- EURUSD preserves February opening-range; losses to offer favorable long-entries

- Check out our 2018 quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

EUR/USD is in retreat but price continues to hold within the monthly range. The recent sell-off is now approaching initial support targets with a move lower to ultimately offer more favorable buying opportunities.

EUR/USD Daily Price Chart

Technical Outlook: EUR/USD has carved out a well-defined monthly opening range just above former slope resistance, now support. Price has continued to trade within the confines of a series of ascending slope lines originating off the April lows and keeps the broader focus higher while above the 2017 high at 1.2092 (bullish invalidation). Daily resistance stands with the monthly / yearly high-day close at 1.2409 with a breach there targeting the long-term 61.8% retracement of the 2014 decline at 1.2598.

New to Forex Trading? Get started with this Free Beginners Guide

EUR/USD 120min Price Chart

Notes: A closer look at EURUSD price action sees the pair trading within the confines of a near-term descending pitchfork formation extending off the February highs, with a break of the weekly opening-range shifting the immediate focus lower. That said, we’re looking for a possible exhaustion low on a move towards support objectives at 1.2206 & 1.2172- both levels of interest for long-entries IF reached.

Look for interim resistance back at 1.2281backed by the 61.8% line of the descending slope pattern / weekly opening-range high at 1.2352. A breach/close above confluence resistance at 1.2409 would be needed to mark resumption of the broader uptrend with such a scenario targeting January high at 1.2538 and 1.2598.

Why does the average trader lose? Avoid these Mistakes in your trading

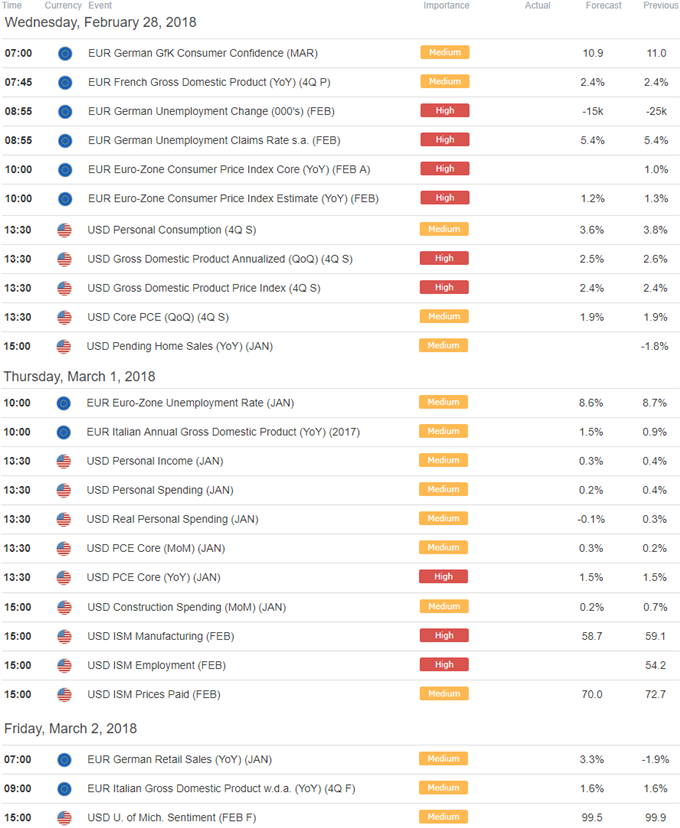

Bottom line: Looking for signs of exhaustion on a move lower here with the decline to offer more favorable long-entries targeting a breakout of this formation. Keep in mind there’s a good amount of event risk on tap still this week with the Eurozone Consumer Price Index (CPI) and the second read on US 4Q GDP figures on tap tomorrow.

---

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy.

Relevant EUR/USD Data Releases

Other Setups in Play

- Weekly Technical Outlook: USD Down-Trend in Focus Ahead of March Open

- USD/CAD Surges Into Resistance- Rally Vulnerable Ahead of Canada CPI

- AUD/NZD Price Tumbles to Five-Month Lows; Relief in Sight?

- USD/JPY Price Analysis: Rebound to Offer Opportunity

- Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly via email, please SIGN UP HERE

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com