Talking Points

- NZDUSD fails to breach daily resistance- Sentiment extremely one-sided ahead of RBNZ

- Check out our 2Q NZD/USD projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

NZD/USD Daily

Technical Outlook:Kiwi failed an attempted breach above trendline resistance extending off the 2016 highs last week with the pair continuing to hold just below heading into the RBNZ interest rate decision later today. Sentiment on NZDUSD is extremely heavily weighted on the short-side (lowest on record) and as such, we’ll take a more neutral stance ahead of the decision while noting the threat for a pullback while below the 2017 high-day reversal close at 7301.

NZD/USD 120min

Notes: A closer look at price action sees the pair in consolidation after last week’s failed breach with near-term slope highlighting support at 7204 (August 30th swing lows). A break below this mark targets key near-term support at 7166/70 where the 100% extension of the decline converges on former swing lows and the longer-term 50-line of the broader ascending pitchfork. We’ll reserve this threshold as our broader bullish invalidation level.

Resistance stands at today’s high ~7250 with a breach above the triangle resistance at ~7275/80 needed to mark resumption of the broader up-trend. From a trading standpoint, I would be interested in fading weakness / buying a pullback into structural support near the median-line on a knee-jerk RBNZ reaction.

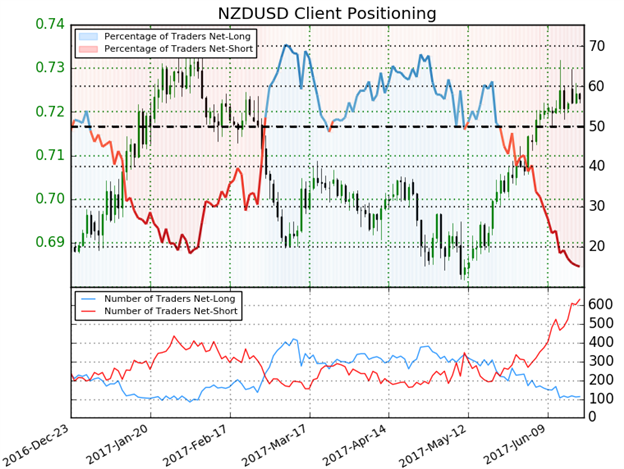

- A summary of IG Client Sentiment shows traders are net-short NZD/USD- the ratio stands at -5.59 (15.2% of traders are long / record low)- bullish reading

- Retail has been net-short since May 24th; price has moved 4.2% higher since then

- Long positions are 10.3% lower than yesterday and 25.7% lower from last week

- Short positions are 2.9% higher than yesterday and 35.0% higher from last week

- Traders are further net-short than yesterday and last week with the combination of current sentiment and recent changes offering a strong NZDUSD bullish contrarian trading bias. That said, price is at resistance, and if the pair pulls back, look for an accompanied build in long-positions for further conviction.

See how shifts in NZD/USD retail positioning are effecting market trends- Click here to learn more about IG Client Sentiment indicators!

---

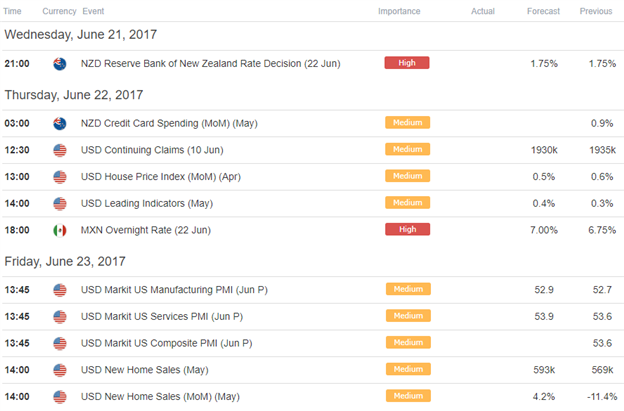

Relevant Data Releases

Other Setups in Play:

- Loonie Slides as Crude Dives- USDCAD Recovery Eyes Resistance

- USDJPY Moment of Truth: Rally Attempts Breach of Key Slope Resistance

- Strategy Webinar: USD Majors in the Fed Aftermath- Yen Crosses in Focus

- GBP/JPY- Range Break to Set Directional Bias Ahead of BoE, BoJ

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.