- Updated daily technicals on BTC/USD, ETH/USD and XRP/USD

- Review Michael’s Foundations of Technical Analysis series on Building a Trade Strategy

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT to review these setups and more!

Cryptocurrencies have been in free fall for the past few days with the recent sell-off in prices taking the crypto-bloc towards the yearly lows. Here are the levels to know in Bitcoin, Ethereum and Ripple as prices approach critical make-or-break support thresholds.

Bitcoin Daily Price Chart (Log)

Notes: Earlier this month we noted that, “The risk remains lower while below 11171 with basic trendline resistance extending off the record highs further highlighting this region. Interim resistance remains steady at 9222 with a break lower targeting the 200-day moving average at ~8915 and 8159 where the 61.8% retracement converges on the March 2017 trendline support.” Prices are testing this region now with today’s swing low reversing sharply off 2018 low-day close at 7737 (low registered at 7682) - It’s make-or-break here for the cryptocurrency near-term.

Note that daily RSI turned ahead of the 60-threshold for the past two months with this decline taking the momentum signature back below 40. The current momentum profile continues to highlight the downside risk for prices.

Bottom Line: Bitcoin prices are testing major support- look for a reaction here with a weekly close below risking substantial losses for the cryptocurrency towards support targets at the yearly close-low at 6874 and 6039. Interim resistance now stands at 9222 with a breach above 11171 still needed to mark resumption of the broader uptrend.

New to Bitcoin Trading? Get started with this Free Beginners Guide

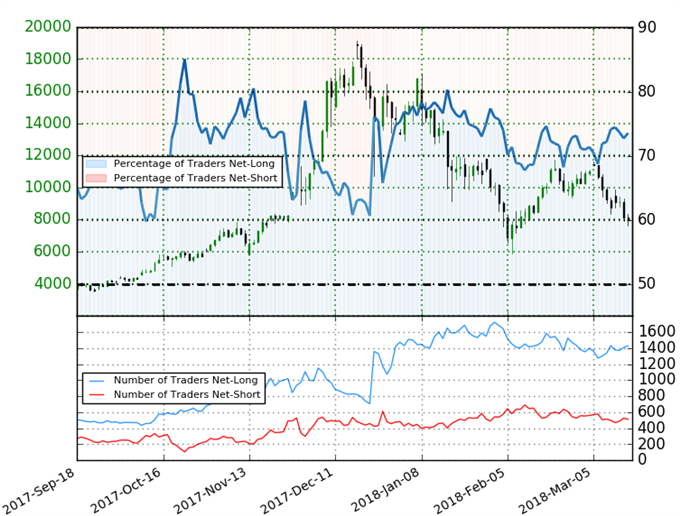

Bitcoin IG Client Positioning

- A summary of IG Client Sentiment shows traders are net-long Bitcoin- the ratio stands at +2.79 (73.6% of traders are long) – bearishreading

- Long positions are 3.3% higher than yesterday and 8.6% higher from last week

- Short positions are 3.4% lower than yesterday and 1.3% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Bitcoin-bearish contrarian trading bias from a sentiment standpoint.

Check out our New 2018 trade projectionsin our Free DailyFX Trading Forecasts

Ether Daily Price Chart (Log)

Notes: In my previous Cryptocurrency Technical Outlook I noted that, “Ethereum prices have continued to consolidate just below basic trendline resistance extending off the February highs. Key near-term support is eyed at 770/83 where the yearly low-day close converges on the 50% retracement of the rally off the lows.” Ethereum prices broke below this threshold less than a week later with the subsequent decline taking out basic trendline support extending off the July lows.

Ether is now testing a critical near-term support confluence at 556 where the 2018 lows converges on a slope line extending off the June highs. Note that daily RSI is also testing 30 and a break below these levels would risk accelerated losses towards the November high at 499 and more a significant support confluence at 405/24.

Bottom line:Ethereum is testing a confluence support zone as momentum is testing a break into oversold. The immediate downside bias is at risk while above this threshold with a breach above 783 needed to alleviate further downside pressure. A break lower risks a drop towards the June highs just above 400.

Why does the average trader lose? Avoid these Mistakes in your trading

Ripple Daily Price Chart (Log)

Notes: At the March open we noted that, “given recent price action, a break below 7600 would likely see accelerated losses for the cryptocurrency with such a scenario risking a drop towards the 200-day moving average at ~6400.” Ripple prices are now testing confluence support around 6475 where the 88.6% retracement of the February advance converges on the median-line of the descending pitchfork formation extending off the 1/18 high.

Bottom line: Ripple is testing BIG support here with the immediate short-bias at risk while above today’s lows. Initial resistance stands back at the 2018 low-day close at 7600 with a breach above the March high-day reversal close at 9395 needed to shift the broader focus higher. A break below this support zone keeps the short-bias in play targeting the yearly lows at 5729 backed by 4905.

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

To receive Michael’s analysis directly, please sign-upto his email distribution list

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com