Talking Points

- DXY carves monthly OR just above confluence support

- Check out our 2Q projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

DXY Daily

Technical Outlook: The DXY has been trading within the confines of this descending slope formation extending off the yearly highs with the index turning just ahead of confluence support at 96.47 last week. Heading into tomorrow’s highly anticipated FOMC interest rate decision, the focus is on a break of the monthly opening range which has taken shape just above. Note that bullish divergence in the daily RSI profile into the recent lows warn of waning momentum with a resistance trigger pending. Simply put- the index is rebounding of downtrend support- whether it maternities into a more meaningful recovery is the question heading into FOMC.

DXY 120min

Notes: A closer look at price action highlights an embedded ascending pitchfork formation extending off the lows with a sliding parallel catching last week’s high (red). Monthly-open support is now being tested at 96.98 and is backed by more significant support zone at 96.70/80 – A region defined by the yearly low-day close, the May swing low and the lower median-line parallel (blue). A break below this level would be needed to keep the near-term focus lower targeting 96.47.

Look for initial resistance at the weekly open at 97.27 with a breach above the 97.51/57 needed to shift the broader focus back to the topside. Bottom line: if we’re going to see a bounce, it may come from these levels- either way we’ll want to ultimately use such a rally as an opportunity to get back on the short-side. Keep in mind markets have largely priced in a 25basis point hike and the focus will be on the updated interest rate dot-plot and the monetary policy outlook over the medium-term horizon. Added caution is warranted heading into the subsequent presser with Chair Janet Yellen with the session likely to fuel added volatility in the USD crosses.

See how shifts in retail positioning are effecting market trends- Click here to learn more about IG Client Sentiment indicators!

---

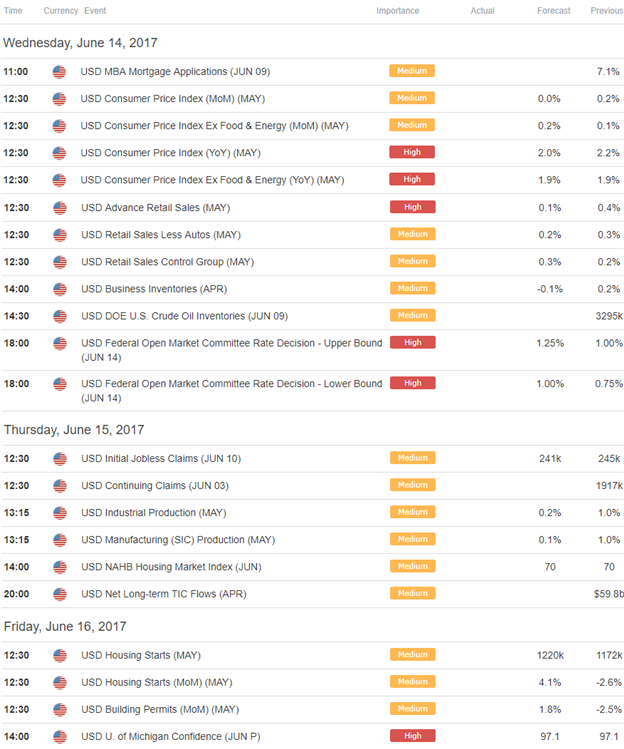

Relevant Data Releases

Other Setups in Play:

- USD/CAD Freefalls into Critical Zone

- Strategy Webinar: USD Majors in Focus as FOMC Takes Center Stage

- Kiwi Rally Continues: Bullish Up-Trend Vulnerable Sub-7230

- ECB to Make-or-Break EURJPY – Watch This Range

- EUR/USD Stalls at Resistance Ahead of ECB, Comey

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.