To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

- EURUSD possibly trading within near-term bull flag-immediate risk still lower

- Check out our EURUSD quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: Euro has been trading within the confines of a well-defined ascending pitchfork formation with prices reversing off the upper parallel early in the month. The risk remains for a deeper pullback in with the pair while below monthly open resistance at 1.1841. Key daily support is eyed along the median-line / 2016 highs at 1.1616.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

EURUSD 240min

Notes: A closer look at price action highlights a near-term descending channel formation extending off the monthly high (could be a bull-flag). Immediate resistance is eyed at the highlighted trendline confluence around ~1.1815. A breach above the 2010 low at 1.1877 would be needed to validate resumption of the broader uptrend targeting 1.1998.

Channel support converges on the median-line at ~1.1650s with more significant support seen at 1.1616(area of interest for long-entries)- a break below this level would be needed to suggest a more meaningful high is in place. Bottom line: I’ll favor the short-side while within this near-term channel with a broader pullback to offer more favorable long-entries.

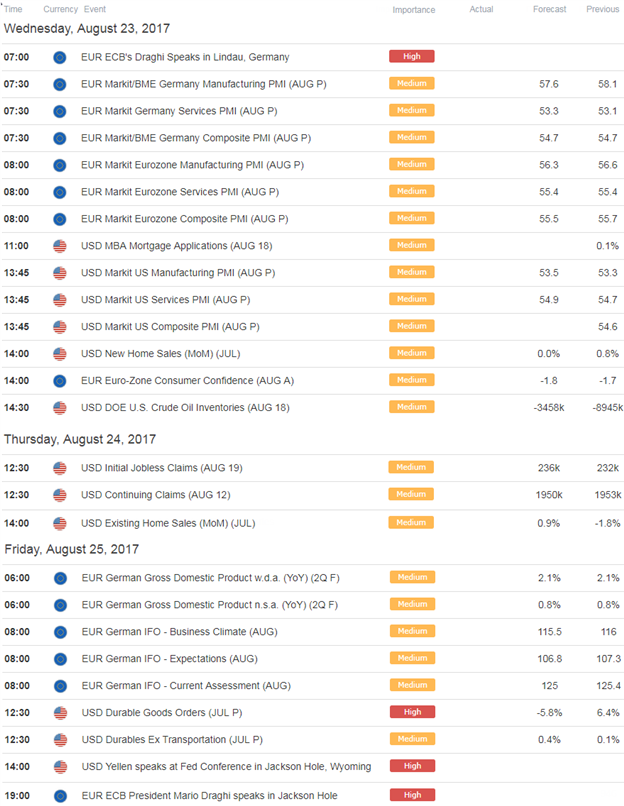

Note that the annual Jackson Hole Economic Symposium represents significant event risk for the pair with ECB President Mario Draghi & Fed Chair Janet Yellen slated for commentary on Thursday & Friday. Added caution is warranted heading into these events with remarks likely to fuel increased volatility in the EUR & USD crosses.

New to Forex? Get started with this Free Beginners Guide

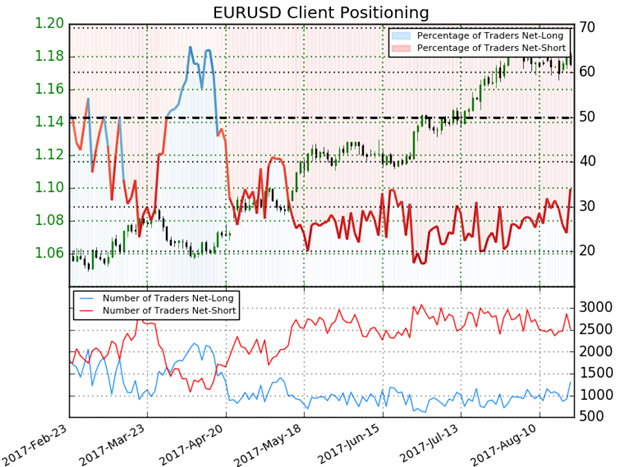

- A summary of IG Client Sentiment shows traders are net-shot EURUSD- the ratio stands at -1.94 (34.0% of traders are long) –bullishreading

- Retail has been net-short since April 18th - Price has moved 10.0% higher since then

- Long positions are 22.3% higher than yesterday and 16.4% higher from last week

- Short positions are 5.7% lower than yesterday but 0.4% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

See how shifts in Euro retail positioning are impacting trend- Click here to learn more about sentiment!

---

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play:

- Webinar: FX Markets Brace for Yellen - Ethereum Breakout Accelerates

- Are Gold Prices on the Verge of Fresh Yearly Highs?

- AUD/USD Bull-Flag Breakout in the Works

- GBP/USD Prices Testing Support- Risk for Further Losses Remains

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.