Talking Points

- EUR/USD carving weekly / monthly opening range below resistance ahead of ECB

- Check out our 2Q EUR/USD projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

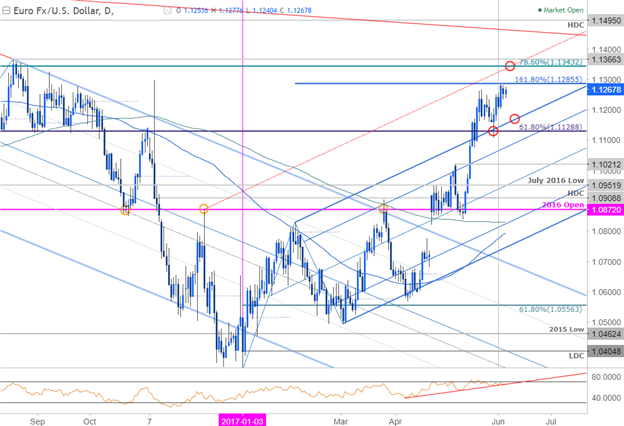

Technical Outlook:Last month we noted that the Euro rally had failed just ahead of resistance at 1.1285 with our broader outlook weighted to the topside while above confluence support at 1.1129. Indeed prices probed deep into this level before rebounding sharply to close higher on the day. (low was 1.1109). Prices finally made a test of key resistance on Friday (high was 1.1285 on the mark) on building momentum divergence with the weekly & monthly opening-range now taking shape just below.

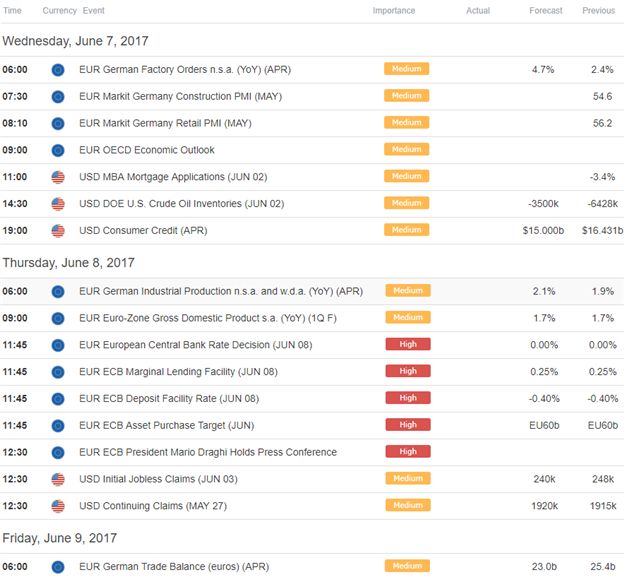

Look for a break head into the European Central Bank (ECB) rate decision on Thursday with our broader bullish invalidation level now raised to former trendline resistance, currently around ~1.1160. “A topside breach targets initial resistance objectives at 1.1343 backed closely by 1.1366 and the 2017 high-day close at 1.1495.”

EUR/USD 120min

Notes: We’ve continued to track this near-term slope extending off the April lows with the lower parallel now converging on Friday’s low at 1.1205- the near-term outlook remains constructive while above this level with a break below 1.1160 needed to suggest a more meaningful correction is underway.

From a trading standpoint, the long bias is at risk sub-1.1285 and I’ll favor fading a decline into 1.12 OR buying a breach & retest of 1.1285 as support. Added caution is warranted heading the interest rate decision with the release likely to fuel increased volatility in the Euro crosses. Keep in mind that former FBI Director James Comey will also be testifying before the senate intelligence committee on Thursday and could further stoke dollar volatility alongside broader risk assets.

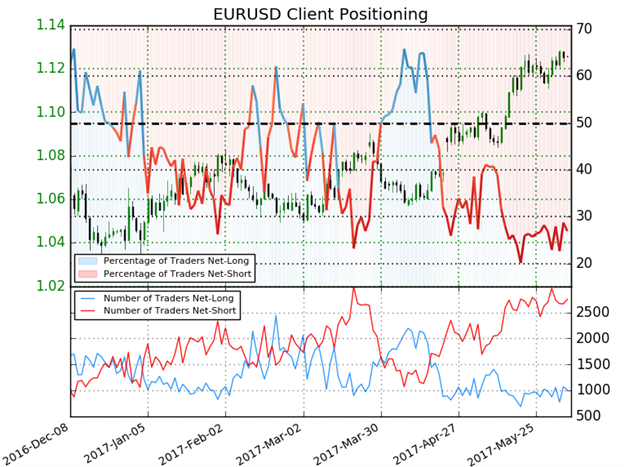

- A summary of IG Client Sentiment shows traders are net-short EUR/USD- the ratio stands at -2.71 (26.9% of traders are long)- bullish reading

- Retail has been net-short since April 18th – price has rallied 6.3% higher since

- Long positions are 5.0% lower than yesterday but 2.1% higher from last week

- Short positions are 3.5% higher than yesterday but 4.4% lower from last week

- While broader sentiment continues to point higher for the Euro, it’s worth noting that the recent reduction in short-positions from last week leaves the immediate long-bias vulnerable while below resistance. That said, from at trading standpoint, I’ll still favor fading weakness while above structural support around the 1.12-handle.

See how shifts in EURUSD retail positioning are effecting market trends- Click here to learn more about IG Client Sentiment indicators!

---

Relevant Data Releases

Other Setups in Play:

- AUD/USD Bullish Reversal in the Spotlight as RBA Takes Center Stage

- Strategy Webinar: Navigating the June FX Open Ahead of Key Event Risk

- USD/JPY Range-Bound, NFP on Deck: Levels to Know

- Cable Reversal Targets Monthly Open Ahead of NFPs, UK Elections

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.