To receive Michael’s analysis directly via email, please SIGN UP HERE

- NZD/USD rebound eyes critical resistance- constructive while above 6920

- Check out our 4Q NZD/USD projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

NZD/USD Weekly

Technical Outlook: Kiwi broke above the December opening range last week, shifting the medium-term outlook higher in the pair. The rally turned just ahead of a key resistance confluence at 7038- note that the 52-week moving average stands just higher at ~7100. The immediate advance is at risk heading into this threshold and the focus is on a reaction off this mark.

NZD/USD Daily Chart

The daily chart further highlights 7037/77 as a key resistance zone with both long & short-term slopes converging on a pair of Fibonacci retracements. A pullback off this level is likely but the broader focus remains weighted to the topside while above the yearly open at 6919.

New to Forex? Get started with this Free Beginners Guide

NZD/USD 240min Chart

Notes: A closer look at price action sees the pair trading within an ascending channel formation extending off the yearly lows with slope resistance capping last week’s rally. Look for initial support at 6975/79 backed by 6945- a break below this region would risk a larger setback towards the yearly open at 6920 & confluence support at 6873/77- (both levels of interest for near-term exhaustion / long-entries if reached).

A breach above this near-term descending channel off the highs targets the upper parallels backed by 7077/78. Note that a measured move of the consolidation break noted last week targets a stretch towards 7100 (also the 52-week moving average). Bottom line: The immediate threat is lower but we’ll be looking for the decline to offer favorable long-entries, ultimately targeting a breach towards 7100.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

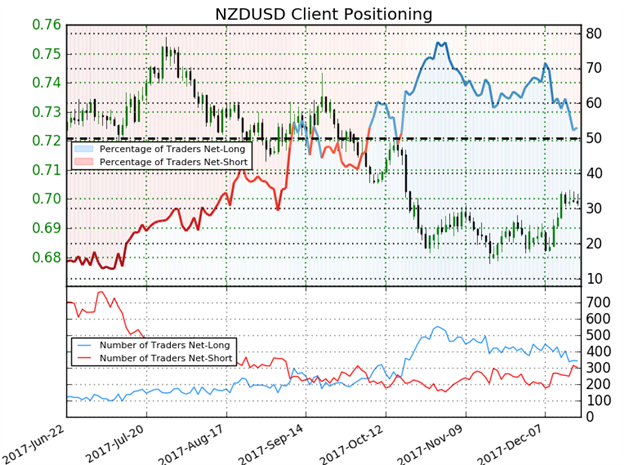

- A summary of IG Client Sentiment shows traders are net-long NZDUSD- the ratio stands at +1.13 (53.1% of traders are long) – weak bearishreading

- Retail has remained net-long since Oct 18; price has moved 1.0% lower since then

- Long positions are 0.9% lower than yesterday and 21.1% lower from last week

- Short positions are 9.7% higher than yesterday and 23.6% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZDUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current NZDUSD price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in NZD/USD retail positioning are impacting trend- Click here to learn more about sentiment!

---

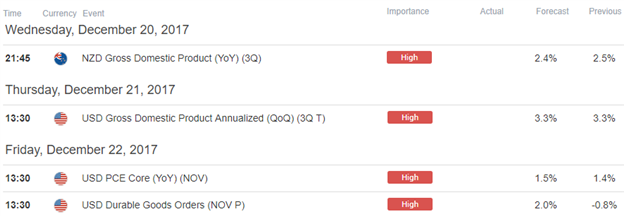

Relevant Data Releases

Why does the average trader lose? Avoid these Mistakes in your trading

Other Setups in Play

- Weekly Technical Outlook: Top 2018 Trade Setups

- AUD/USD Bullish Reversal Eyes Initial Resistance Targets

- USD/JPY Searches for a Top Ahead of FOMC

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com