To receive Michael’s analysis directly via email, please SIGN UP HERE

- Euro responds to long-term slope resistance- Break of near-term range to offer guidance

- Check out our EUR/USD quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

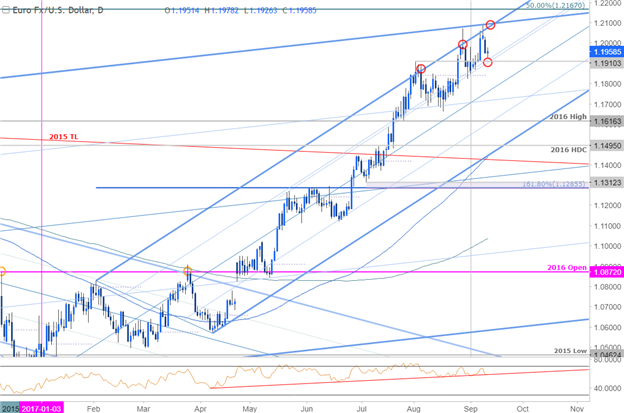

EUR/USD Daily Chart

Technical Outlook: Yesterday we highlighted a longer-term technical resistance confluence in EURUSD with the long-bias at risk while below 1.2042/80. Daily support rests at 1.1910 (8/2 swing high / monthly open) - this level converges on the 75% line over the next few days. The focus is on a break of this range with a move lower suggesting a more significant correction is underway. A breach of the highs targets the 50% retracement at 1.2167.

EUR/USD 240min

Notes:A closer look at price action highlights a rebound off near-term confluence support at 1.1910/28 and although we could see some further upside, the focus remains weighted to the downside while below the weekly open at 1.2015. A break lower targets the 61.8% retracement at 1.1826 backed by the median-line / 76.4% retracement at 1.1764/74–(both levels of interest for exhaustion / long-entries).

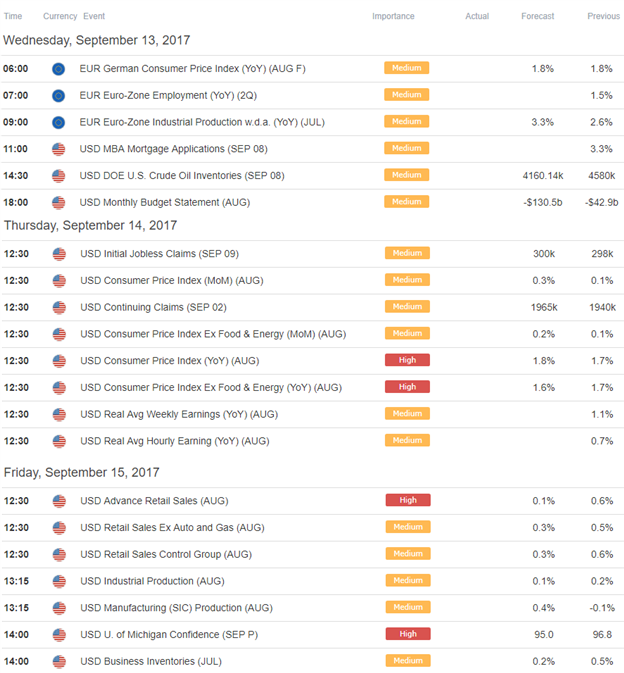

A breach above Friday’s high at 1.2092 would invalidate the reversal-play with such a scenario targeting the upper median-line parallel around 1.2167. Bottom line: the risk remains for a larger setback but ultimately, we’d be looking to fade a move lower into structural support near the median-line. Added caution is warranted heading into U.S. event risk later this week with the release of the August Consumer Price Index (CPI) & Advanced Retail Sales likely to fuel increased volatility in the dollar crosses.

New to Forex? Get started with this Free Beginners Guide

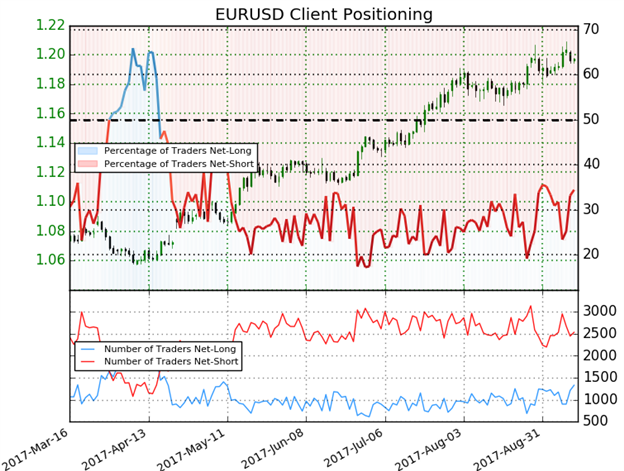

- A summary of IG Client Sentiment shows traders are net-shot EURUSD- the ratio stands at -1.9 (34.4% of traders are long) – bullishreading

- Retail has been net-short since April 18th - Price has moved 9.9% higher since then

- Long positions are 18.8% higher than yesterday and 3.3% higher from last week

- Short positions are 11.5% lower than yesterday and 3.0% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

See how shifts in Euro retail positioning are impacting trend- Click here to learn more about sentiment!

---

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- A Weekly Technical Perspective for USD Majors

- Technical Setups for the Week Ahead as DXY Flirts with Disaster

- GBP/USD Struggles at Resistance- Weakness to Offer Opportunity

- AUD/USD Battles to Surpass 8000- Watch for a Break of this Range

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.