To receive Michael’s analysis directly via email, please SIGN UP HERE

- Aussiebreaks October opening range- selloff eyes yearly slope support

- Check out our 3Q AUD/USD projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: Aussie broke below confluence slope support at ~7778 last night on the heels of a lackluster print on 3Q CPI. The decline is now targeting a critical support confluence highlighted in yesterday’s weekly technical perspective at 7630/65. A break below this mark risks substantial losses for the pair with such a scenario eyeing the lower median-line parallel, currently ~7570s.

New to Forex? Get started with this Free Beginners Guide

AUD/USD 240min

Notes:A closer look at price action highlights AUDUSD trading within the confines of a descending pitchfork formation extending off the yearly highs. Note that the lower 50-line (blue) converges on yearly slope support (red) around 7675 with the 61.8% retracement of the May advance just lower at 7632- an area of interest for possible exhaustion / long-entries.

Interim resistance now stands at 7750 with our immediate focus lower while below the median-line / November highs at ~7778. Bottom line: looking lower for a reaction at critical long-term support for a possible near-term recovery in price. Added caution is warranted heading into the close of the week with the release of US 3Q GDP figures likely to fuel increased volatility in the USD crosses.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

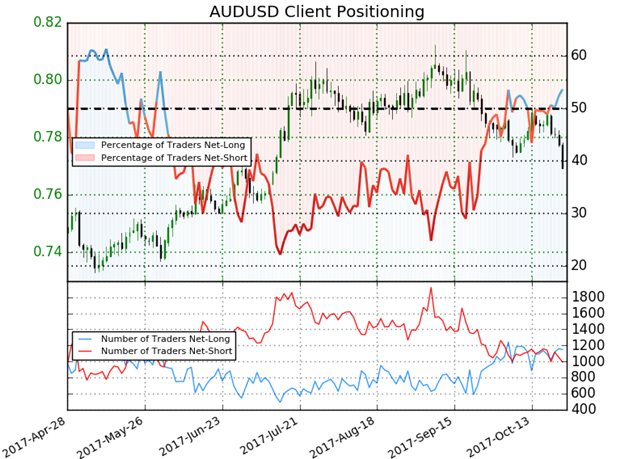

- A summary of IG Client Sentiment shows traders are net-long AUDUSD- the ratio stands at +1.16 (53.6% of traders are long) – Weak bearishreading

- Long positions are 2.9% lower than yesterday and 3.8% lower from last week

- Short positions are 11.0% lower than yesterday and 10.1% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger AUDUSD-bearish contrarian trading bias from a sentiment standpoint.

See how shifts in AUD/USD retail positioning are impacting trend- Click here to learn more about sentiment!

---

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- Ethereum Prices Settle on Fibonacci Support

- Weekly Technical Outlook: USD Turn or Burn at Key Resistance

- USD/CAD Battle Lines Drawn Ahead of Canada CPI

- Crude Oil Price Analysis– Pullback to Offer Opportunity

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.