- DAX rally fails to hold 2017 highs- risk is lower near-term while below 13480

- Check out our 2018 quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

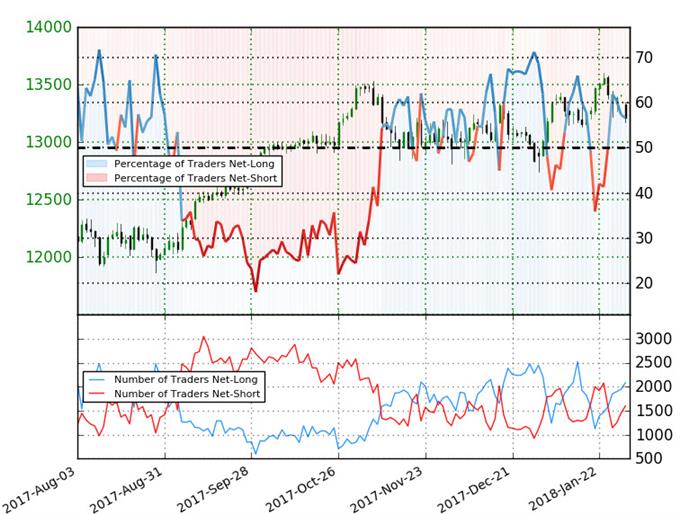

GER30 Daily Chart

Technical Outlook: The German DAX has been trading within the confines of this ascending slope line formation (red) extending off the 2016 lows with price reversing off parallel resistance back in November. A waning momentum profile and failure to hold above the 2017 high-close at 13480 suggests the index remains vulnerable for further losses in the days ahead.

Look for initial daily support targets at the 2017 high-week reversal close at 13127 backed by the 100-day moving average at ~13038- note that this threshold converges on the proposed median-line of a near-term downslope (blue) and a break below this level would be needed to suggest a more significant high is in place. Such a scenario would shift the medium-term focus lower towards key confluence support at 12734/39- a region defined by the 200-day moving average & the 50% retracement of the late-August advance and converges on a pair of slope lines (roughly second week of February).

New to Forex Trading? Get started with this Free Beginners Guide

GER30 240min Chart

Notes: A closer look at price action further highlights this slope with a near-term pitchfork extending off the January highs deriving virtually the identical gradient of the broader structure. That said, we could see a bump off this confluence at 13169 but the focus remains lower for now while below 1341. A break lower targets 13127 and the 13038/67 support zone- look for a reaction there.

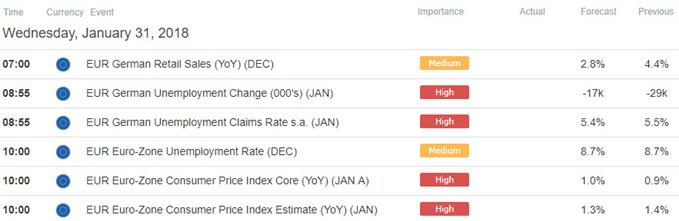

Bottom line: I’ll favor fading strength while within this formation with a daily close sub-13038 needed to suggest that a larger reversal is underway. Keep in mind we get the release of German Retail Sales and Unemployment Claims tomorrow morning.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis mini-series

Germany 30 IG Client Sentiment

- A summary of IG Client Sentiment shows traders are net-long the GER30- the ratio stands at +1.3 (56.6% of traders are long) – weak bearishreading

- Long positions are 13.9% lower than yesterday and 11.9% higher from last week

- Short positions are 12.9% higher than yesterday and 30.9% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Germany 30 prices may continue to fall. However, retail is less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed Germany 30 trading bias from a sentiment standpoint.

See how shifts in retail positioning are impacting trend- Click here to learn more about sentiment!

---

Relevant Data Releases

Why does the average trader lose? Avoid these Mistakes in your trading

Other Setups in Play

- Weekly Technical Outlook- US Dollar Bears to Face FOMC, NFP

- USD/JPY Plummets to 4-Month Lows; More Pain to Follow?

- AUD/JPY Outlook Hinges on Break of Monthly Opening

- GBP/USD Breakout Underway - Topside Targets in View

- Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly via email, please SIGN UP HERE

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com