To receive Michael’s analysis directly via email, please SIGN UP HERE

- Sterling rally approaching initial resistance targets- broader outlook remains constructive

- Check out our GBP/USD quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: Last month we noted that Sterling prices were approaching a region of key, “structural support at the December high / lower parallel at 1.2760/75- a level of interest for possible exhaustion.” Indeed prices registered a low of 1.2773 before reversing sharply higher with the advance now approaching initial resistance targets at 1.3121- a level defined by the 38.2% retracement of the Brexit decline and the mid-July swing highs.

While the immediate risk is for some pullback off this threshold, the broader outlook remains constructive while above 1.2854 with a breach higher targeting subsequent resistance objectives at 1.3272 & the median-line (currently ~1.3350s).

See how shifts in GBPUSD/USD retail positioning are impacting trend- Click here to learn more about sentiment!

GBP/USD240min

Notes:A closer look at price action highlights a near-term slope extending off the August lows with the rally now testing a parallel extending off last week’s high. Interim support rests at 1.3021 with our near-term bullish invalidation level set to 1.2962.

A breach above 1.3121 still has to contend with a near-term Fibonacci zone at 1.3163/84- a region which could be a bigger hurdle for this advance. Bottom line: from a trading standpoint, I’ll continue to favor buying weakness while within this near-term up-slope (red) with a breach above 1.3184 needed to clear the way for the next leg higher in the British Pound.

New to Forex? Get started with this Free Beginners Guide

---

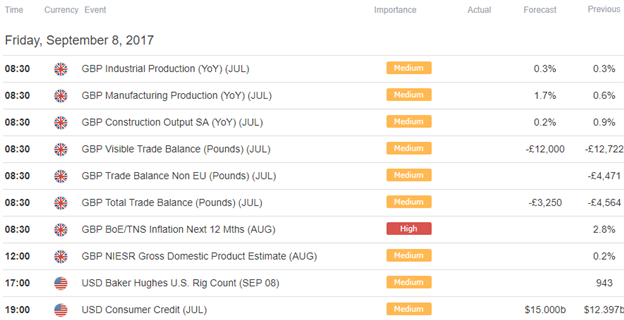

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- AUD/USD Battles to Surpass 8000- Watch for a Break of this Range

- Strategy Webinar: ECB, BoC Highlight Key Setups for September

- Ethereum Prices Plummet into Support- 295 Critical

- NZD/USD Slides Into Support- Key Levels to Know for NFP

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.