To receive Michael’s analysis directly via email, please SIGN UP HERE

- USD/JPY rally approaching key resistance objectives ahead of FOMC

- Check out our 4Q USD/JPY projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

USD/JPY Daily Chart

Technical Outlook: USD/JPY has broadly held within the confines of this ascending pitchfork formation extending off the yearly lows. Note that a parallel of the same slope (red) extending off the October lows is now coming into view. Key resistance for the pair stands with the range highs / 61.8% retracement at 114.30/36 with support steady at 111.65 where the October low converges on the 100 & 200-day moving averages. Broader bullish invalidation rests at 111.03.

New to Forex? Get started with this Free Beginners Guide

USD/JPY 120min Chart

Notes: A closer look at price action highlights a near-term ascending channel formation extending off the lows with the upper parallel converging on the 78.6% retracement at 113.90 into the close of US trade today. Interim support rests at 113.25 with our near-term bullish invalidation level now raised to 112.48.

A breach higher targets the 114.30/50 range- a critical threshold which if compromised would open up an advance targeting the 61.8% retracement of the 2015 decline at 115.52. Bottom line: heading into the FOMC policy meeting tomorrow, the near-term uptrend is at risk while below 114.50. Look for either signs of exhaustion there, or a break below 112.48 to shift the focus lower. A close above would keep the long-bias in play targeting subsequent resistance objectives.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

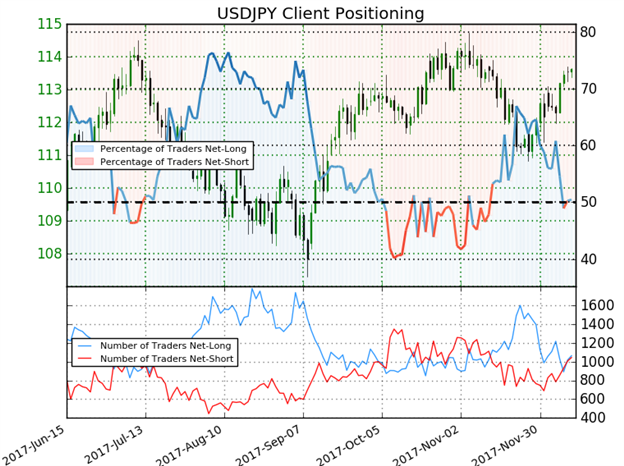

- A summary of IG Client Sentiment shows traders are net-long USDJPY- the ratio stands at +1.02 (50.5% of traders are long) – weak bearishreading

- Long positions are 9.9% higher than yesterday and 4.3% lower from last week

- Short positions are 1.0% higher than yesterday and 12.9% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. However, retail is more net-long than yesterday but less net-long from last week and the combination of current positioning and recent changes gives us a further mixed USDJPY trading bias from a sentiment standpoint.

See how shifts in USD/JPY retail positioning are impacting trend- Click here to learn more about sentiment!

---

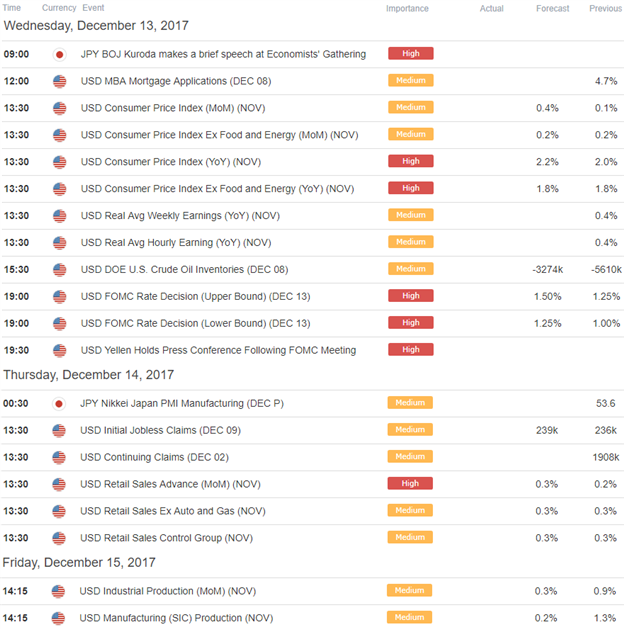

Relevant Data Releases

Why does the average trader lose? Avoid these Mistakes in your trading

Other Setups in Play

- Weekly Technical Outlook: USD Trade Setups Heading into FOMC Forecast

- Ethereum Price Analysis- Traders Look to Bitcoin Rally for Inspiration

- GBP/USD Responds to Confluent Support – Outlook Constructive Above 1.3226

- AUD/JPY Recovery Stalls at Resistance- Monthly Opening Range in Focus

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com