To receive Michael’s analysis directly via email, please SIGN UP HERE

- DXY testing confluence support- Focus is on a break below 94

- Check out our 4Q projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

DXY Daily Chart

Technical Outlook: We’ve been tracking a long-term slope line dating back to 2011 and in last week’s Technical Outlook, we highlighted the risk for a pullback while below this key threshold. The subsequent decline is now testing initial support at the 94-handle where basic channel support converges on the broader 23.6% retracement of the yearly range. A break lower still has to contend with the 100-day moving average / median-line (blue) at ~93.60s – a close below this region is needed to suggest that a more significant high is in place.

New to Forex? Get started with this Free Beginners Guide

DXY 240min Chart

Notes:A closer look at price action further highlights this near-term support zone around the figure. Resistance stands with the November open / weekly opening-range high at 94.63 with a breach above the ascending median-line (red) needed to shift the focus back to the long-side in the index.

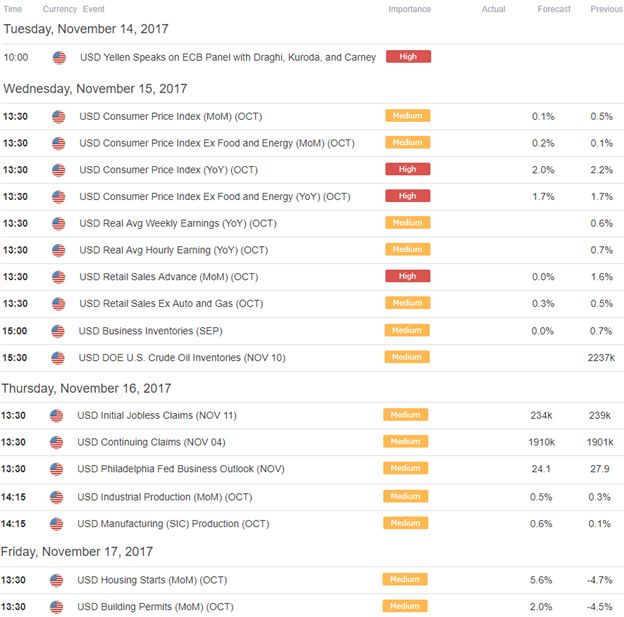

Bottom line: The index is testing initial support and while we could see some immediate relief here, the focus remains lower while within this near-term descending pitchfork formation (blue). Keep in mind that we have the release of the U.S. Consumer Price Index(CPI) tomorrow with the event likely to spark increased volatility in the USD crosses.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

---

Relevant Data Releases

Why does the average trader lose? Avoid these Mistakes in your trading

Other Setups in Play

- Ethereum Price Breakout Underway

- EUR/USD Responds to Initial Support- Recovery to Offer Opportunity

- Crude Oil Price Analysis- Breakout Targets to Know

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com