Talking Points

- NZD/USD approaching key resistance confluence – rally vulnerable sub-7230

- Check out our 2Q Kiwi projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

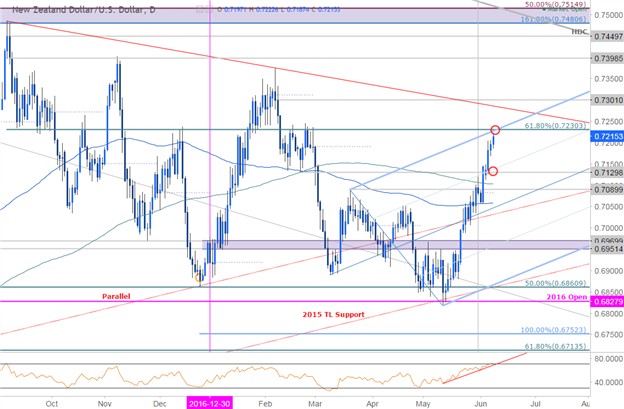

Technical Outlook:Kiwi broke above the median-line of an ascending pitchfork formation extending off the yearly lows last month. The subsequent advance is now approaching key resistance at the confluence of the 61.8% retracement of the September 2016 decline and the upper median-line parallel around 7230. The immediate long-bias is at risk heading into this threshold. Interim support is eyed at 7130 with broader bullish invalidation now raised to 7090. A breach above this level targets basic trendline resistance extending off the 2016 high, currently around ~7280s and the yearly high-day reversal close at 7301.

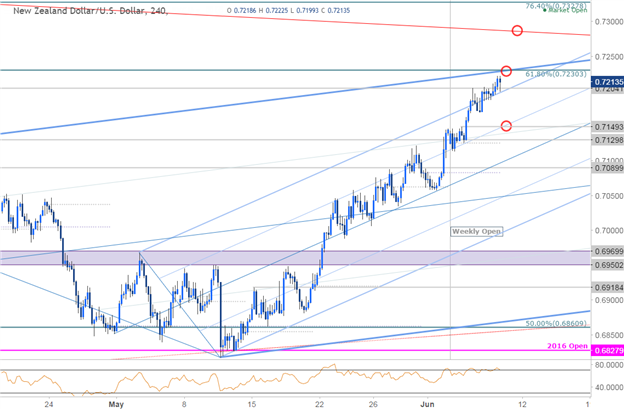

NZD/USD 240min

Notes: A closer look at price action highlights this key zone of resistance and heading into the close of the week I’ll be looking for possible near-term exhaustion. Initial support rests at 7204 backed by 7149 and the weekly open at 7125- both levels of interest for support IF the pair is going to breach above this resistance zone. The daily average true range (ATR) has been rather tight on kiwi, so for now we’ll target roughly 20-pips per scalp.

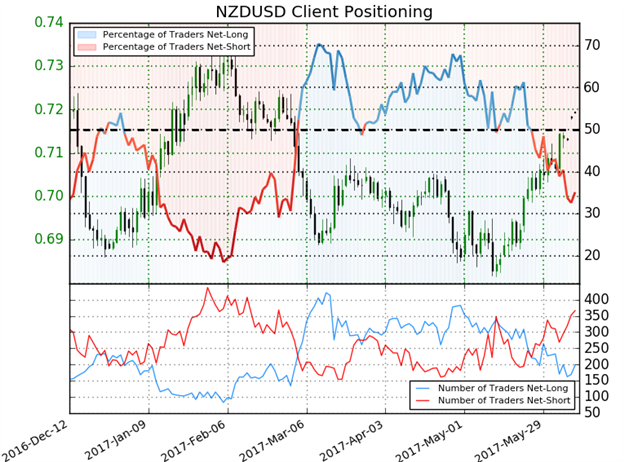

- A summary of IG Client Sentiment shows traders are net-short NZD/USD- the ratio stands at -1.85 (35.1% of traders are long)- bullish reading

- Retail has been net-short since May 24th – price has rallied 2.9% higher since

- Long positions are 2.6% higher than yesterday but 20.5% lower from last week

- Short positions are 9.3% higher than yesterday and 22.4% higher from last week

- Sentiment continues to point higher for Kiwi as traders continue to build on the short-side. That said, price is approaching resistance and the immediate long-bias is at risk into 7230. From at trading standpoint, I’ll be looking for a reaction there with a setback to offer more favorable long entries.

See how shifts in NZD/USD retail positioning are effecting market trends- Click here to learn more about IG Client Sentiment indicators!

---

Relevant Data Releases

Other Setups in Play:

- ECB to Make-or-Break EURJPY – Watch This Range

- EUR/USD Stalls at Resistance Ahead of ECB, Comey

- AUD/USD Bullish Reversal in the Spotlight as RBA Takes Center Stage

- Strategy Webinar: Navigating the June FX Open Ahead of Key Event Risk

- USD/JPY Range-Bound, NFP on Deck: Levels to Know

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.