To receive Michael’s analysis directly via email, please SIGN UP HERE

- Ethereum takes out initial resistance targets- Broader focus is higher while above 315

- Check out our 4Q projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

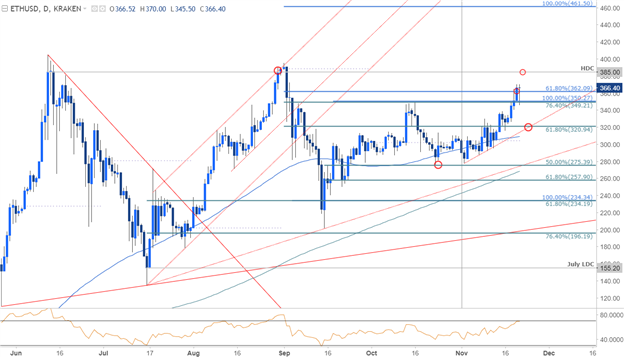

ETH/USD Daily Chart

Technical Outlook: We’ve been tracking this rally in Ethereum prices since the breach above the November opening range earlier in the month with the advance already taking out initial targets at 350 & 362. Critical topside resistance objectives are eyed at the high-day close at 385 backed by the record high at 405. Interim support now rests back at 349 with bullish invalidation now raised to 315/20. A break below the monthly open at 304 would be needed to put the bears in control.

New to Forex? Get started with this Free Beginners Guide

ETH/USD 240min Chart

Notes: A closer look at price action shows Ethereum breaking above channel resistance before checking this slope as support last night. Note that the near-term momentum profile looks a bit tired here and leaves the immediate advance vulnerable. Bottom line: while we could see some pullback from here, the outlook remains weighted to the topside and we’ll favor fading weakness while above 315.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

Why does the average trader lose? Avoid these Mistakes in your trading

---

Other Setups in Play

- NZD/JPY Range Break Targets Fresh Monthly Lows

- GBP/USD Consolidation Breakout Imminent

- U.S. Dollar Sell-off Targets Initial Support

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com