keep the short-bias in focus targeting 7552 backed by 7501 & the 50% retracement at 7476.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: Be on the lookout for a near-term exhaustion low with 7637 & 7612 both representing key zones of interest. From a trading standpoint, I’ll favor fading weakness into this support confluence with a breach above channel resistance needed to validate a near-term reversal. Ultimately, this is a BIG level for Aussie and a break below could prove terminal to the multi-year uptrend - tread lightly until we get some convincing near-term price action.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

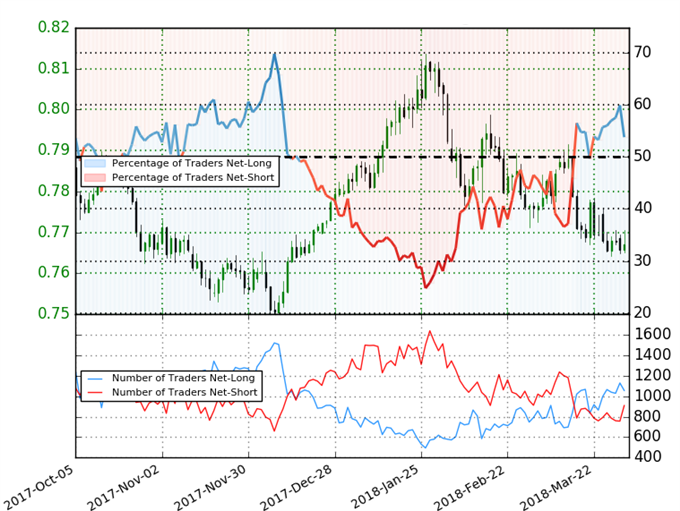

AUD/USD IG Client Positioning

- A summary of IG Client Sentiment shows traders are net-long AUDUSD- the ratio stands at +1.16 (53.8% of traders are long) –weak bearishreading

- Retail has remained net-long since Mar 22nd; price has moved 1.4% lower since then

- Long positions are 4.3% lower than yesterday and 11.2% higher from last week

- Short positions are 13.6% higher than yesterday and 5.1% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are less net-long than yesterday but more net-long from last week andthe combination of current positioning and recent changes gives us a further mixed AUDUSD trading bias from a sentiment standpoint.

See how shifts in AUD/USD retail positioning are impacting trend- Learn more about sentiment!

---

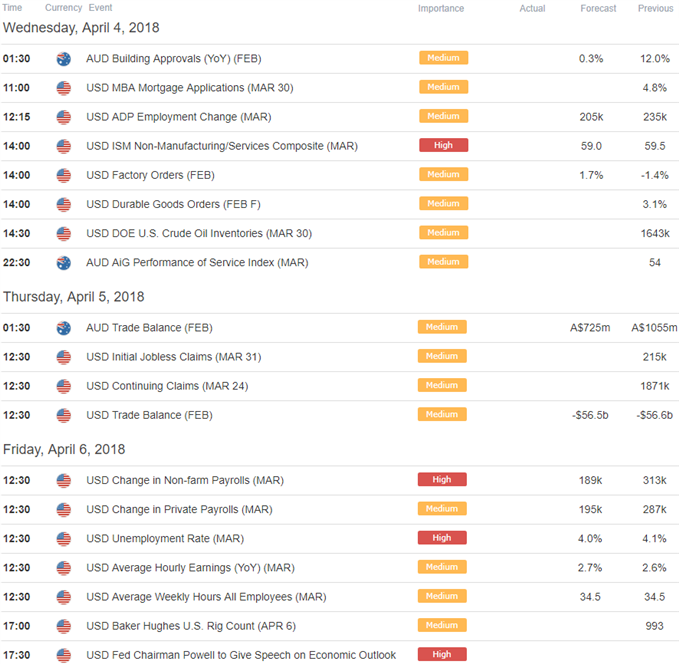

Relevant Data Releases

Other Setups in Play

- Weekly Technical Outlook: Monthly Open Trade Setups- Levels to Know

- EUR/USD Uptrend Remains Viable If Price Can Hold Above these Levels

- USD/JPY Price Outlook: Is a Low in Place?

- Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly, please sign-upto his email distribution list

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com